What is Visa Merchant Purchase Inquiry (VMPI)?

- March 18, 2018

- 3 minutes

Visa Merchant Purchase Inquiry (VMPI) is a chargeback prevention tool. It is part of the new Visa Claims Resolution (VCR) initiative, helping to streamline and simplify the chargeback process.

VMPI has potential benefits for issuers, acquirers, processors, and merchants — but only if the initiative is fully understood and embraced.

NOTE

VMPI is currently being phased out. As of July 17, 2020, VMPI’s functionality will be replaced with Order Insight.

Order Insight retains many of the features of VMPI, however, there are some differences between the platforms. Read this article to learn more about Order Insight.

What is VMPI?

Visa recognized that the process for managing chargebacks and disputes was outdated. The card network set out to create a more modern, streamlined approach; the result was Visa Claims Resolution (VCR).

In order to achieve its goals, VCR uses automated technology. One automated component of VCR is VMPI.

-

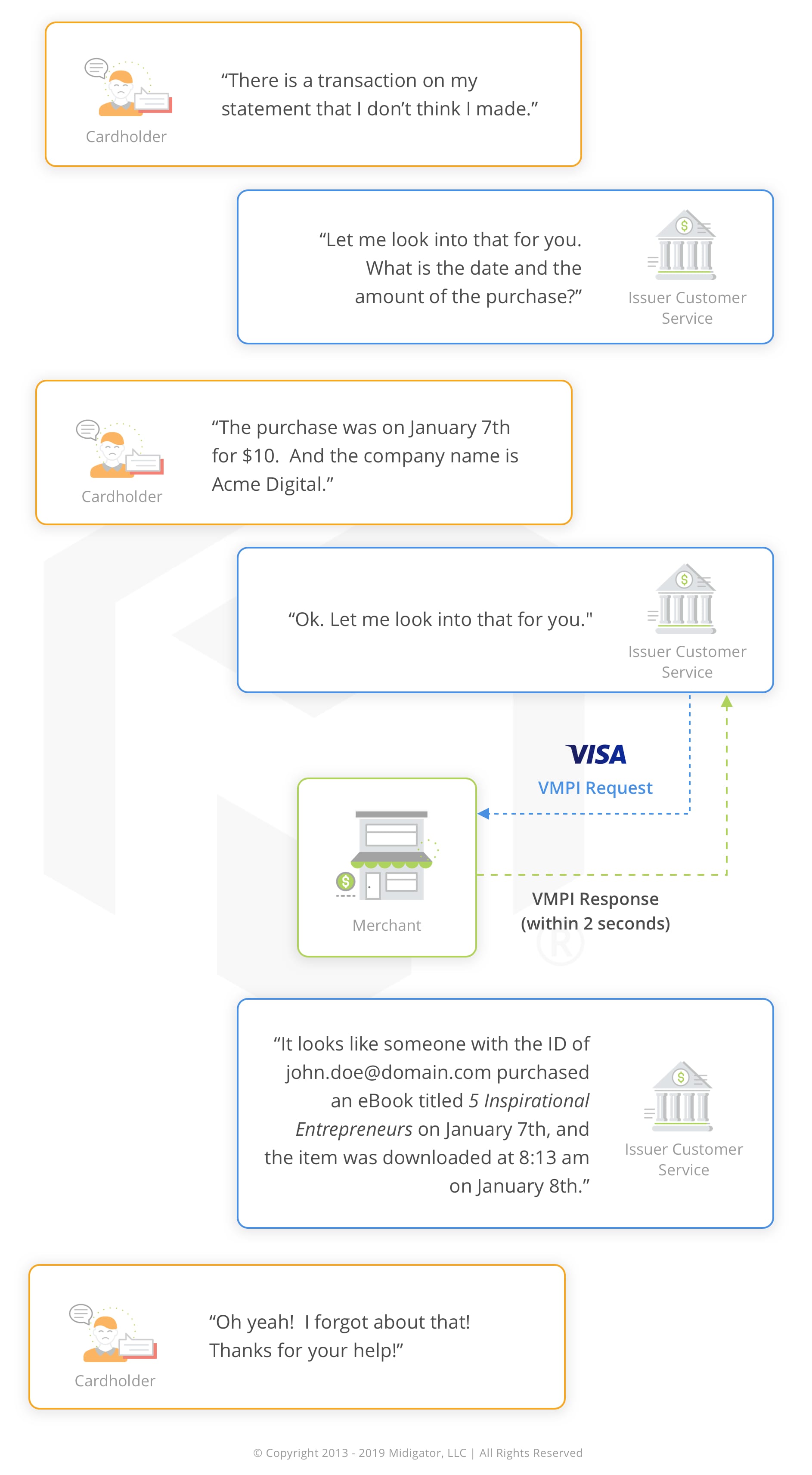

WHAT IS VMPI? VMPI is a platform that allows issuers to communicate directly with merchants and exchange detailed transaction data in real time.

-

HOW DOES VMPI PREVENT CHARGEBACKS? The purpose of VMPI is to provide issuers with the information they need to “talk off” disputes before they occur.

-

DO I HAVE TO USE VMPI? Issuers, acquirers, and merchants are highly encouraged to use this platform for dispute prevention, but participation isn’t required.

-

HOW DO I USE VMPI? Participating merchants can respond to VMPI with a transaction inquiry response, a credit notice, or both.

Transaction Inquiry Responses

Merchants can reply to a VMPI request with a transaction inquiry response.

This response option shares detailed transaction information with the issuer in real time. It explains the cardholder-merchant interaction with more clarity so the issuer can better understand what happened.

This should allow the issuer to resolve the cardholder’s complaint so the dispute won’t have to go any further.

Credit Notices

If there isn’t enough transaction information available to help the issuer make an informed decision, there is another VMPI response option.

The merchant can respond with a credit notice, notifying the issuer that the order will be refunded. In this situation, the issuer will likely consider the dispute resolved and the case shouldn’t go any further.

VMPI as a Part of VCR

What is Visa Merchant Purchase Inquiry? Essentially, VMPI is one small piece of a bigger chargeback puzzle.

VMPI is one of the first stages in the dispute-resolution process. It is an attempt to resolve the issue without investing significant amounts of time or money. However, it isn’t the only management tool that is available.

If VMPI doesn’t successfully resolve the cardholder’s issue, the merchant doesn’t respond in time, or the merchant isn’t enrolled in VMPI, the case will progress to prevention alerts or VCR.

(click image to enlarge)

Should Merchants Sign Up for VMPI?

VMPI has the potential to significantly reduce the number of disputes a merchant sustains and help keep dispute-to-transaction ratios in check.

While Visa has identified the following merchants as ideal candidates for VMPI, any card-not-present merchant would benefit from VMPI:

- Merchants who receive high volumes of disputes categorized as unrecognized transaction or fraud

- Merchants with vague or difficult-to-recognize billing descriptors

- Merchants with low-dollar transactions

- Merchants who sell digital goods

- Merchants who sell products using a free trial or introductory offer.

Visa sees great potential in this initiative. However, some industry members are overwhelmed by the integration process and feel the benefits don’t justify the effort. Fortunately, there is a simple solution.

Midigator® simplifies the dispute process for the entire payment ecosystem.

By accessing VMPI thorough Midigator, merchants can experience maximum chargeback prevention without any hassle. With just one integration, merchants can access VMPI, prevention alerts, and VCR-compliant dispute responses from a single portal.

If you’d like to learn more, contact Midigator today for a demo.

Related articles

Definitions & Explanations

Should You Manage the VMPI Integration Through a Visa Facilitator?

Stay Up-to-Date on Visa Programs

The VMPI process will likely undergo various updates as the industry transitions to the new dispute resolution style. If you’d like to stay current on policy changes and developments, sign up for our newsletter.

If you are ready to get started with VMPI, we’re happy to help. Contact Midigator today.