Are you ready to make some radical changes to your chargeback management philosophy? Are you tired of simply accepting chargebacks as a loss?

Here’s how to deal with chargebacks and start improving your bottom line.

Determine the Type of Fraud

Before you can start handling a chargeback request, you have to know what type of chargebacks you’re dealing with — fraud or friendly fraud.

Data analysis can help. Trace your chargeback data back to the original transactions to test the validity of “unauthorized transaction” claims.

How to Detect Criminal Fraud

If your business is processing transactions that are legitimately unauthorized — the result of criminal activity — you’ll want to use a pre-sale fraud detection tool to help stop those purchases from happening. But if criminal activity isn’t an issue, you shouldn’t waste resources on services that aren’t needed.

Criminal fraud often has distinctive patterns and characteristics. We have a list of common red flags:

- Orders that include more merchandise or are more expensive than the norm

- Orders that include multiples of the same item

- Orders that include merchandise that is easily resold and converted to cash

- Rush or overnight delivery requests

- International delivery addresses

- Multiple orders being shipped to different addresses, but processed with the same card

- Orders with different names and/or card numbers, but made from the same IP address

- First time customers that don’t fit the normal purchasing pattern

If you determine fraud-coded chargebacks really are criminal activity, you might want to sign up with a pre-sale fraud detection service that will review each transaction for indicators of fraud prior to payment processing.

You can also take advantage of services provided by your gateway or processor, tools like Address Verification Service (AVS), 3D Secure 2.0, and the card validation code (CVC2, CVV2).

How to Detect Friendly Fraud

Friendly fraud, on the other hand, would usually be void of fraud indicators because the original purchase was legitimate and authorized.

Friendly fraud might be involved when a customer files a chargeback on orders that are:

- Not eligible for a return or refund

- Big-ticket items that later trigger buyer’s remorse

- Items that could unknowingly be purchased by a family member, such as a game or music download, that appeared suddenly on a credit card statement

If you determine that your chargebacks are the result of friendly fraud, you’ll want to use a service like Midigator.

Consider Prevention Alerts

Prevention alerts let merchants refund the transaction so customer disputes won’t turn into chargebacks from the credit card company. This helps keep chargeback ratios low.

And depending on your shipping procedures, getting advanced warning of a transaction dispute might enable you to stop fulfillment so the cost of goods isn’t lost.

Perhaps most importantly, prevention alert data is available 2-5 weeks earlier than chargeback data. This allows you to identify issues sooner, anticipate future chargeback trends, and take preemptive action to reduce risk exposure.

Ask yourself these questions. If you answer yes to any of them, alerts might be able to increase your chargeback protection.

How Can Prevention Alerts Help Handle Chargebacks?

- Do you sell (or want to sell) to a national or international market? Locally-owned banks are less likely to be included in prevention alert networks. If the majority of your customers use obscure financial institutions in a small community, you’ll see very little impact on your chargeback rates. However, if you are selling to customers outside your hometown, prevention alerts could reduce your chargeback exposure significantly. If you are unsure, check the most commonly used BINs (bank identification number) associated with your chargebacks.

- Do you sell digital goods? Digital goods require meticulous and expertly-composed representment paperwork. If you are unwilling or unable to apply the expertise to create a winning dispute, you may be better off refunding the dispute.

- Do you sell products or services with a trial offer? Certain sales tactics, such as free trial offers, are often linked to higher chargeback rates. In these situations, merchants usually need an aggressive approach to preventing chargebacks in order to keep merchant accounts healthy. Prevention alerts can help keep chargeback ratios low and reduce the risk of threshold breaches.

- Do criminal fraud and internal errors yield more chargebacks than friendly fraud? Friendly fraud is the only type of chargeback that can be fought. Chargebacks that result from verified criminal activity or processing mistakes on your part must simply be accepted as a loss — they can’t be challenged. Therefore, it would be advantageous to refund these transactions rather than increase your chargeback-to-transaction ratio.

- Are you enrolled in a chargeback monitoring program or are in danger of enrollment? If you are enrolled in a chargeback monitoring program with either card association, you need an immediate reduction in chargebacks — and prevention alerts might be able to provide that.

- Are you hoping to acquire more merchant accounts? Before allocating more merchant accounts, payment processors will critique how well you’ve managed risk on the accounts you already have. Taking a proactive approach to risk mitigation will improve your credibility.

Look for Hidden Issues

If the underlying issues that cause transaction disputes aren’t resolved, solutions are only temporary. Therefore, the best way to identify and solve issues at their source is to analyze your prevention alert and chargeback data. You’ll want to look for patterns and anomalies.

Examples of Hidden Issues

The following are examples of how merchants were able to deal with chargebacks because data analysis revealed hidden issues. More examples can be found here.

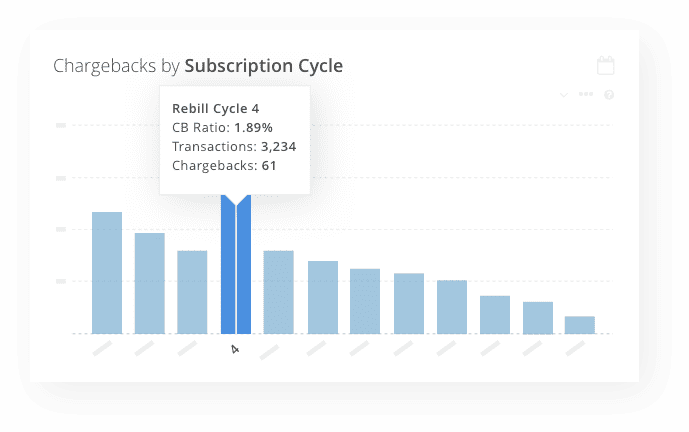

- A merchant analyzed chargebacks by billing cycle and discovered transaction disputes spiked after the fourth billing cycle. The merchant realized perceived value tapered off the longer customers used the product.

- Another merchant noticed the majority of chargebacks were coming from one particular country. He realized the risk associated with that marketplace likely outweighed the earning potential.

-

Another merchant analyzed chargebacks by reason code and discovered an error in the fulfillment department. Orders weren’t being shipped out!

Analyzing prevention alert and chargeback data is one of the most impactful things you can do; it will lead to the most significant reduction of chargebacks and risk. And, this strategy creates a long-term solution. Other risk mitigation strategies are really just a temporary fix.

Change Your Policies and Procedures

Once you’ve identified issues, start resolving them.

Data analysis is going to play an important role as you deal with the chargeback process. Make changes to your policies and procedures, but conduct A/B tests for everything to determine the appropriate amount of friction, risk exposure, and profit or loss.

Examples of Policy Changes

Consider some of the following updates that may be needed. More suggestions can be found here.

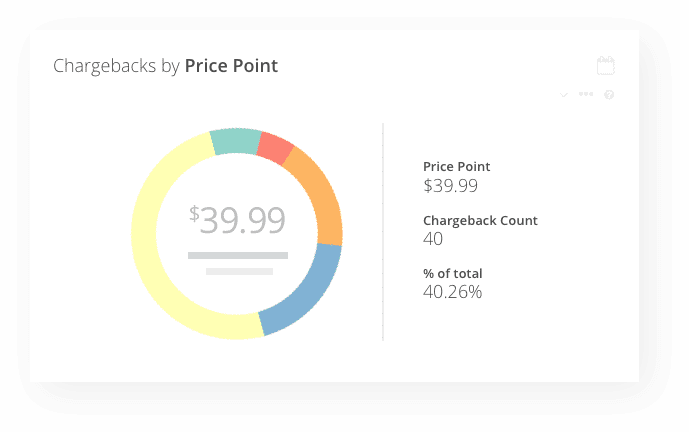

- Adjust prices until you find the sweet spot between revenue and risk. Provide products at the price customers feel is most reasonable but still yields sufficient profits.

- What about your return policy? If you are more lenient and customer-friendly, do you get fewer chargebacks?

- Do you have a lot of chargebacks marked “cancelled recurring billing”? Are those cases of friendly fraud or is your customer service department lacking follow-through?

Determine if Friendly Fraud is Worth Fighting

Friendly fraud is the only type of chargeback that can be fought. However, that does not mean it makes sense to fight every instance. Here’s how to tell if fighting a chargeback is a smart move — or a complete waste of time and effort.

Check the Chargeback Amount

Before you do anything else, check to see if there is positive ROI if you dispute the chargeback.

Midigator® conducted a case study of labor costs. We found that it takes most in-house teams at least 40 minutes to create and submit a chargeback response. If you pay your employees $20 an hour, it costs at least $13.33 to fight a chargeback.

If your chargeback amount is less than that, fighting could have a negative return on investment (ROI). You’ll spend more than you’ll recover.

Check the Chargeback Expiration Date

Each chargeback has an expiration date. This cutoff date is the last day you can submit a response.

If you submit a response after the expiration date, it will not be accepted. There is no chance of winning. If you fight the chargeback anyway, you’ll waste time, money, and effort on a lost cause.

Check Your Compelling Evidence

To fight a chargeback, you need compelling evidence. Compelling evidence is documentation that proves the original transaction was valid or disproves claims made in the dispute process.

If you have compelling evidence, you can and should fight. If you don’t, you have a low probability of winning.

The compelling evidence you need depends on the chargeback’s reason code. Check what’s required, and then see if you have those documents.

Are You Ready to Handle Chargebacks?

You’ll be amazed by the difference these changes will make to your bottom line.

If you’ve been accepting chargebacks as a loss every time a customer disputes a charge, assuming effective management required too many resources — time, money, expertise — you’ll be pleasantly surprised to learn that isn’t the case.

If you’d like to learn more about how to deal with chargebacks in the most effective way possible, the team at Midigator would be happy to discuss options with you. Schedule a demo today.