Want the best chargeback protection? You found it!

Learn how to get the most complete chargeback protection possible. Prevent and fight chargebacks, all from a single platform.

The #1 Choice for Chargeback Protection

See why Midigator has a 4.4 out of 5 star rating on Capterra.

![]()

Nick

Sr. Software Engineer II,

Computer Software

Integration with Midigator is easy, and once it’s established, you have access to their full suite of services and reporting without any additional development effort.

![]()

![]()

![]()

![]()

Paul

Manager,

Health, Wellness and Fitness

The automation is the best part for us. We can put people into other roles rather than chasing chargebacks, knowing Midigator is working in the background. It’s a huge timesaver.

![]()

![]()

![]()

![]()

Connor J.

Owner,

Retail

I love the easy-to-use interface that provides actionable data to help reduce and deflect chargebacks.

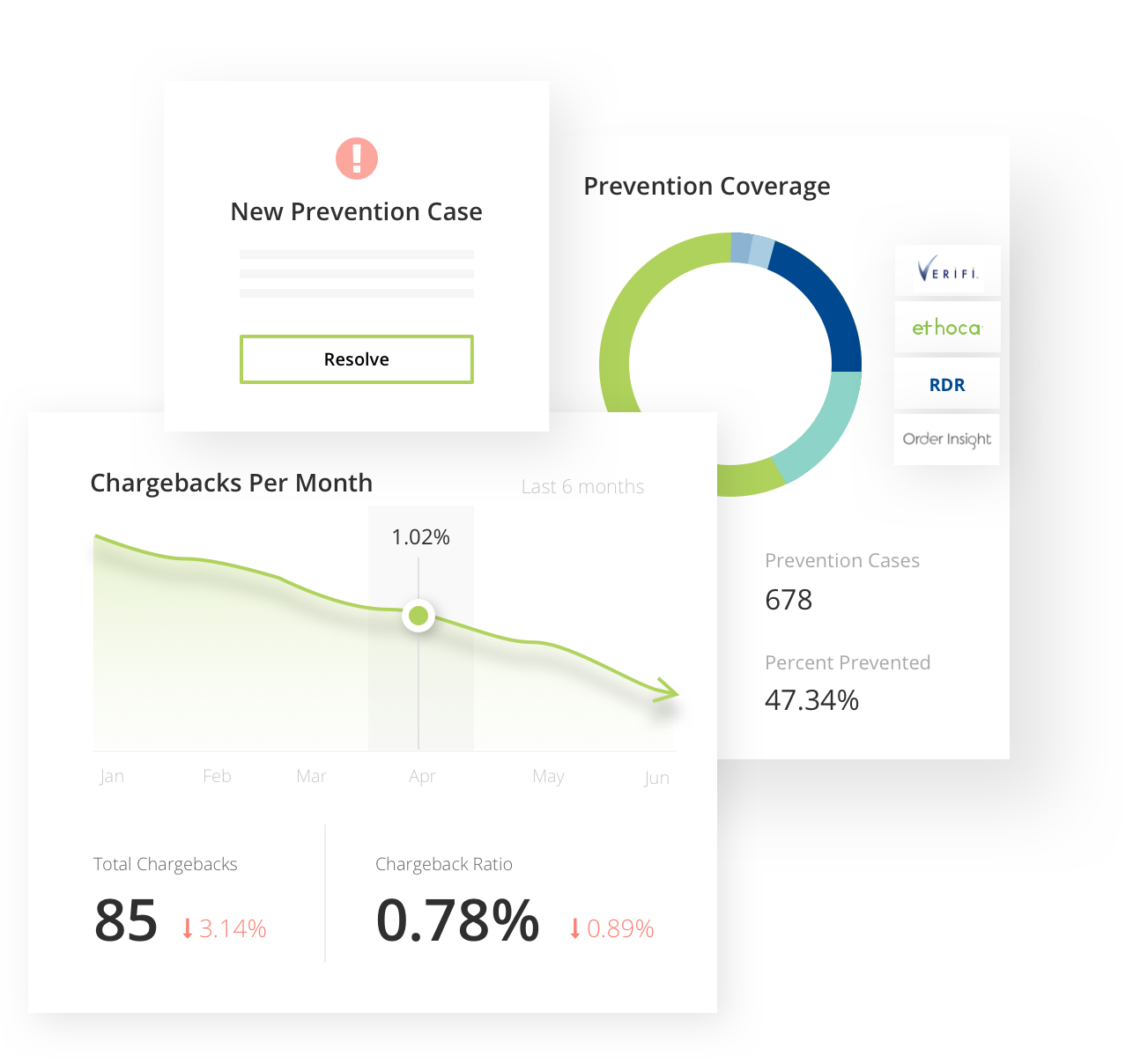

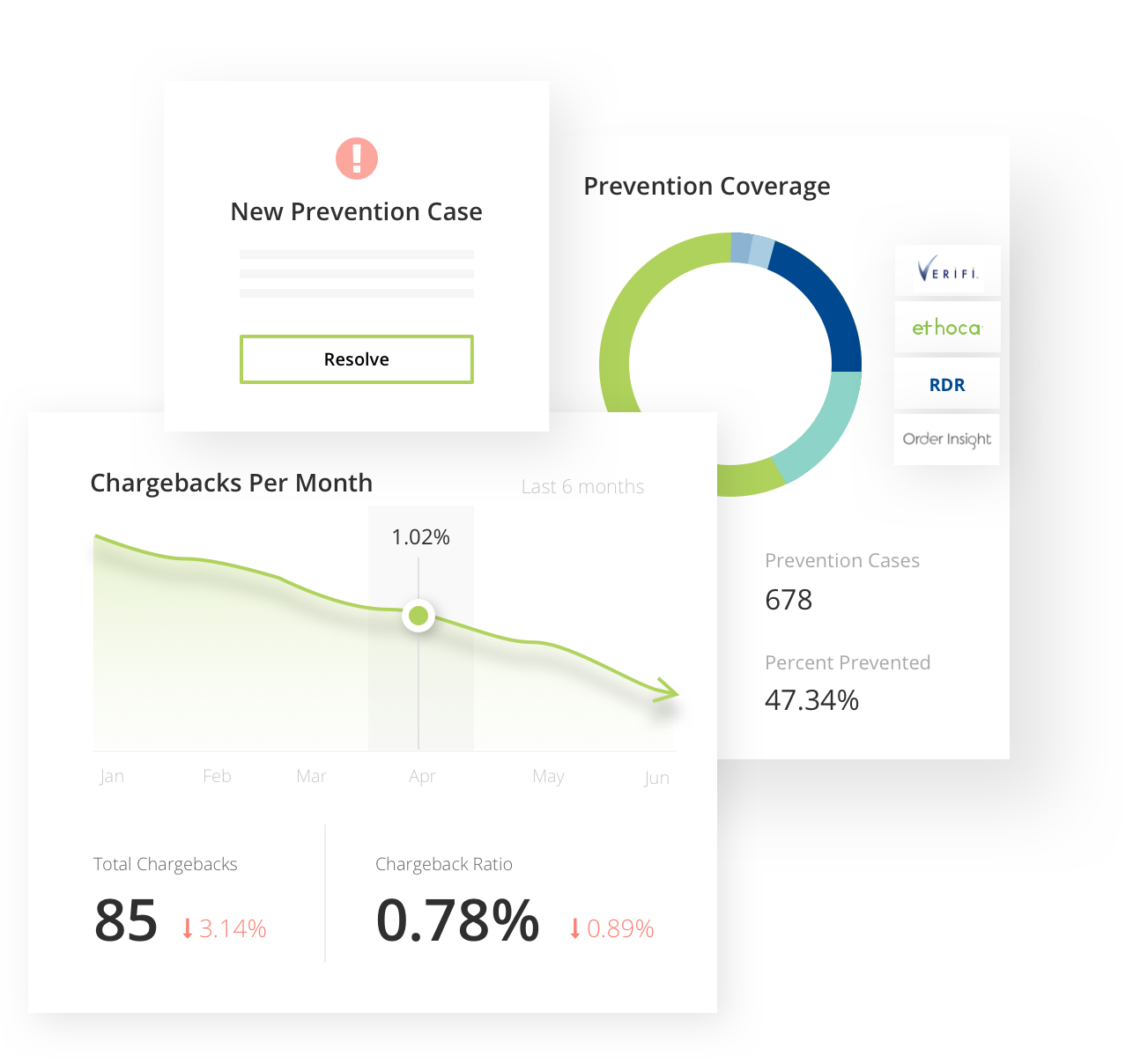

Prevent chargebacks & minimize revenue loss.

The easiest-to-win fight is the one you can avoid. That’s why chargeback prevention is a crucial first step in your management strategy. Midigator has everything you need to prevent the preventable.

- Start seeing results in as little as 24 hours

- Prevent up to 50% of chargebacks

- Solve issues up to 5 weeks sooner

Fight chargebacks & recover more revenue.

When you lose money to chargebacks, Midigator gets it back. Our philosophy for revenue recovery is simple: we want you to have the best ROI possible. That means we fight chargebacks with the greatest efficiency and highest probability of success.

- High win rates consistently improve over time

- Intuitive, easy-to-use technology removes guesswork

- Flexible automation replaces time-consuming, error-prone processes

- On-demand support connects you with industry veterans

Chargeback Protection

Customers who would like to dispute an online transaction may request their issuing banks for a chargeback. Essentially, a chargeback is a debit or credit card transaction that has been reversed. Buyers are protected with chargebacks against sellers who might be offering low-quality goods or services or engaging in unethical business practices.

For merchants, chargeback disputes may appear to be a daunting task. By understanding the chargeback process and knowing the necessary procedures, merchants can better manage chargeback disputes. While chargebacks cannot be completely avoided, some methods may be taken to reduce the number of chargebacks that occur.

There are instances in which chargebacks are caused by common merchant errors. For example, merchants might have made clerical errors, such as duplicate or inaccurate bill payments. Other merchants may not have followed card network regulations. Some businesses may have an ambiguous billing descriptor, or how their company’s name appears on the billing statement, making it difficult for the cardholder to identify the merchant and transaction correctly.

Chargebacks could also be caused by fraudulent transactions or the use of a debit or credit card without the knowledge of the cardholder. Customers can make an unauthorized transaction claim to their issuing bank if they believe their account has been compromised by phishing attempts or a data breach.

Another type of chargeback fraud is when a cardholder files a chargeback by accident or takes advantage of consumer protection policy by refusing to pay for products and services that were legitimately ordered and mutually agreed upon with the merchant. This is called friendly fraud.

A seller protection policy — like the one offered by eBay — protects both sellers and customers from fraudulent chargebacks and circumstances where customers do not receive the goods they ordered online. Seller protection is particularly useful for small businesses that may be hesitant to sell their goods online due to the risk of fraud.

In seller protection, digital goods such as e-books, subscriptions, and software packages are usually covered in addition to physical commodities. This means that digital sellers can be protected from erroneous customer claims and chargebacks.

The first step to avoiding chargebacks is to prevent them from happening in the first place. Ideally, the best chargeback protection services should be able to protect you from chargebacks even before they occur.

Midigator can help you prevent and fight chargebacks and recover lost revenue, whether you are a new merchant or a well-established financial institution. The chargeback prevention alert from Midigator can help minimize chargeback rates by up to 40%.

See why we’re #1.

Midigator is a true software solution, providing complete, intelligent chargeback management.

- A team of experts to help you succeed

- Efficient, flexible automation

- Everything you need in one platform

Chargeback Protection For Merchants

What is chargeback protection? Chargeback protection services can assist merchants in decreasing the likelihood of chargebacks. Payment processors or third-party vendors may provide chargeback protection plans to safeguard merchants from fraudulent complaints.

There are different types of chargeback protection services. Chargeback protection price varies depending on the chargeback rates of the payment processor, terms of service, and the number of chargebacks you may receive. This means that the higher your chargeback ratio, the more costly it will be for your business. A chargeback protection insurance can help prevent revenue loss when the dispute can’t be avoided.

A chargeback alert system, in which a merchant is notified when a customer files a dispute, may help prevent chargebacks. When a cardholder disputes a transaction, issuing banks can communicate directly with merchants in real-time by sending an alert.

By using Midigator’s chargeback alerts and customizable notifications, you can respond to refund notifications, investigate questionable purchases before fulfilling them, cancel subscriptions before the next payment period, and monitor disputes. Alternately, you may also opt not to take any action and accept the chargeback.

Chargebacks may also be deflected by providing issuing banks with information derived from the merchant’s customer relationship management system to prevent cardholder inquiries from escalating into disputes or chargebacks. This solution is called order validation and is made available by Order Insight and Consumer Clarity.

With Midigator’s real-time reporting and in-depth analytics, you may take preemptive action against chargebacks and understand why chargebacks are happening in the first place so you can resolve them right at their source.

Some payment processors and fraud prevention companies may offer chargeback prevention guarantees by utilizing machine learning, or by rating and scoring purchases against the likelihood of fraud.

Midigator is the first company to leverage technology to prevent chargebacks by resolving issues preemptively. Midigator also empowers merchants to fight chargebacks through intelligent dispute responses to help maximize their revenue recovery.

Credit Card Chargeback Protection

Credit card chargeback policies are typically structured to prioritize cardholder rights and protect customers from fraudulent transactions. Regarding credit card chargeback laws, there are policies enforced by both the card brands and the U.S. government.

On the other hand, merchants should be aware of the credit card chargeback process to safeguard their business from fraudulent dispute claims and reduce their chargeback losses.

When it comes to credit card chargeback merchant rights, policies have been put into place so that merchants can fight back against illegitimate chargebacks that can significantly impact their bottom line. As an added layer of security, merchants may benefit from partnering up with technology companies such as Midigator, which can manage the complexity of payment disputes with intelligent chargeback management software.

Chargeback Response

When it comes to the chargeback time limit, the time window given to merchants to respond with chargeback disputes is decided by card networks and acquiring banks. Depending on the reason code — or alphanumeric codes chosen by issuing banks to explain the cause for the dispute — chargebacks may have a time limit of 75, 90, or 120 days. A clerical error made during transaction processing usually has a shorter time limit, whereas customer disputes may have a longer time limit. As a result, knowing the various chargeback reason codes might help you anticipate chargeback patterns and mitigate chargeback risks.

Preventing disputes from turning into chargebacks is necessary to help make sure that your chargeback ratio is kept in check. The chargeback ratio is calculated by dividing the total number of chargebacks received in a given month by the total number of monthly transactions. For example, if you receive 65 chargebacks per 9,000 monthly transactions, your chargeback ratio will be 0.7%, which is generally considered safe.

If your company’s chargeback percentage consistently surpasses 1%, it is possible that you might have to pay higher fees. Midigator’s fully automated order validation solution with multiple integration options can help you cut down on chargebacks and potential revenue loss.

Chargeback Management

A lost chargeback happens when a client wins a dispute or when a merchant refuses to contest a chargeback. Chargeback management is important not only for assisting businesses in recouping income lost due to chargeback disputes but also for preventing chargebacks by analyzing chargeback data to detect patterns and trends to take preemptive measures.

Chargeback insurance means that the merchant is compensated for lost revenue and the cost of the merchandise due to the occurrence of chargeback. Chargeback insurance differs depending on the vendor as well as stipulations and restrictions covered by the chargeback policy. When choosing a fraud detection service for your business, it would be beneficial to select one that offers a chargeback guarantee. It is important to note that usually only chargebacks with fraud-related reason codes qualify for reimbursement.

While a chargeback guarantee protects merchants from criminal fraud, friendly fraud, which occurs when customers buy something online and then dispute the transaction when it shows up on their bank account for no legitimate reason, is not covered by the chargeback insurance policy.

Chargeback Services

Perhaps you might be wondering if you need chargeback services to help you reverse a chargeback decision and protect your revenue. A chargeback app, for example, can collect and analyze relevant transactional data, allowing you to resolve disputes in real time and reduce the risk of chargebacks. There are also chargeback alerts that can notify you of pending disputes and enable you to settle them before they become chargebacks, such as by canceling billing statements and issuing a refund.

A chargeback company such as Midigator can help streamline the dispute process, as well as manage and track chargebacks in a single platform.

When choosing the right chargeback service providers for your company, it is considered a good idea to look at the technology features of third-party vendors. Midigator could be one of the best chargeback companies, offering customized automation and real-time risk assessment for data-driven intelligent decisions in the payment dispute process. With Midigator, you may acquire valuable insights into why disputes occur and take proactive steps to decrease the risk of fraud exposure.

The best way to combat chargebacks is to prevent them from happening. Midigator can assist you with tracking any potential customer difficulties even before they become a larger issue and hurt your bottom line.

Chargeback Process

The chargeback definition is clear and straightforward: a chargeback is a payment reversal that occurs when a customer files a dispute after making a purchase with a debit or credit card. Fraudulent transactions, product cancellations and returns, merchant errors, and misunderstandings over a legitimate purchase are common chargeback examples.

While a chargeback process can be a complex and time-consuming procedure involving multiple parties and several steps, partnering with a technology company such as Midigator can help simplify your payment disputes. Midigator — the world’s first software-as-a-service platform — can help you minimize chargebacks by allowing you to resolve issues before they escalate into problems, as well as enable you to fight chargebacks and maximize your return on investment.

Related Reading

-

- Chargeback Management Company

- Chargeback Software

- Chargeback Services

- Chargeback Automation

- Chargeback Management Services

- Chargeback Company

- Chargeback Management System

- Chargeback Stripe

- Chargeback Management Tools

- Bank of America Chargebacks

- Chargeback Solutions

- Chargeback Management Solutions

- Chargeback Tools

- Chargeback Shopify

Are you ready to see why thousands of companies trust Midigator to manage millions of payment disputes with unprecedented ROI? Sign up for a demo today, and see what you’ve been missing!

Certified & secure technology