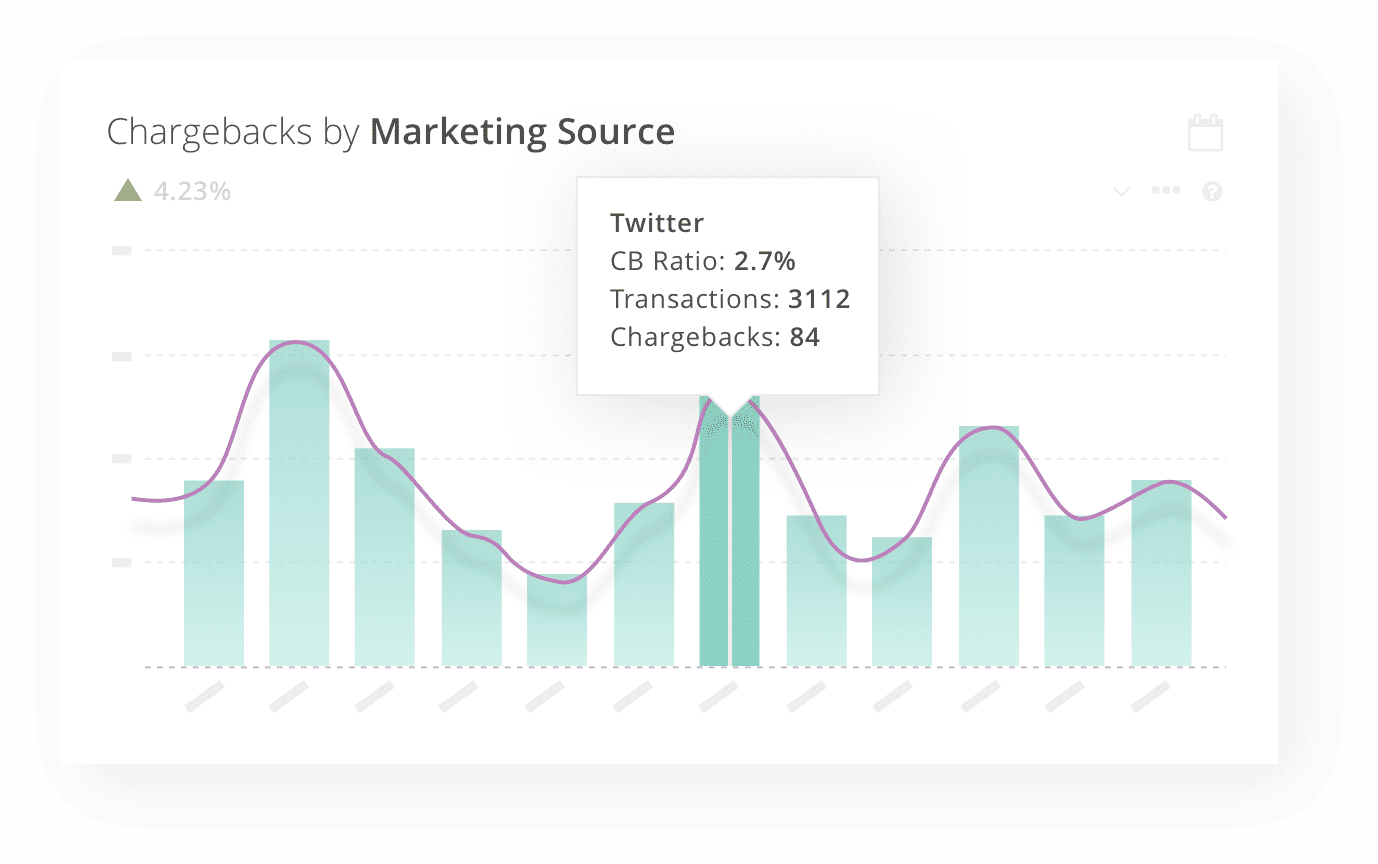

Marketing Source

Easily balance conversion rates with chargeback rates, and discover low-quality customers before they hurt your bottom line.

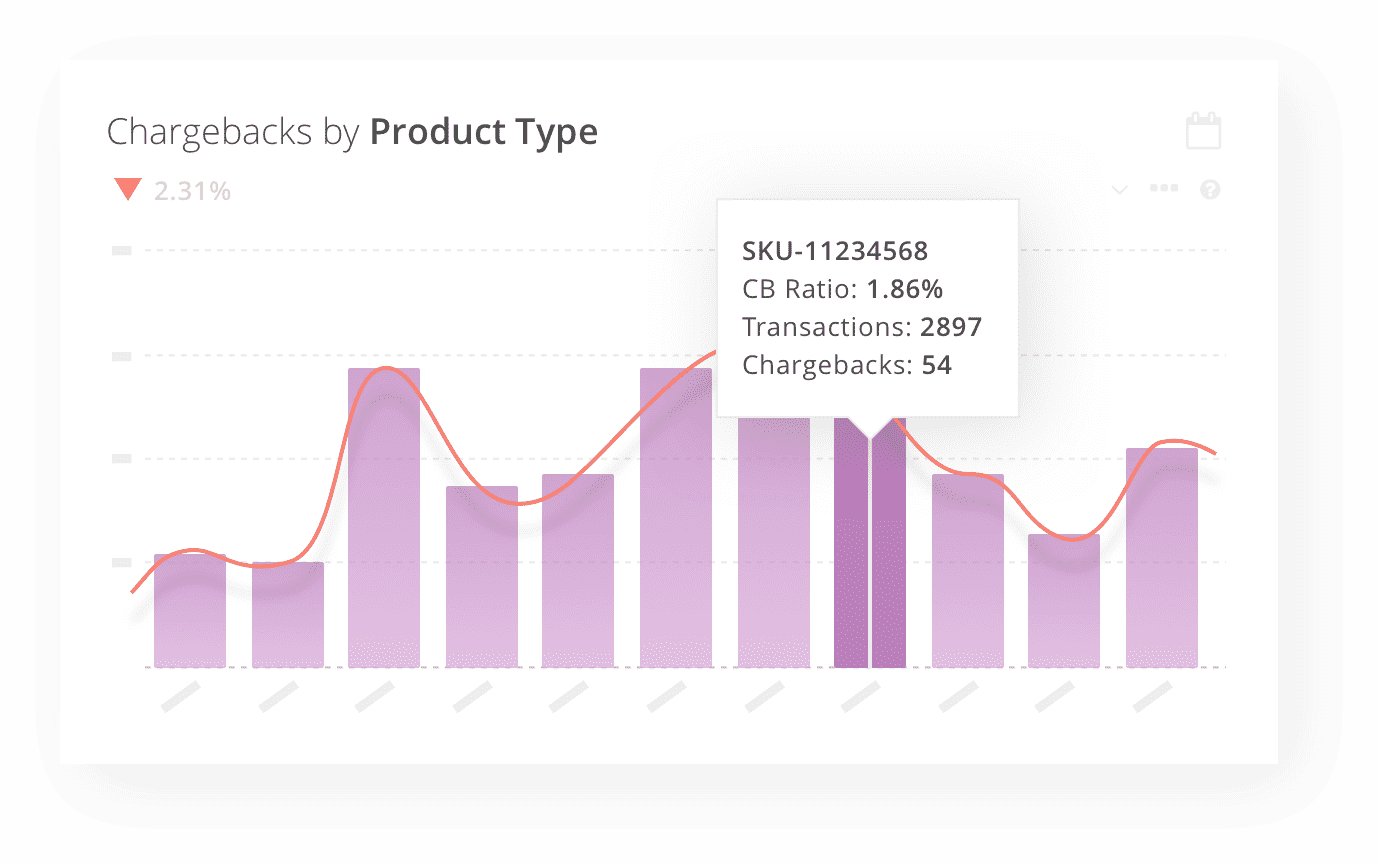

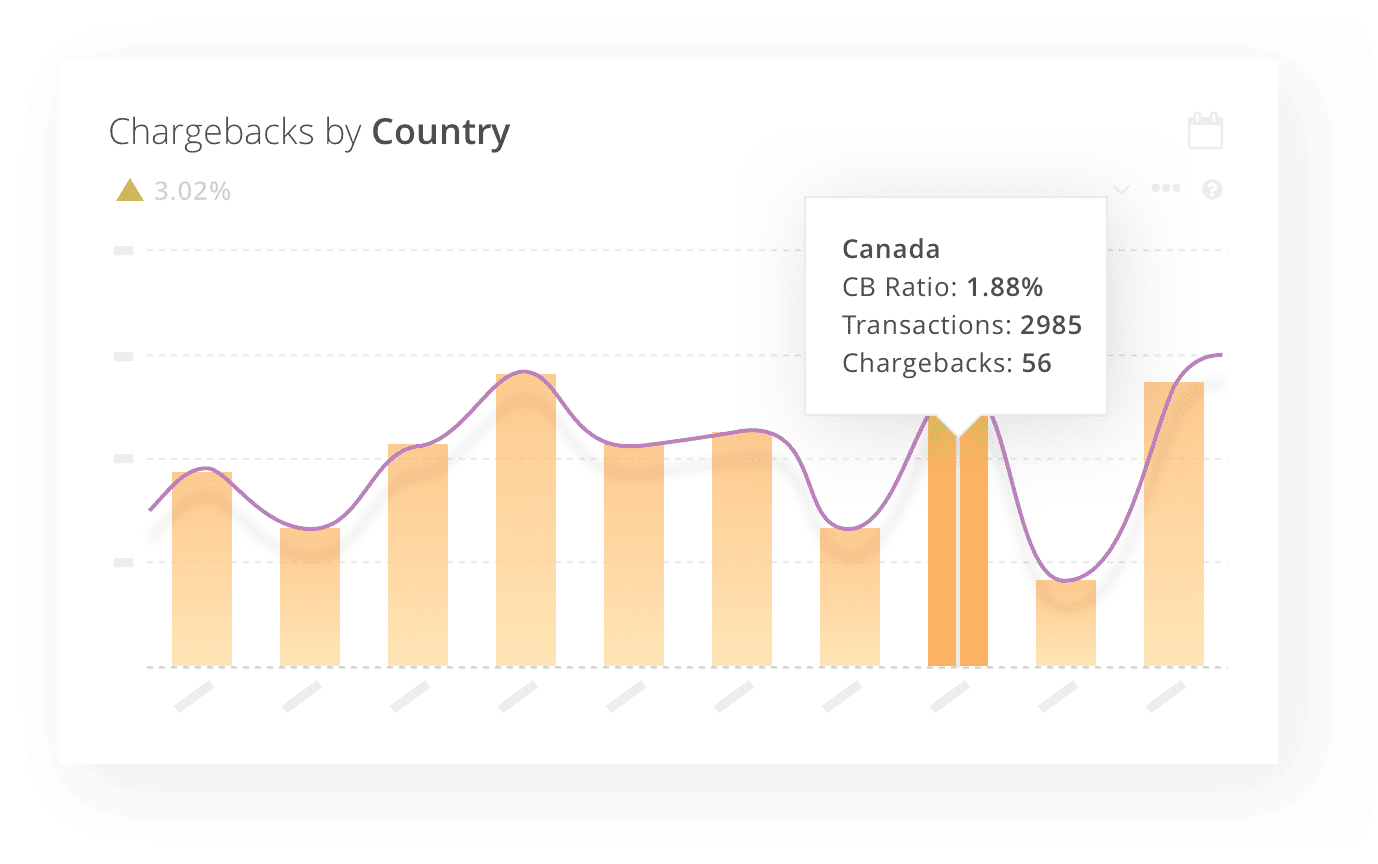

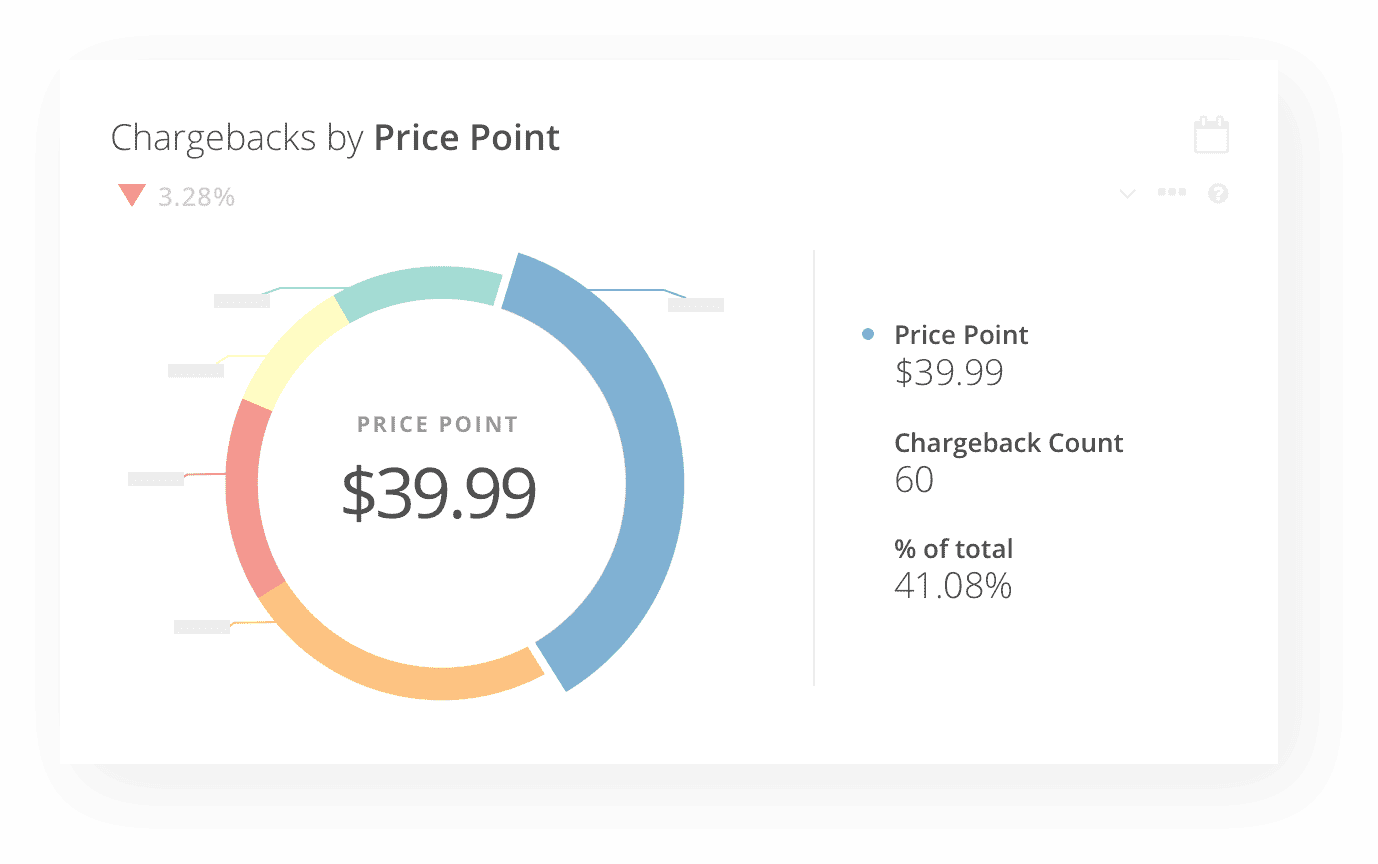

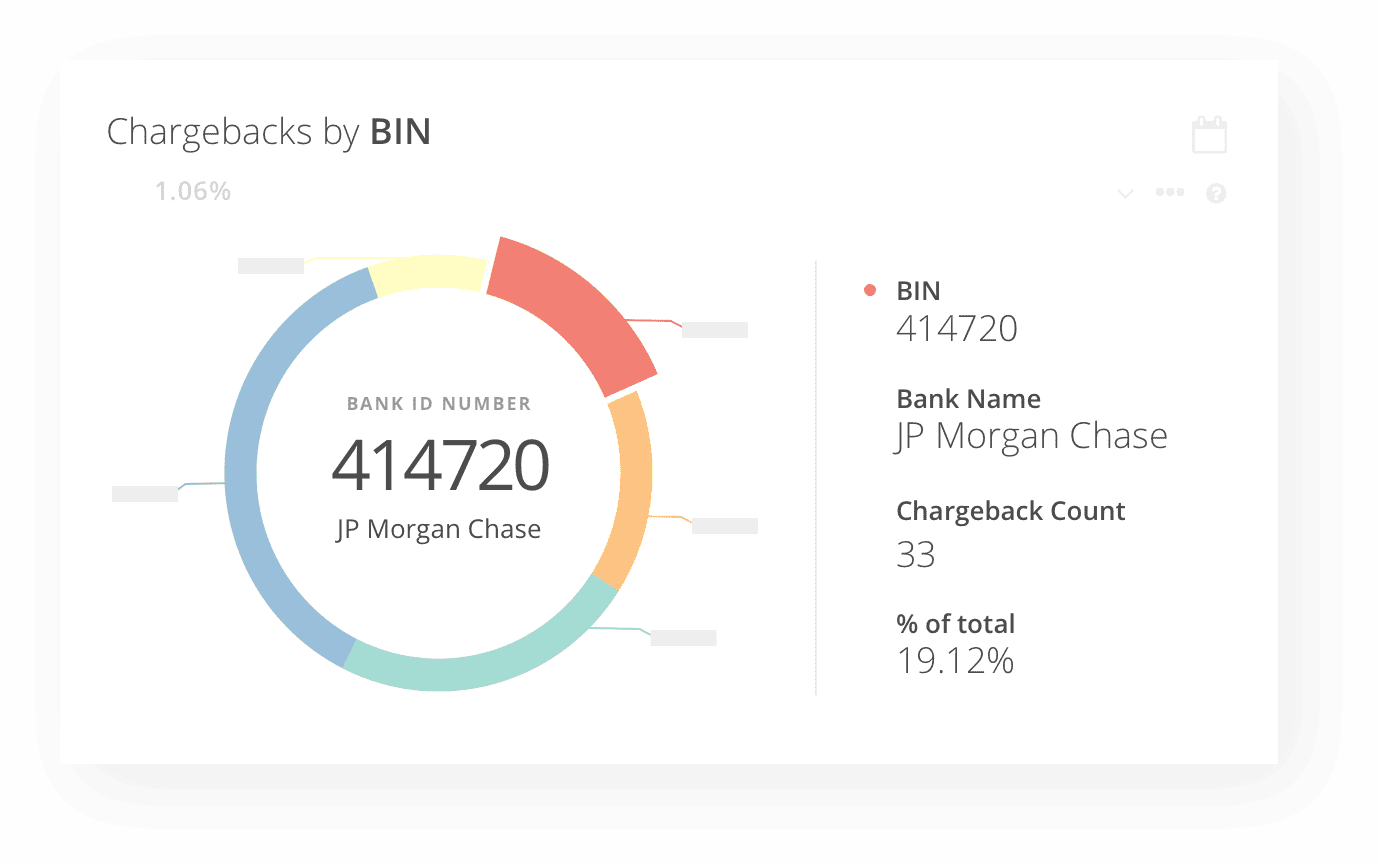

Identify High-Risk Strategies

Discontinue marketing strategies that

generate more risk than reward.

Focus on Your Target Audience

Invest resources in tactics that reach your

ideal customer.