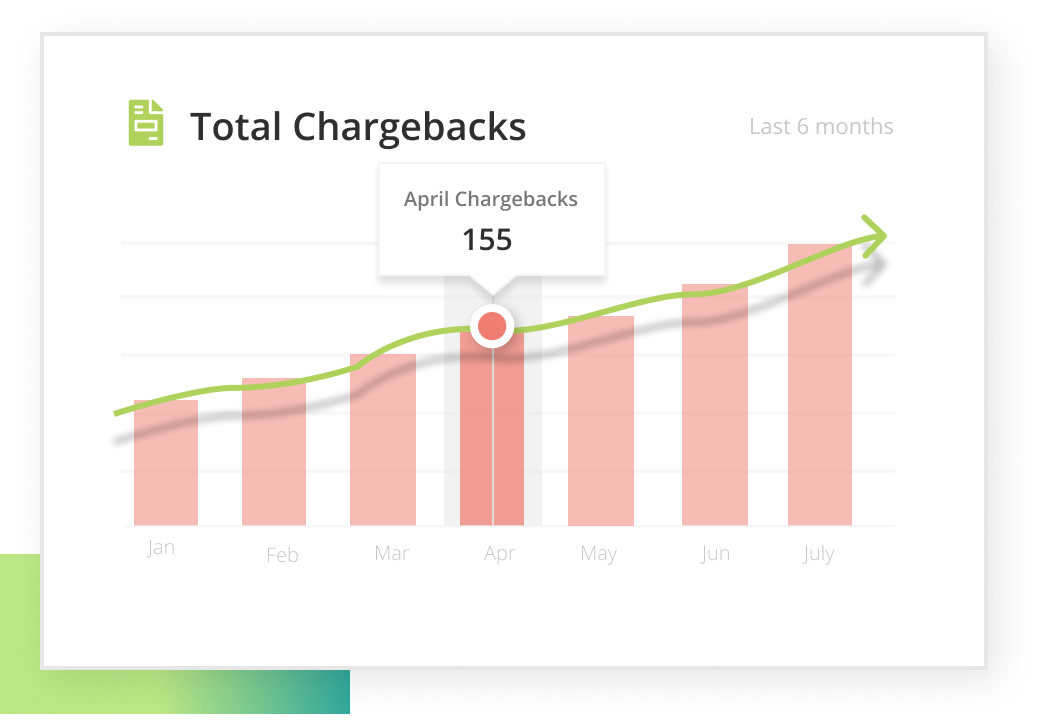

The Chargeback Problem

Chargebacks are unfair. They weren’t always so biased, but they are now. Close to 80% of chargebacks are invalid because banks and consumers are using the chargeback process incorrectly.

If a chargeback isn’t your fault, should you be held responsible? In a court of law, a defendant is innocent until proven guilty. But in the chargeback process, a business is guilty until proven innocent. And that’s a problem. Because trying to work within a system that’s not in your favor becomes a confusing, labor-intensive, and costly process.

Chargebacks are confusing.

Rules are difficult to understand. And they change all the time. It’s hard to know if you are doing things the right way.

Chargebacks are

labor-intensive.

Chargebacks involve tons of repetitive, error-prone tasks. All that manual work takes a lot of time and effort.

Chargebacks are

costly.

There is so much loss. Everything from revenue earned to advertising costs is gone. And fees add insult to injury.

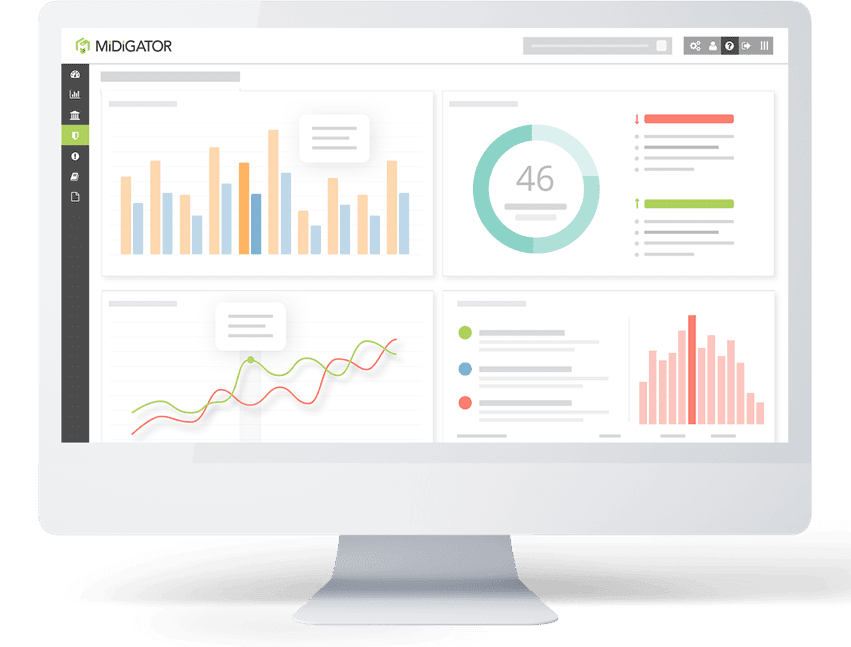

Introducing Intelligent Chargeback Technology

We believe the solution to confusing, labor-intensive, costly, manual processes is intelligent chargeback management.

We use technology to overcome the challenges that commonly plague chargeback management teams of all sizes in all industries. The result is more chargebacks prevented and more revenue recovered with higher ROI.

Intelligent Chargeback Technology is…

Automated

You decide how much or how little is automated. Then the technology goes to work, replacing repetitive, error-prone processes with accurate efficiency.

Flexible

You retain full control. We’ll accommodate your existing processes, resources, and abilities. And we’ll keep pace as your business grows and your goals change.

Data-Driven

We don’t make assumptions. We know what needs to be done. Because data-driven decisions eliminate hunches and guesses.

Intuitive

Simplicity is always a top priority. We’re focused on creating intuitive, easy-to-use features that are relevant to your business.

What Our Clients Are Saying

Integration with Midigator is easy, and once it’s established, you have access to their full suite of services and reporting without any additional development effort.

Nick

Sr. Software Engineer II,

Computer Software

The automation is the best part for us. We can put people into other roles rather than chasing chargebacks, knowing Midigator is working in the background. It’s a huge timesaver.

Paul

Manager,

Health, Wellness & Fitness

I love the easy-to-use interface that provides actionable data to help reduce and deflect chargebacks.

Conner

Owner,

Retail

How Midigator Is Different

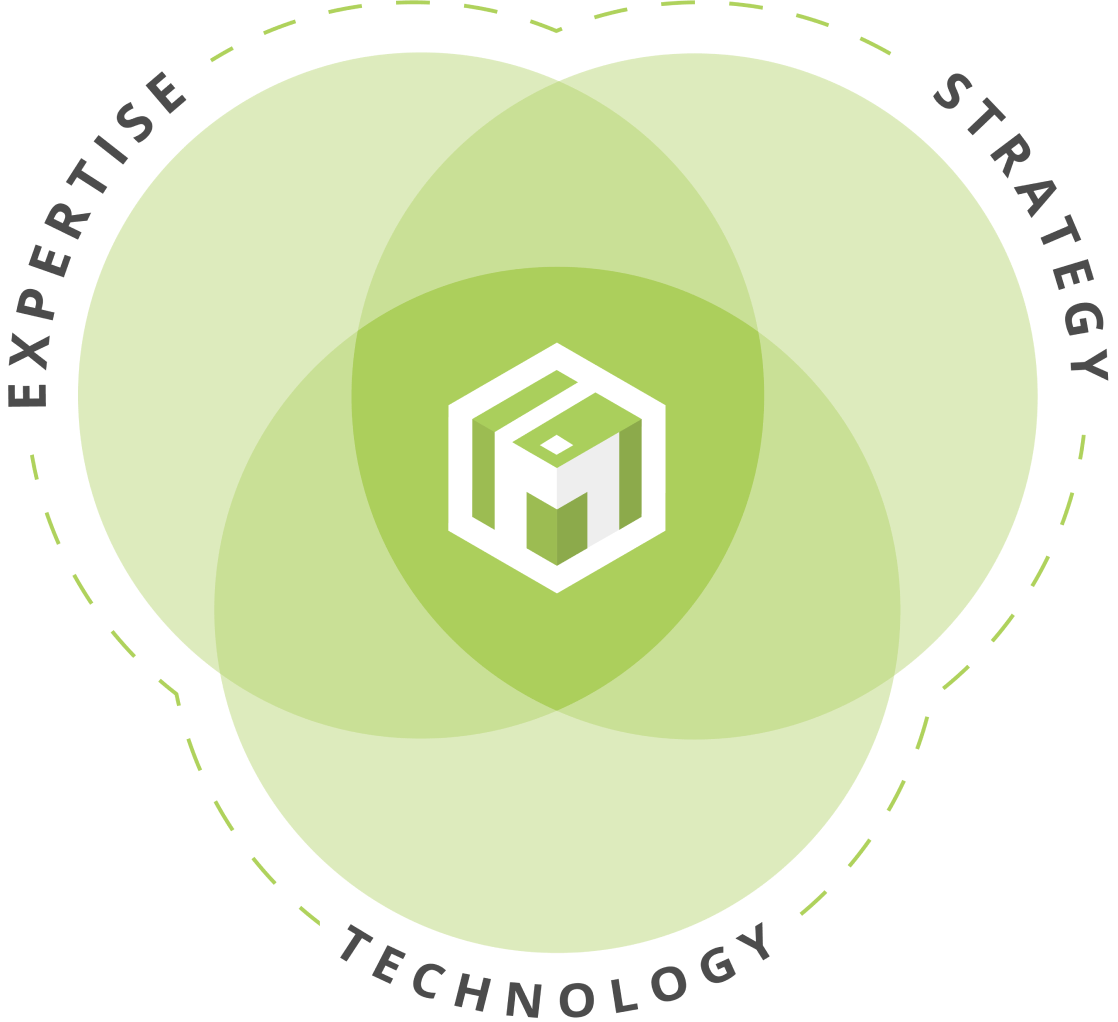

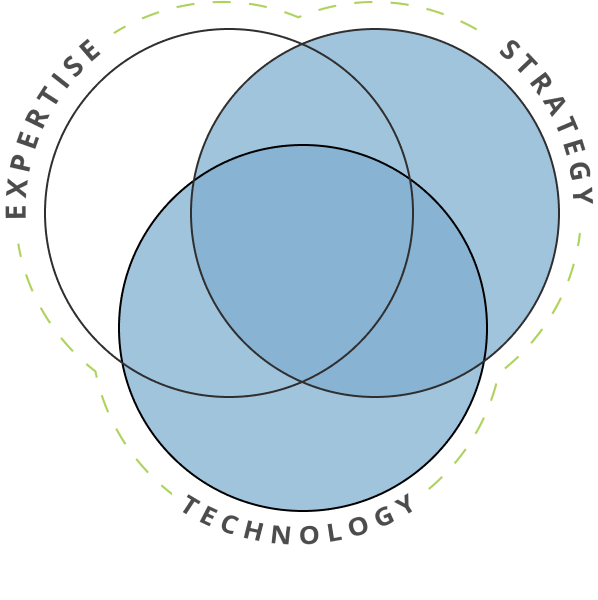

Midigator is a true software solution, providing complete, intelligent chargeback management. There are three things that define Midigator.

1. Expertise

We’ve spent decades learning the rules, testing strategies, and building relationships. We know what it takes to succeed.

2. Complete Strategy

Everything you need is in one platform. Whether it’s preventing, fighting, or analyzing chargebacks — Midigator can do it all.

3. Technology

Efficient, flexible automation replaces error-prone, manual processes. Data-driven decisions eliminate hunches and guesses.

These three characteristics combined led to Midigator creating the first and leading intelligent chargeback technology, which is genuinely different from what everyone else has to offer. If any one element is missing, you won’t achieve the results you deserve.

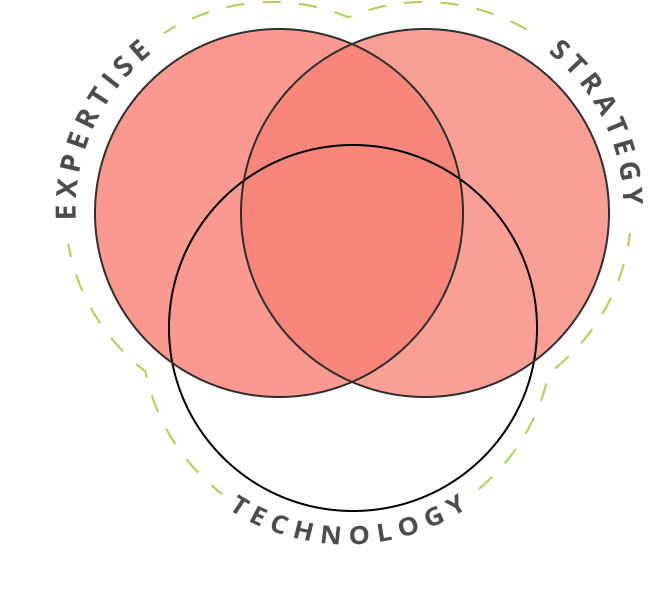

The Alternatives

If you don’t use Midigator, what are the alternatives?

No Technology Company

No Technology Company

These chargeback processing companies might have years of experience, but they haven’t evolved with the times. They still do things manually. Their “technology” is a dashboard that displays their results.

WHY IT MATTERS

Insight without technology is impossible to scale consistently. It’s unrealistic to expect hundreds of offshore employees to all do a task the exact same way every time. Humans make mistakes. And mistakes will cost you money.

No Expertise Company

No Expertise Company

These chargeback processing companies offer to automate your responsibilities, but they don’t know how to improve their outcomes. They don’t have the expertise to optimize what they build.

WHY IT MATTERS

Automation without intelligence is just going through the motions. If there is no expertise to be shared, what will you gain? You would still be responsible for figuring out how to win. So your results — and your level of confusion — would stay the same.

No Strategy Company

No Strategy Company

These chargeback processing companies have a very narrow focus, putting a lot of restrictions on what you can and can’t do. Their limited abilities have a limited impact on your chargeback problem.

WHY IT MATTERS

Technology without capacity is a one-trick pony. Your business won’t be able to grow and evolve if it is stuck within the confines of someone else’s limitations. Want to try a new processor? A new shopping cart software? A new chargeback prevention technique? You can’t, because your service provider isn’t as innovative as you are.

How Much Midigator Costs

How much does intelligent chargeback management software cost?

That depends! Midigator offers a la carte pricing so you only pay for the services you need — and nothing you don’t. That means your cost depends on the solutions you use.

What We Offer

![]() Transparent pricing

Transparent pricing

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

How Much Midigator Costs

How much does intelligent chargeback management software cost?

That depends! Midigator offers a la carte pricing so you only pay for the services you need — and nothing you don’t. That means your cost depends on the solutions you use.

What We Offer

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The Top Problems We Solve

How will Midigator help your business? We solve the challenges that are most common with chargeback management.

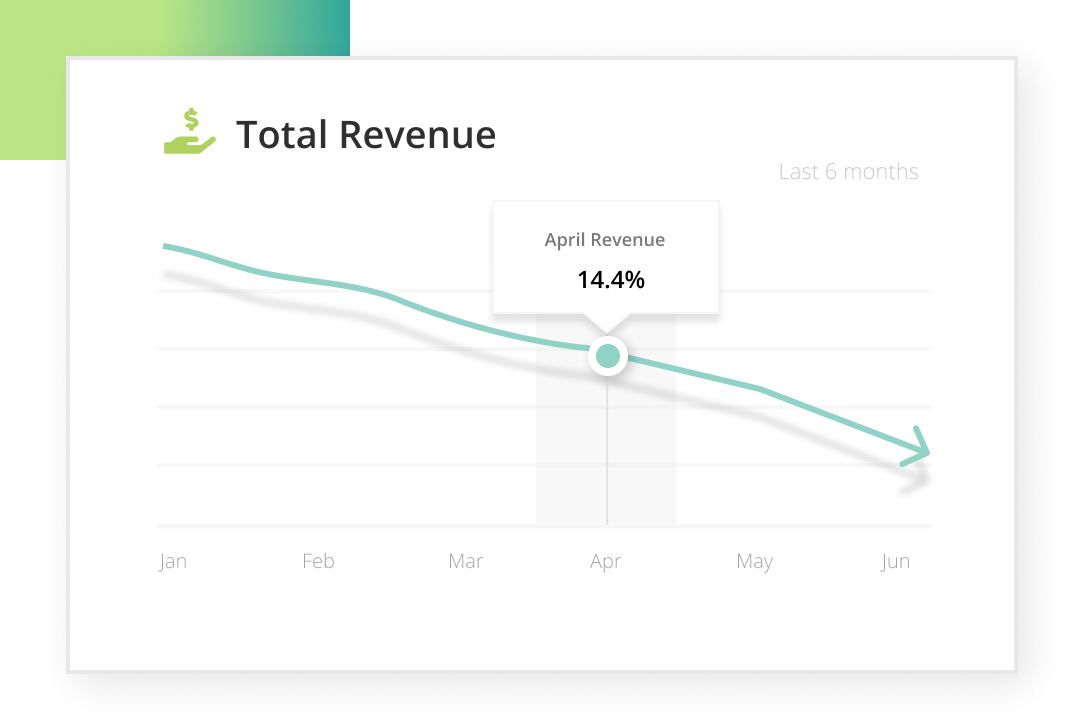

Losing Revenue to Chargebacks

You lose money with each and every chargeback you receive. And as your business grows, so does your revenue loss. You can’t afford to let chargebacks eat into your bottom line any longer.

Midigator’s Solution

- Intelligent technology knows what it takes to win

- High win rates consistently improve over time

- Technology-driven pricing reduces costs

- Significant return on investment protects your bottom line

WHAT OUR CLIENTS SAY

“What used to be a tedious task with marginal results has effectively turned into a money-making part of our business, fighting fraud and chargebacks. We’ve never been more profitable, and Midigator is a big reason.”

– Jason G., President | Health, Wellness, and Fitness

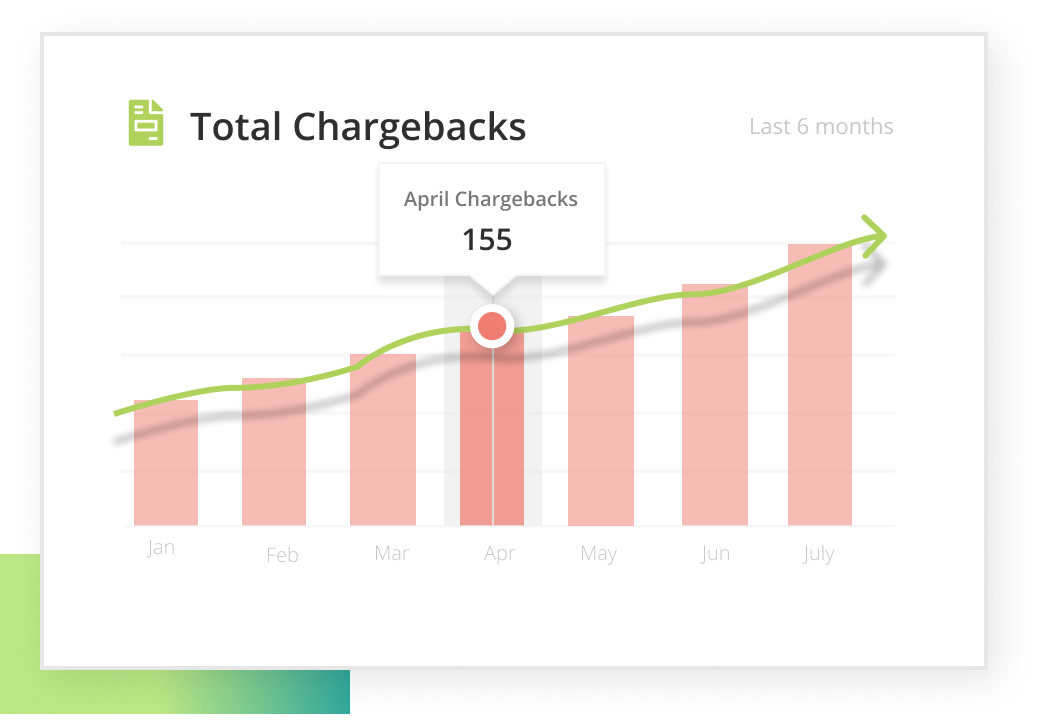

High Chargeback Ratios

When your chargeback activity increases, it seems like everyone in the industry takes note. And then the penalties start. You need to get the situation under control — quickly.

Midigator’s Solution

- Easy onboarding means you can start preventing chargebacks in as little as 24 hours

- Multiple solutions create multiple layers of protection — Visa® Order Insight, Visa Rapid Dispute Resolution (RDR), Verifi CDRN, Ethoca Alerts, and Mastercard® Consumer Clarity

- All-in-one platform increases transparency and efficiency

WHAT OUR CLIENTS SAY

“Prevention services are really useful. If your company deals with a high volume of payments, you surely need Midigator to have a heads-up and resolve possible disputes.”

– Laura L., Customer Success Manager | E-Learning

Chargebacks Take Too Much Time and Effort

Chargeback management consists of thousands of nuanced, detailed tasks — all of which take time. But your time is valuable — and limited. You need someone to take this burden off your plate so you can focus on more important things.

Midigator’s Solution

- Simple on-boarding options mean you can get up and running with minimal effort

- Technology reduces time spent managing chargebacks by up to 84%

- Flexible automation can reduce manual processes — or eliminate them entirely

WHAT OUR CLIENTS SAY

“The automation is the best part for us. Once the service is set up, you can just focus on other things knowing Midigator is working for you in the background. We can put people into other roles rather than chasing chargebacks. It’s a huge timesaver.”

– Paul A., Manager | Health, Wellness, and Fitness

Not Knowing What To Do

Chargebacks rules are complicated. And they change all the time. It’s difficult to keep up. You need someone to figure out what to do and then do it!

Midigator’s Solution

- Decades of experience means we understand industry expectations

- Official partnerships with Visa and Mastercard provide a direct line of communication and insights on what it takes to win

- Automation removes the guesswork

- Intuitive features are easy to understand and use

- On-demand support ensures you always have help when you need it

WHAT OUR CLIENTS SAY

“The reason why I highly recommend Midigator is actually because of the level of care and help provided by our account manager. She has spent so much time helping us, even when it’s not always something that makes Midigator more money. That level of support is unmatched and is why we want to build this relationship with Midigator.”

– Bryan S., Director of Finance & HR | Information Services

Inability to Improve Results

Do you have the best strategy? Could your results be better? What would it take to improve? Who knows?! Midigator does.

Midigator’s Solution

- Years of experience consolidated into a technology solution

- Constant code optimization means results are always improving

- Technology seamlessly keeps pace as your business scales

- Data consolidation provides transparency from beginning to end

WHAT OUR CLIENTS SAY

“We handed off the chargeback representments that we were doing manually to Midigator, and realized a significant cost savings and win rate.”

– Nick C., Sr. Software Engineer | Computer Software

Frequently Asked Questions

Midigator’s average win rate is about 65%.

We use the following formula to calculate win rates:

NOTE: If you are comparing Midigator’s win rate to another service provider’s, be sure to ask which formula is being used. Other companies commonly count pre-arbitration cases as wins. Pre-arbs technically indicate you had a winning argument, but they don’t return revenue. So including pre-arbitration cases in the win rate makes it difficult to calculate an accurate ROI.

But what does that mean for you? Will Midigator be able to achieve those same results for your business?

Maybe. Maybe not.

Maybe you can achieve something even better!

It’s not always helpful to compare the success of one merchant to another. There are dozens of factors that influence win rates, and those variables fluctuate significantly from one business to another.

Instead, let your focus be on improving your results.

So rather than asking, “What is Midigator’s win rate?”, the question becomes, “Can Midigator improve my current win rate?”

And we feel confident the answer to that question — which is far more influential — will always be yes!

But win rates aren’t the only thing we worry about. They are just one of the many metrics that can be used to measure success. Because, to be quite honest, it’s pretty easy to manipulate win rates so results seem better than they are (take a look at this alarming example).

At Midigator, we consider win rates within the bigger picture of ROI. Because at the end of the day, your bottom line (net dollars recovered after all related fees) is what matters most.

So what would your win rate be with Midigator? Would it be better than what you are currently achieving? And how would your win rate impact ROI? Let’s find out!

Sign up for a demo so we can understand your current situation. Then we’ll provide you with a personalized estimate. It will be based on data from comparable merchants in our portfolio — businesses in the same industry with a similar mix of reason codes and types of compelling evidence.

Once you have a realistic target for your win rate, Midigator will work to consistently optimize your outcomes. With the very best win rates possible and ROI that improves over time, you’ll always be enhancing your bottom line.

Our clients have an average ROI of 914%.

Because success is influenced by dozens of different factors, return on investment — for individual businesses and entire industries — varies significantly. Our most recent Year in Chargebacks report shared the average ROI for the following industries.

| Industry | Average ROI |

|---|---|

| Accounting & Taxes | 2749% |

| Arts & Collectibles | 106% |

| Automotive | 573% |

| Big-Box Ecommerce | 146% |

| Business Services | 1197% |

| Dating Services | 533% |

| Electronics | 573% |

| Fitness, Sports, & Well-Being | 343% |

| Furniture | 6910% |

| Health Care & Medical | 571% |

| Home Goods & Appliances | 2197% |

| Jewelry & Accessories | 182% |

| Legal | 1178% |

| Marketing & Advertising | 925% |

| Moving & Transportation | 7739% |

| People Search | 295% |

| Personal Financial Services | 5430% |

| Real Estate | 3196% |

| Security | 382% |

| Supplements & Skin Care | 458% |

| Telecommunications | 358% |

While it’s helpful to have a goal in mind, it’s not always a good idea to compare your results against an average. Because your business isn’t average — it’s totally unique!

So rather than critique Midigator’s standard rates, let us provide you with a personalized estimate.

Sign up for a demo so we can understand your current situation — your chargeback count, amount of revenue lost, common reason codes, and win rate. Then we’ll crunch the numbers and let you know what you can expect from Midigator.

But regardless of what the initial estimate is, know that Midigator’s aim is to constantly increase your ROI. Ensuring you have the highest ROI possible is our top priority.

No matter which solutions or integration option you choose, we promise to do our best to optimize your bottom line. We’ll prevent chargebacks and recover revenue with fewer costs and greater efficiency.

We don’t think Midigator is better than other chargeback management companies. We believe we are different.

And that’s an important distinction. Because putting Midigator in the same category as any other service provider is like comparing apples to oranges.

| MIDIGATOR | OTHER COMPANIES | |

|---|---|---|

| CATEGORY | Midigator is chargeback technology that continuously optimizes results. | Other companies do chargeback processing. They check tasks off a to-do list. |

| PROCESS | Midigator uses technology to automate and simplify workflows. | Other companies use manual processes that are error-prone and inefficient. |

| EXPERTISE | Midigator has decades of experience that’s been condensed into code, making it easy to scale and optimize. | Other companies might understand chargebacks, but they can’t communicate those insights consistently or accurately to hundreds of off-shore, low-paid representatives. |

| STRATEGY | Midigator offers a complete strategy. Whether it’s preventing, fighting, or analyzing chargebacks — we handle it all. | Other chargeback companies help with one small part of the chargeback problem. That leaves a lot of work for you to do on your own. |

What was my reason for choosing Midigator? Because it looked and felt more professional.

– Javan R., Owner

Midigator is capable of serving any merchant of any size in any industry with any billing model.

Our current portfolio of merchants ranges from small startup businesses to large enterprise brands. Last year, Midigator’s clients received between $279 and $13.8 million in chargebacks.

Integration timelines vary and are based on client-side resources. The following are timeline averages broken down by service levels.

Basic Automation

24 Hours

Average

Complete Automation

14 Days

Average

Integration with Midigator is easy, and once it’s established, you have access to their full suite of services and reporting without any additional development effort.

– Nick C., Midigator Client

The following is Midigator’s standard implementation plan. Processes and timelines may change as we become acquainted with your specific goals and desires.

Agreement Signed

Midigator will work with your team to create a mutually beneficial agreement. It will outline specifics related to:

- Pricing and invoicing

- Solutions being implemented

- Integration preferences

Project Launch

Once the contract has been signed, you’ll be introduced to one of our skilled on-boarding specialists. This person will be your point-of-contact during implementation.

One of the first steps in the on-boarding process is to determine a target date for completion.

On-boarding timeframes are dependent on several variables including:

- Adequate client-side resources

- The solutions being implemented

- The selected level of integration.

As a result, timeframes can vary from a few hours to several weeks. The ideal situation is to have integration completed in 30 days or less.

Once a timeline has been defined, Midigator will propose a plan to complete the on-boarding process. You and your dedicated on-boarding specialist will establish a cadence for meetings that will ensure tasks are completed within the agreed upon timeframe.

Account Setup

During the account setup phase, an on-boarding specialist will collaborate with your team to obtain necessary information. Information will be shared in various ways:

- During one-on-one phone or video calls

- Via online forms

- Through email conversations

Some examples of information that you’ll share with Midigator include:

- The name of your processor(s)

- The names and email addresses of desired users

- The various billing descriptors that you use

- Your customer service phone number

- The date you’d like Midigator to begin services

Account Kick-Off Meeting

Once your account is ready, we’ll hold a meeting to introduce your new services.

During this meeting, your account manager will give a demonstration of the platform. The goal of this meeting is to familiarize your team with Midigator’s functionality so you’ll get the most out of the technology.

Your team will have the opportunity to explore the platform and ask questions. Your account manager will also share valuable resources to help ensure the transition goes smoothly.

The schedule for future check-ins (usually weekly, bi-weekly, or monthly) will also be set during this call.

From this point onward, all of your contracted services will be completely implemented and fully operable.

“There have been just a handful of times I can recall where a third-party service provider has hit the ground running so effortlessly and seamlessly. From an on-boarding and operations perspective, the Midigator rollout has been fantastic.”

– Nimit S., VP of Engineering, Bouqs

Yes! Midigator can support international merchants. The technology is compatible with any currency.

Our team of experts is also familiar with region-specific regulations and will ensure your chargeback management strategy is fully compliant with card brand rules.

Yes! Midigator is intelligent chargeback technology that replaces repetitive, error-prone, labor-intensive tasks with automation.

Our automation is flexible. It fits what you need, working with your existing processes, resources, and abilities. You have full control over what the technology manages — you decide how much or how little is automated.

Sign up for a demo of Midigator, and see the automation in action. We’ll explain the different options and discuss the best fit for your business.

Midigator can currently process 2,000,000 chargebacks per hour, and this capability is constantly increasing as our company grows.

Midigator has access to limited PII (personal identifiable information). We may receive some or all of the following customer data:

- Cardholder name

- Phone number

- Email address

- IP address

- Truncated PAN (card account number)

- Card expiration date

All data is encrypted in transit and at rest. Either Secure File Transfer Protocol (SFTP) or Hypertext Transfer Protocol (HTTPS) is used for data transmission.

Midigator is PCI Level 1 compliant. We also conduct a Type 1 Service Organization Control (SOC) 2 compliance audit each year. Additionally, Midigator is GDPR and Privacy Shield compliant.