A chargeback is a transaction reversal. It reverses the original purchase by withdrawing funds that were deposited into your business’s bank account and returning them to the cardholder.

There are several reasons why a transaction might be reversed. But regardless of the motive, the outcome is the same: chargebacks cause revenue loss, reputational damage, and sometimes even business closure.

It is essential to learn about chargebacks before they become an unmanageable liability for your business. Use this detailed guide from Midigator® to minimize their impact and prevent future risk.

Handling chargebacks can be a difficult task, especially for a new or growing business. But fortunately, you don’t have to do it alone.

Midigator is a chargeback management platform. Our technology helps merchants of all sizes in all industries prevent, fight, and analyze chargebacks. We make it easy to get chargebacks under control and recover lost revenue.

- Zero-integration or technical know-how required

- Cost-effective strategies and a la carte pricing

- Efficient, tech-driven processes with little to no manual labor

- On-demand customer support

- Quick results with maximum success

We are ready and willing to help you with whatever chargeback challenges you are dealing with. Sign up for a demo today to learn how Midigator will benefit your business.

The Difference Between Chargebacks and Refunds

It may seem like ‘chargeback’ is just another name for ‘refund’ because there aren’t many obvious differences between the two. After all, both chargebacks and refunds cause you to lose money.

But despite their similarities, there are a few important differences that you need to be aware of.

| REFUND | CHARGEBACK | |

|---|---|---|

| COMMUNICATION | You and your customer work together to identify a solution that benefits you both. | Your customer bypasses you and discusses the problem with the bank instead. |

| CLARITY | Your customer tells you exactly what’s wrong so you can solve the underlying issue. | You have to make adjustments based on assumptions that may or may not be accurate. |

| REVENUE LOSS | You are aware of the upcoming revenue loss and can plan for it. | Funds are forcibly removed from your account without any warning. |

| MERCHANDISE | The customer may be willing to return the merchandise so you can try to sell it again. | You can’t ask the customer to return the merchandise since you’ve been omitted from the conversation. |

| IMPACT | Refund counts are monitored but they are a relatively low indicator of risk. | Chargebacks are meticulously scrutinized and penalties are quickly issued if activity increases. |

Refunds aren’t great, but they are usually much better than chargebacks. Ideally, you’ll be able to create a great customer experience that reduces the need for both refunds and chargebacks.

The Purpose of Chargebacks

If refunds and chargebacks do the same thing — return money to the customer — but refunds have fewer consequences, why even bother with chargebacks?

The Invention of Chargebacks

When general purpose credit cards were introduced several decades ago, the new payment method offered several benefits — but it also brought unprecedented challenges. For example, what would happen if someone stole a credit card and used it without permission? Would the cardholder have to pay for the unauthorized purchases?

To address this and other concerns, lawmakers took steps to provide needed protections for consumers. The new laws prompted the card brands (Mastercard®, Visa®, etc.) to create their own safeguards. The result was a chargeback process that ensures cardholders aren’t liable for fraud and other transaction issues.

Merchant Expectations

Designed for consumer protection, chargebacks ultimately hold you accountable for your actions and encourage you to do things like:

- Sell high-quality goods or services

- Follow through on promises (deliver merchandise, issue refunds, etc.)

- Do your best to stop fraudsters from making unauthorized transactions

Important Chargeback Terms

The chargeback process and its regulations can be difficult to understand. One common reason for confusion is the unique terms and phrases that are used. Here is a brief introduction to chargeback terminology.

| TERM | DEFINITION |

|---|---|

| Cardholder | A cardholder is a consumer who has been approved to use a credit or debit card to make purchases. |

| Card Brand | Through partnerships with participating banks, card brands enable cardholders to make purchases at authorized businesses. Some examples of card brands include Visa, Mastercard, American Express®, and Discover®. |

| Issuer | An issuer, or issuing bank, is the cardholder’s bank. These financial institutions are authorized by the brands to issue payment cards to cardholders. |

| Merchant | A merchant is a business that has been approved to process credit and debit card purchases. |

| Merchant Account | A merchant account is the bank account where funds are deposited after credit and debit card transactions are processed. |

| Acquirer | An acquirer, or acquiring bank, is the merchant’s bank. These financial institutions are authorized to provide merchant accounts to merchants and accept deposits on their behalf. |

| Processor | An acquirer partners with a processor to facilitate transactions. The processor’s technology platform shares and receives necessary payment data between merchants and issuers. |

| Dispute | A chargeback is sometimes called a dispute because the legitimacy of the transaction is disputed. |

| Chargeback Response or Representment | A chargeback response is a merchant’s reply to an invalid chargeback. The goal is to prove the original transaction was legitimate, reverse the chargeback, and recover the funds that were withdrawn. This is sometimes called representment because the merchant is re-presenting the transaction to the issuer for consideration. |

| Compelling Evidence | Compelling evidence is documents included in a chargeback response that help prove the merchant’s argument. |

| Pre-Arbitration | Pre-arbitration is the final stage of the chargeback process. It is the last chance for an issuer and merchant to resolve a dispute before it escalates to arbitration with the card brand. |

To learn about other common industry terms, visit our glossary.

The Chargeback Process

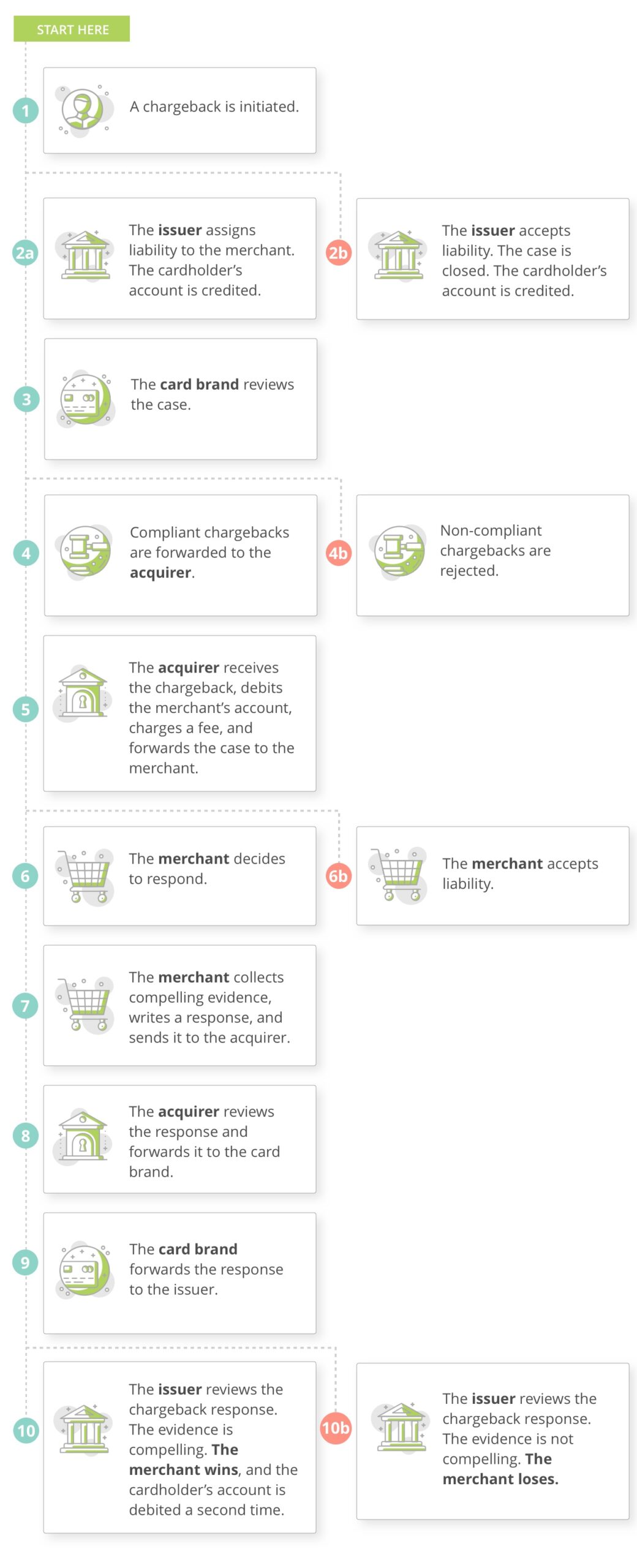

The chargeback process involves several tasks that are completed at different stages of the chargeback lifecycle. Sometimes the process is long, and the chargeback advances through multiple stages. Other times, the dispute is resolved quickly with limited effort.

The following is a simplified explanation of the full chargeback process.

While the above process is typical for most disputes, workflows can vary by card brand. For example, this article explains a different process used by Visa.

The Difference Between Valid and Invalid Chargebacks

Chargebacks are an important and much-needed form of consumer protection. But over time, cardholders gradually started to use the chargeback process in ways it wasn’t originally intended to be used.

Now, merchants receive a mix of both valid and invalid chargebacks.

A valid chargeback is a legitimate payment dispute. The reason for the dispute is credible, and the dispute adheres to card brand rules.

There are really only two reasons why a chargeback should be initiated:

- Criminal activity resulted in an unauthorized transaction.

- You made a mistake but aren’t willing to accept responsibility.

Ironically, valid chargebacks make up a very small percent of overall chargeback activity. The majority of disputes — by far — are invalid.

An invalid chargeback is an unnecessary or non-compliant payment dispute — a chargeback that shouldn’t have happened. The reason for the dispute is false or inaccurate, or the dispute doesn’t follow card brand rules.

Invalid chargebacks are commonly the result of ‘friendly’ fraud. Similar to the military concept of friendly fire, friendly fraud is an attack that comes from someone you would normally trust — your customers.

Friendly fraud happens when a cardholder uses the chargeback process incorrectly, either as an intentional attempt to get something for free or an innocent misunderstanding. There are several reasons why a cardholder might seek an invalid chargeback:

- The cardholder experienced buyer’s remorse and regretted the purchase.

- The cardholder didn’t act quick enough and the refund time limit has passed.

- The cardholder wanted something for free so made the purchase with the intention of later disputing it.

- The cardholder didn’t cancel a subscription before the next billing cycle.

- The cardholder didn’t remember the purchase and incorrectly assumed it was fraud.

Unfortunately, all disputes — even the invalid ones — have a negative impact on your business.

The Impact of Chargebacks

Chargebacks are a costly, time-consuming, frustrating process for everyone involved. But usually, merchants are affected the most.

There are several ways that chargebacks can negatively impact your business. Here are just a few:

- Dissatisfied customers stop doing business with you.

- Customer lifetime value (CLV) decreases.

- Bad reviews damage your reputation.

- Revenue is lost when transactions are disputed.

- Fees are added for every chargeback you receive.

- Even more revenue could be withheld in a reserve account.

- Enrollment in one or more chargeback monitoring programs could add more fines.

- You might lose the ability to process payments.

- You could go out of business.

The impact that chargebacks have on your business can intensify over time. The longer you have a chargeback problem, the worse it will be.

That’s why you shouldn’t ignore chargebacks or just accept them as a cost of doing business. There are steps you can take to prevent disputes and recover lost revenue to improve your bottom line.

Chargeback FAQs

The more you know about chargebacks, the easier they are to manage. Check out these commonly asked questions and our in-depth resources that help answer them.

How Can You Reduce Chargebacks?

Since chargebacks can have such a significant impact on your business, it’s important to make dispute prevention a top priority.

We’ve created a detailed resource that outlines the best tips and strategies to reduce chargebacks. You can find it here.

How Do You Fight Invalid Chargebacks?

When it comes to invalid chargebacks, there is both bad news and good news. The bad news is you unnecessarily lose revenue. The good news is you can get it back.

If you have evidence that proves a chargeback is invalid, you can fight it and win. Check this article for tips on how to successfully fight chargebacks.

Do Chargebacks Have a Time Limit?

Each phase of the chargeback process has a submission deadline. That means there is a limit to how long a cardholder can wait to dispute a transaction and a limit on how long you can take to respond. We share the chargeback time limits in this article.

What are Chargeback Reason Codes?

Every chargeback is assigned a reason code to help you understand why the transaction was disputed. Reason codes regulate things like the time limit, what evidence is needed to fight the chargeback, and what can be done to prevent future disputes.

Each card brand has its own unique codes. You can find the entire list of codes here.

Are Chargebacks Increasing?

Chargeback activity fluctuates over time. It’s important to monitor trends so you can proactively address potential threats before they become unmanageable.

Our annual Year in Chargebacks report shares valuable data that can help you create a management strategy that evolves simultaneously with industry trends. You can find it here.

Prevent, Monitor, and Fight Chargebacks with Midigator

Do chargebacks seem like a confusing topic — something you aren’t willing to tackle on your own? Let Midigator help.

At Midigator, we believe the challenge of running a business should be delivering great products or services, not managing payment risk. Our technology makes it simple to prevent, fight, and analyze chargebacks — all from a single, easy-to-use platform.

Let us handle the chargebacks. You focus on growing your business.

Sign up for a demo today to get started.