A chargeback reversal is an attempt to reverse the revenue loss caused by a chargeback. As a merchant, you have the right to challenge chargebacks that shouldn’t have been filed by proving the original transaction was valid. If your reversal is successful, you’ll recover the funds revoked by the chargeback.

If you want to boost your bottom line, you need to fight invalid disputes, submit chargeback reversals, and recover lost revenue. The process is important and profitable, but it can be challenging. In fact, that’s why Midigator was created — to make the complex process easy for merchants.

If you are ready to write a winning chargeback reversal and take on all of the work yourself, check these step-by-step instructions.

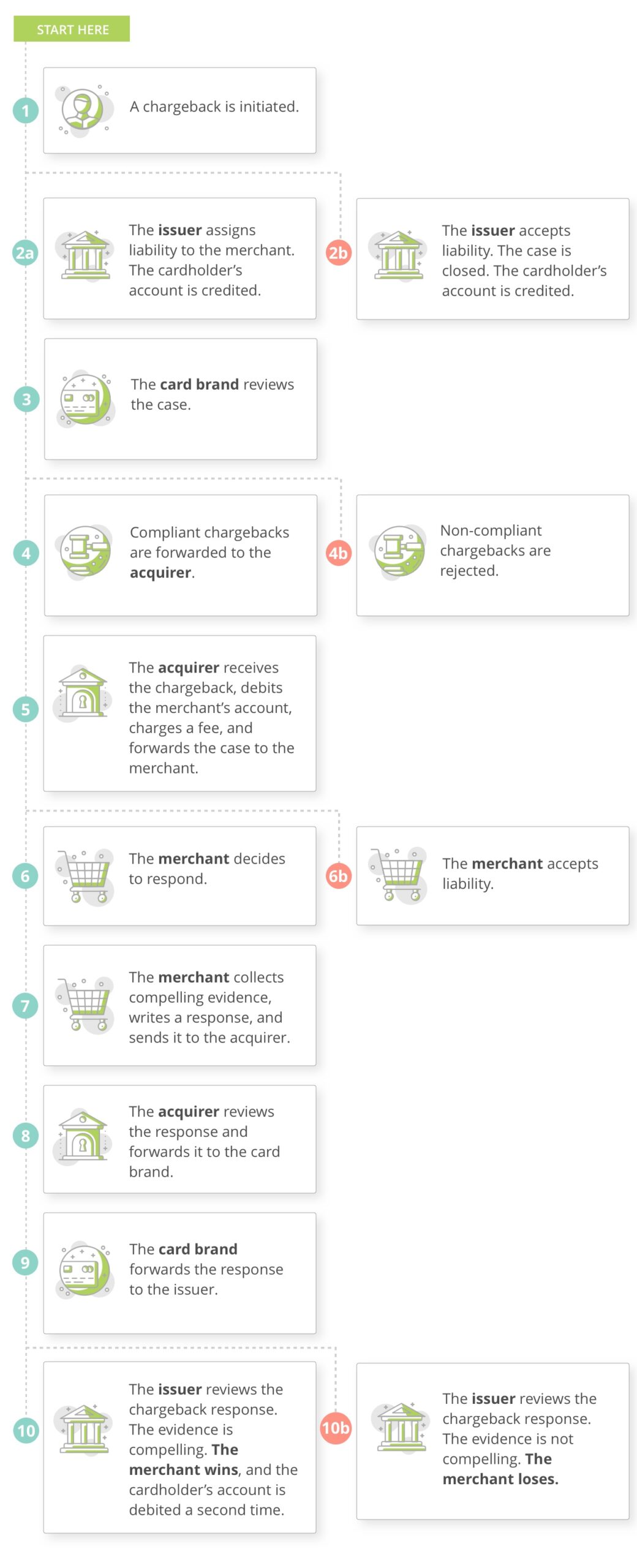

1. Understand the process.

Writing chargeback reversals is an essential process for any merchant that wants to maximize profitability. However, the chargeback process is very detailed which sometimes makes it hard to understand.

The following is a simplified explanation of the chargeback process.

As you navigate the chargeback process, there are a few things to keep in mind.

Things You Should Do

If you want to win the chargeback reversal, you’ll need to be able to accomplish the following four things.

- Be ready to put in the effort. Writing a chargeback reversal can be a challenging task. Unless you use a technology platform that makes dealing with chargebacks easier — like Midigator® — expect a lengthy process with several different steps.

- Get organized. If you want to reverse the chargeback, you need evidence to prove the original transaction was valid. What can help you make that claim? As you collect evidence, keep it organized so you can easily find what you need when it is time to build your response.

- Be patient. Fighting chargebacks is a long process. A lot of different people have to review the case before a decision can be made. Unfortunately, there is no way to fast-track a response. It sometimes takes up to 90 days to find out if the chargeback reversal was successful or not.

- Ask for help. You are an expert at running and growing your business. But you probably aren’t an expert at fighting chargebacks — and that’s ok! Other people are — like the professionals at Midigator. If you let others help, you will have the best chance at reversing your chargeback.

Things You Should Not Do

If you make mistakes during the chargeback reversal process, you could unintentionally damage your relationship with customers or harm your reputation.

- Don’t fight valid chargebacks. There are different types of chargebacks — valid and invalid. You can and should fight invalid chargebacks. These are disputes that shouldn’t have happened — either the cardholder or the bank made a mistake. But valid chargebacks are the result of your own shortcomings — for example, you shipped the wrong merchandise or you failed to stop an unauthorized transaction. If you made a mistake, you should not fight the chargeback. Instead, you need to accept responsibility.

- Don’t leave anything out. There are certain forms of compelling evidence that must be included in your chargeback response. If you omit these items, your case will automatically be rejected.

- Don’t be unprofessional. What you say in your chargeback reversal will be read by a lot of people (your bank, the customer’s bank, and maybe even your customer). Don’t say anything negative about the customer or damaging about your own business processes.

2. Provide great customer service.

Success starts long before you begin writing your chargeback reversal. Set the tone by proactively doing things that will help you win — such as providing exceptional customer service.

If you provided a great customer experience, it lets the bank know you made an effort to do things the right way and weren’t trying to be deceptive. This improves your chance of winning.

Many standard customer service practices will be useful if you need to fight a chargeback. In many cases, chargeback reversals can be won by:

- Creating clear product descriptions

- Maintaining easy-to-understand policies (terms of service, returns, cancellations, refunds, etc.)

- Sending order confirmation emails

- Promptly responding to customer service requests

- Asking about satisfaction and proactively resolving issues

For more tips on how to improve your customer service, check out this article.

3. Use tools that will help you win.

There are many different types of compelling evidence that can help you win the chargeback reversal. Some forms of evidence you can provide yourself (like proof of a quality customer experience). But other types will need to be created and provided by a third party (like proof of identity verification).

If a transaction is incorrectly disputed because the cardholder falsely claims it was unauthorized, you’ll need to prove the cardholder actually was the one to make the purchase. This type of compelling evidence comes from tools that verify the shopper’s identity and authorize the purchase.

There are a couple different tools that you may want to consider using.

- Address Verification Service – AVS verifies a cardholder’s identity by comparing the billing address provided at checkout to the cardholder’s address on file with the issuing bank.

- Card Security Codes – Every debit and credit card has a security code printed on it. Asking for this code during checkout helps ensure the shopper has the card in hand and isn’t using account information that has been stolen.

- 3D Secure 2.0 – 3DS2 allows you to send transaction and contextual information to the issuing bank in real time. The bank compares the information provided to information on file to determine the likelihood of fraud.

4. Know when you’ve received a chargeback.

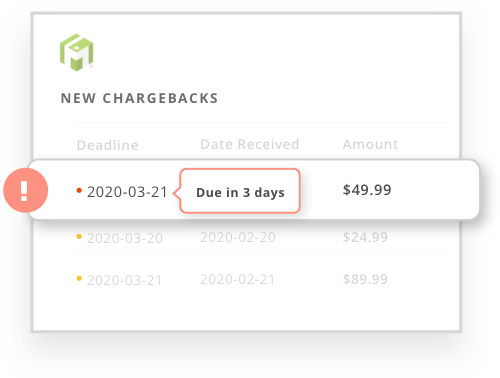

It will be impossible to fight and win a chargeback response if you don’t know when a transaction is disputed.

Processors use different techniques for sending chargeback notifications including mail, email, and online portals. Make sure you know which method your processor uses, and then keep an eye out for notifications — whether that’s opening your mail or logging into your portal daily.

Also, it’s important to note that the chargeback reversal process has tight deadlines. If you don’t respond within the time limit, your case will not be considered. Late responses result in an immediate loss.

Since chargebacks require your immediate attention, it’s important to be notified of disputes as soon as possible. But keeping track of chargeback activity isn’t an easy thing to do on your own — especially if you have multiple merchant accounts.

Ensure that you are always in control of your chargeback situation by working with Midigator. Our dispute management technology will consolidate all your dispute notices in a single platform, making it easy for you to respond to chargebacks and recover lost revenue. Contact Midigator today to learn more.

5. Check the reason code.

All chargebacks have a reason code. Reason codes help you understand why the transaction was disputed. They also help you know what evidence is needed to reverse the chargeback.

Card brands have specific requirements for compelling evidence. Depending on the reason for a chargeback, you will need to include evidence that shows you:

- Processed the transaction correctly

- Verified the identity of the shopper

- Explained the merchandise or service accurately

- Delivered the item as promised

When you receive a chargeback notice, check the reason code. Then, look it up in our reason code database. We’ll tell you what evidence is required for that particular code.

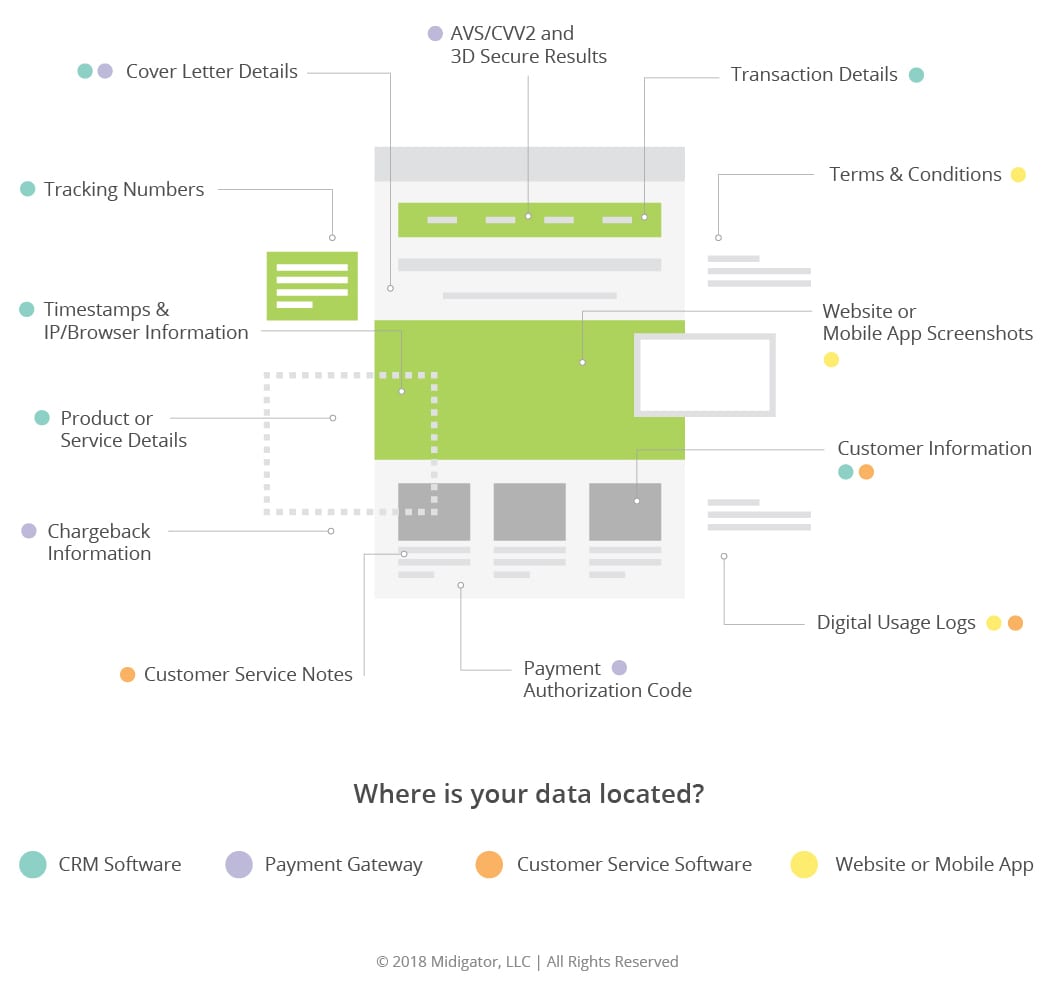

6. Collect compelling evidence.

Once you’ve checked the reason code and know what evidence you need, start collecting your documents. Keep in mind, your compelling evidence could be stored in a couple different places.

Each customer will have had a unique experience, so your chargeback reversal needs to likewise be unique. Don’t create generic, one-size-fits-all responses. Instead, collect evidence that is relevant to the case at hand.

For example, sending proof of identity verification won’t be a very compelling form of evidence if the cardholder claims your merchandise is counterfeit — but a certificate of authenticity from a third party would be.

Customize your evidence based on characteristics such as:

- Item purchased (physical good, digital good, or service)

- Sales method (single sale or recurring purchase)

- Transaction type (card-present or card-not-present)

- Reason code

If this step seems overwhelming, Midigator can help. We offer a couple different chargeback reversal services that can be customized for your business’s needs. Not only do we make it easy to fight chargebacks, we can help you recover the maximum amount of revenue possible. Sign up for a demo today to learn more.

7. Write a great rebuttal letter.

The secret behind any successful chargeback reversal is an excellent rebuttal letter.

A rebuttal letter is an introduction to the chargeback response package. It highlights the most important and compelling parts of the reversal.

There are several critical pieces of information that must be included and formatted in a specific way. This article details the entire letter writing process.

8. Submit your response.

Once you have collected all the compelling information and written a winning rebuttal letter, it is time for you to submit your chargeback response. As you do so, there are a few things to keep in mind.

First, the issuer (cardholder’s bank) is responsible for deciding an outcome, but your processor reviews the reversal first. In order for your case to advance to the issuer for a decision, it needs to first get approved by the processor.

Here’s how to increase your odds of acceptance.

- Optimize for processor preferences, such as page order

- Format the package into a compliant file type, such as a PDF or an image

- Deliver via your processor’s preferred method, such as fax or email

This is a very important step, but it can be challenging. Each processor has different preferences, and it’s difficult for merchants to find out what those preferences are.

Because of our well-established industry partnerships, Midigator is able to customize chargeback reversal packages so they exceed processor expectations and have the highest possible chance of acceptance. If you’d like to take advantage of our insider intelligence, sign up for a demo today. We’ll show you how Midigator makes this step easy and effective.

Second, submit your response before the deadline — don’t wait until the last minute.

We recommend you submit your chargeback reversal at least three days before the expiration date. This allows time for the processor to follow up if items are missing or to resubmit if the first attempt didn’t go through.

9. Review, refine, and repeat!

Chargeback regulations and consumer behaviors are constantly changing. A chargeback reversal strategy that works now might not still be effective in a few months.

That means you’ll want to constantly refine your processes. Here’s how.

Monitor your results, and analyze your data.

Each chargeback you receive contains a wealth of valuable information. Analyzing this data, along with your results, can give you a clearer picture of performance.

Track how many chargeback reversals you won, lost, and didn’t fight. Then break down those outcomes by metrics such as:

- Reason Code – Do you have a higher win rate for certain reason codes?

- Bank Identification Number (BIN) – Do some issuers deny reversals more often than others?

- Product or Service – Do win rates fluctuate based on the item sold?

- Employee – Does one team member write more compelling cases than the others?

- Available Compelling Evidence – Do things like AVS responses or customer services notes impact winnability?

Make this process simple with help from Midigator. Our technology consolidates all relevant data into a single portal for unparalleled transparency. With detailed reports and in-depth analytics, it is easy to monitor results and evaluate performance.

Review your processes and workflows.

After you’ve collected your data and analyze it, think about what it means in relation to your business workflows and processes.

First, identify the tactics that are working well. Keep what you can. Not only will this help you maintain a high win rate, but it will also ensure your processes are as efficient as possible.

Next, identify the strategies that aren’t achieving desired results. What needs to change? How can you improve your efforts?

Adjust and test again.

Once you have identified your strengths and weaknesses, start adjusting your processes. Be sure to monitor your results and retest your outcomes. If you’ve overcompensated, adjust again.

Keep repeating these steps so your results will constantly improve over time.

Let Midigator Handle Your Chargeback Reversals

Submitting chargeback reversals is an important part of maximizing your business’s profitability, but it is easy to get overwhelmed by the process. On the surface, fighting chargebacks seems like a time-consuming, labor-intensive task — and it is if you decide to do it all on your own.

Fortunately, Midigator makes it easy to fight chargebacks and recover lost revenue. Advanced technology and customizable automation remove the challenges that might be holding you back.

Midigator aims to simplify the complexities of payment disputes so you can focus on what matters most: growing your business. Sign up for a demo today to see how simple it can be to win chargeback reversals.