Fight and prevent chargebacks with

Midigator’s chargeback automation.

Do you want better results with less effort? Midigator’s automation simplifies the complex, with a 900% average increase in ROI.

The #1 Choice for Chargeback Automation

See why Midigator has a 4.4 out of 5 star rating on Capterra.

![]()

Nick

Sr. Software Engineer II,

Computer Software

Integration with Midigator is easy, and once it’s established, you have access to their full suite of services and reporting without any additional development effort.

![]()

![]()

![]()

![]()

Paul

Manager,

Health, Wellness and Fitness

The automation is the best part for us. We can put people into other roles rather than chasing chargebacks, knowing Midigator is working in the background. It’s a huge timesaver.

![]()

![]()

![]()

![]()

Connor J.

Owner,

Retail

I love the easy-to-use interface that provides actionable data to help reduce and deflect chargebacks.

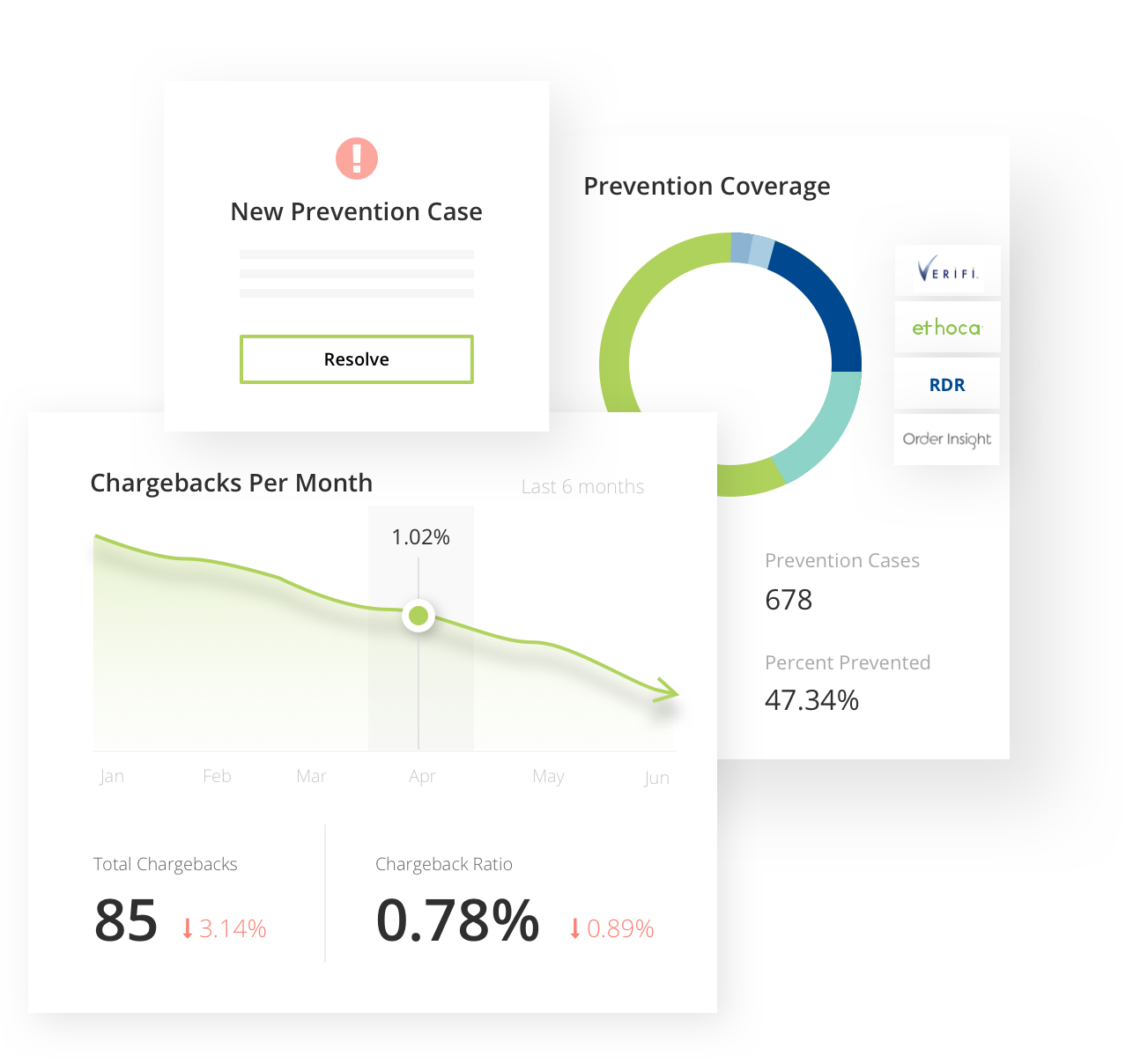

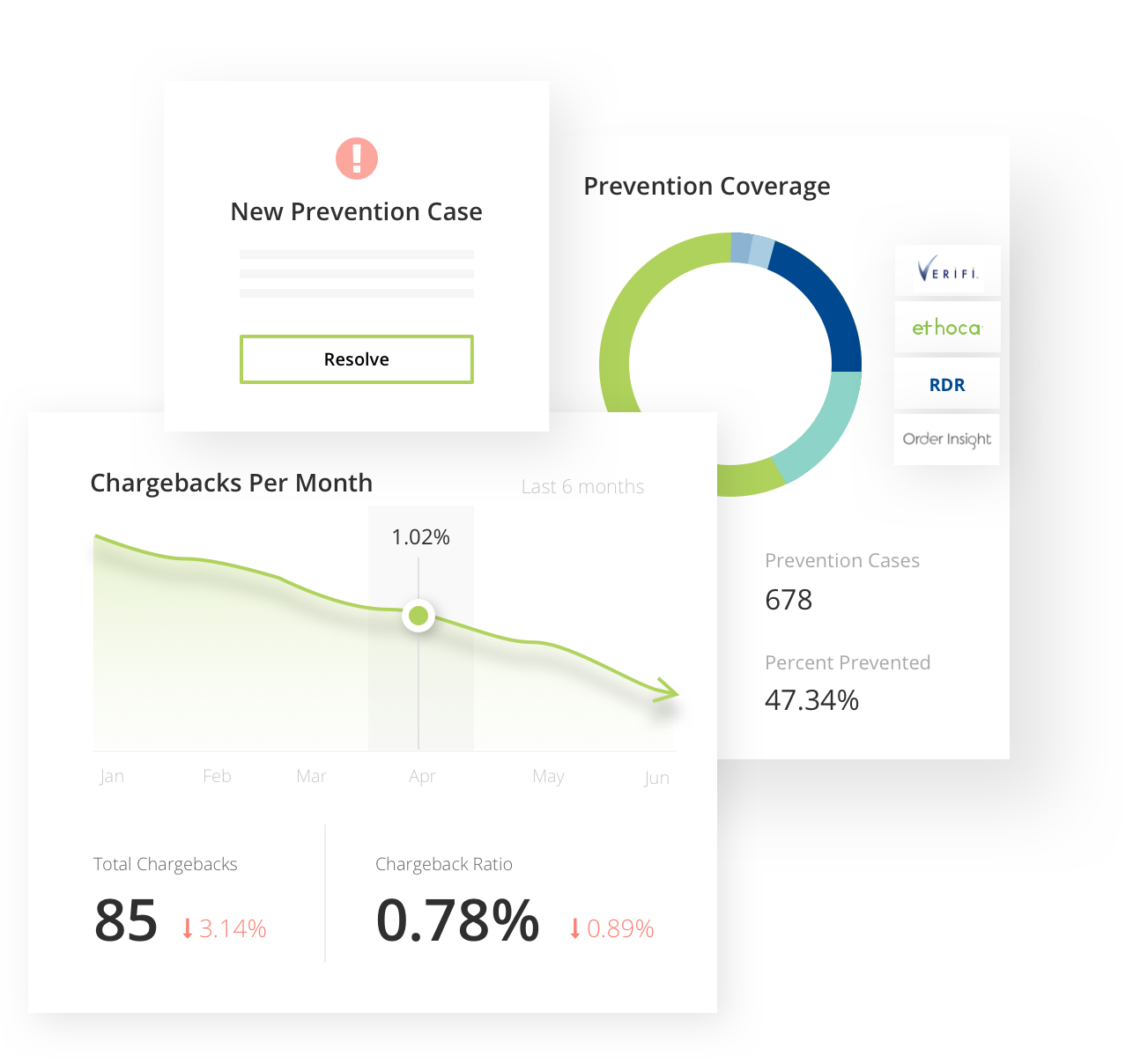

Prevent chargebacks & minimize revenue loss.

The easiest-to-win fight is the one you can avoid. That’s why chargeback prevention is a crucial first step in your management strategy. Midigator has everything you need to prevent the preventable.

- Start seeing results in as little as 24 hours

- Prevent up to 50% of chargebacks

- Solve issues up to 5 weeks sooner

Fight chargebacks & recover more revenue.

When you lose money to chargebacks, Midigator gets it back. Our philosophy for revenue recovery is simple: we want you to have the best ROI possible. That means we fight chargebacks with the greatest efficiency and highest probability of success.

- High win rates consistently improve over time

- Intuitive, easy-to-use technology removes guesswork

- Flexible automation replaces time-consuming, error-prone processes

- On-demand support connects you with industry veterans

Chargeback Automation

Intelligent chargeback management software can benefit businesses in a lot of different ways. One of the most significant benefits is chargeback automation. Using chargeback automation, businesses can simplify payment disputes and improve business efficiency. With chargeback management software, data can be combined into a single platform from which the software can automatically manage payment disputes.

Implementing this kind of automation can improve and streamline the payment dispute process without requiring any extra time and effort from employees. In fact, chargeback automation can actually reduce the team’s workload and allow them to focus their efforts on other tasks. Chargeback management software can also help businesses by providing a method of automatically monitoring chargeback processes. This can help businesses detect problems or inefficiencies before they become worse and optimize the chargeback process.

Businesses can use chargeback automation technology to improve efficiency in a number of different ways. Chargeback management technology can make it easier to dispute chargebacks when a customer files one within the chargeback time limit. By managing the chargeback response workflow with automation, chargeback management software can make the process of disputing chargebacks much simpler. It can also make it possible for businesses to reduce the frequency of chargebacks in the first place. If a customer wins a Visa chargeback dispute, it can result in the payment being returned to their chargeback debit card, so it’s always best to avoid this possibility altogether.

Chargeback automation can enable businesses to streamline the chargeback dispute process while also greatly decreasing the burden on the business to manage chargeback disputes. Automated chargeback management technology is able to manage every step of the chargeback dispute process. This could include many different tasks such as collecting necessary data or writing responses. These tasks can often be completed more efficiently and accurately by automation than by a human. Businesses can take advantage of this improvement and simultaneously decrease the resources necessary to manage chargebacks by implementing chargeback automation software.

Chargeback Management Software

Chargeback management software that provides automated chargeback management can be a very useful tool for businesses for a few different reasons. First of all, dispute management software can make it much easier for businesses to complete the chargeback dispute process in the event of a payment dispute. Chargeback automation can enable a streamlined process that actually requires less effort for employees but may result in a higher rate of success.

Additionally, automated chargeback management software is capable of monitoring the chargeback process in order to detect payment disputes as early as possible. Using chargeback management software as a chargeback tracker is one of the best ways to stay on top of chargeback management. Without an effective dispute management system, a business may not have a way of successfully disputing a chargeback in a timely manner.

Perhaps one of the most substantial benefits that automated dispute management software can offer is the ability to automate chargeback dispute responses. Creating the right response in the case of a chargeback dispute can be challenging, and if you don’t have the right response for the situation, it could have a negative impact on the business’s bottom line. Chargeback automation can help you customize responses according to the reason code of each payment dispute and ensure you’ve accounted for every variable. A payment dispute management system that includes this type of automated function can give a business a better chance of winning payment disputes.

See why we’re #1.

Midigator is a true software solution, providing complete, intelligent chargeback management.

- A team of experts to help you succeed

- Efficient, flexible automation

- Everything you need in one platform

Top Chargeback Management Companies

The top chargeback management companies can provide automated chargeback management software that includes all the aforementioned benefits and more. Not every chargeback management company has the exact same features to offer, however. That’s why it’s important for businesses to research which chargeback company offers the kind of solution that includes all the features they need.

It can be difficult to choose the right chargeback management company, but here are a few examples of the kinds of features that the best chargeback management companies can offer.

Automated chargeback management technology can help create intelligent dispute responses that can give a business a better chance of winning payment disputes. By optimizing responses according to the most important variables relevant to the situation, chargeback automation can create a confident defense backed by reason.

Chargeback management software can also include chargeback prevention alerts. This can help businesses not only fight chargebacks but prevent them as well. The chargeback alert process goes something like this.

- First, a customer files a payment dispute.

- Then, the bank sends an alert through the chargeback prevention software, notifying the business in plenty of time to respond before a chargeback is processed and the chargeback-to-transaction ratio is impacted.

- The business can then use the chargeback management software to streamline the process of managing the alert.

- Finally, the chargeback management software sends a response to the bank through the alert network notifying them that the payment dispute has been handled.

Chargeback Systems Used In Organizations

Chargeback systems used in organizations can be beneficial in numerous ways. Any organization that sells products could benefit from better protection against the risk of chargebacks. Chargeback management automation can not only help organizations fight chargebacks effectively but also help them reduce the risk of chargebacks happening at all.

The chargeback process is not universally well-understood. Some people might wonder: “what is chargeback in cloud computing?” or need to see a chargeback model example to help them understand how the chargeback process works. Learning about the chargeback process can enable more informed decisions when it comes to choosing chargeback management software and fighting payment disputes.

One of the ways that chargeback systems used in organizations can be especially valuable is by enabling deeper analytics that can help businesses understand why chargebacks are happening and prevent them from happening as frequently in the future. Prevention alert data can also be recorded and analyzed according to a variety of different kinds of metrics. This can make it possible for businesses to gain a clear picture of how chargebacks are affecting the bottom line and what can be done to improve the situation.

Chargeback Solutions

Chargebacks pose a serious threat to many different kinds of businesses. When a customer files a chargeback, it can result in lost revenue if not addressed promptly. Luckily, there are quality chargeback solutions that exist to help businesses detect chargebacks and fight them successfully. For example, businesses could find a chargeback company that offers chargeback software that includes automation features to make chargeback management simpler and more effective. These kinds of chargeback solutions can provide a number of different useful features such as prevention alerts, which can help businesses detect disputes early enough in the chargeback process to prevent them effectively.

Not every chargeback company is the same, and each one will likely offer slightly different chargeback solutions. However, the best chargeback management software can offer intelligent automated response suggestions that can help determine the right response for each chargeback situation. This can give businesses a better chance of winning payment disputes and recovering lost revenue.

Chargeback Service

Chargebacks can sometimes result in a significant loss of revenue, which is why chargeback protection for merchants can be an important consideration. A chargeback service that can provide automated chargeback management solutions could equip merchants with the tools they need for effective chargeback recovery. Some automated chargeback solutions come with the benefit of increased accuracy and efficiency, while simultaneously eliminating a great deal of the manual work involved in the payment dispute process.

Intelligent chargeback response automation can also make it much easier for merchants to create compelling responses that can improve the likelihood of winning payment disputes. Overall, chargeback protection for merchants can help ensure that merchants have the means to fight back against chargebacks and potentially recover lost revenue. In addition, the ability to monitor the chargeback process to gain new data-backed insights into the causes of chargebacks can be a valuable asset for organizations. This feature could enable businesses to determine which business strategies are generating the most chargebacks so those strategies can be adjusted or eliminated.

What Is A Chargeback

Preventing chargebacks can help businesses avoid situations in which payment disputes result in lost revenue. When chargebacks do occur, it can be helpful to have a solution like chargeback management software to streamline the dispute process and increase the likelihood of having the chargeback reversed.

However, before you can come up with a strategy to protect your business against chargebacks, it can be beneficial to understand exactly how chargebacks work. It may not be a bad idea to ask yourself “what is a chargeback” and refresh your knowledge of the chargeback dispute process. Analyzing a chargeback example may make it easier to plan for payment disputes in the future.

One factor that can be useful to remember is that a chargeback is not the same thing as a refund. Some people wonder about the difference between chargeback vs refund, but the explanation is actually quite simple: a refund is a voluntary repayment that a merchant offers to a customer. A chargeback is a transaction reversal initiated by the customer and processed by the bank that automatically withdraws the payment from the business’s bank account. Refunds do not have the same level of negative impact on a business as chargebacks do.

Related Reading

-

- Chargeback Management Company

- Chargeback Software

- Chargeback Services

- Bank of America Chargebacks

- Chargeback Management Services

- Chargeback Company

- Chargeback Management System

- Chargeback Stripe

- Chargeback Management Tools

- Chargeback Protection

- Chargeback Solutions

- Chargeback Management Solutions

- Chargeback Tools

- Chargeback Shopify

Are you ready to see why thousands of companies trust Midigator to manage millions of payment disputes with unprecedented ROI? Sign up for a demo today, and see what you’ve been missing!

Certified & secure technology