What are Chargeback Prevention Alerts? Could They Help Your Business?

- July 16, 2018

- 6 minutes

Payment industry experts often talk about using chargeback prevention alerts to reduce risk.

But what are prevention alerts? Could they help your business?

Here’s what you need to know to get the best results from this chargeback prevention tool and how to optimize your ROI.

What are prevention alerts?

A prevention alert is primarily used to resolve a consumer dispute so an issue won’t escalate to a chargeback.

Prevention alert networks enable each participating issuing bank to communicate directly with merchants in real time. The issuer alerts the merchant when a cardholder has disputed a transaction so the merchant has a chance to provide a refund.

Why should you use prevention alerts?

There are several useful benefits of chargeback prevention alerts:

- Reduce chargeback rates by about 20-30% to help prevent chargebacks and chargeback threshold breaches

- Stop order fulfillment so cost of goods isn’t lost

- Improve the customer experience by resolving issues quickly

- Identify issues within 24 hours of a cardholder dispute, rather than waiting until a chargeback is issued 2-5 weeks later

Any merchant — whether card-present or card-not-present, big or small — can benefit from chargeback prevention alerts.

Who offers prevention alerts?

There are two vendors who maintain prevention alert networks: Ethoca™ and Verifi™.

What are the differences between the two prevention alert networks?

The basic functionality of both alert providers is the same. They both help merchants resolve disputes and avoid chargebacks. However, the way they go about providing that functionality is slightly different.

- Originally created to help merchants resolve issues resulting from non-fraud, consumer disputes

- Strong presence in US, expanding into international regions

- Originally created to help merchants resolve issues resulting from legitimate credit card fraud

- Strong presence in both US and international regions

Because each prevention alert vendor has a slightly different area of expertise, they partner with different banks. A few issuing banks are in both networks, but for the most part, each provider has a unique network of issuers.

Which prevention alert network should you use?

There are benefits associated with both chargeback prevention alert networks. The one you choose will depend on characteristics specific to your business.

Use Verifi if...

- the majority of your chargeback reason codes are for consumer disputes (merchandise not received, credit not issued, etc.).

- you sell to a predominately US customer base and seek coverage in the United States.

Use Ethoca if...

- the majority of your chargeback reason codes are for unauthorized transactions.

- you sell to customers within the US, but also globally.

Use both if...

- you receive a mixture of both fraud and non-fraud chargebacks or many regular transactions are high risk

- you want the most comprehensive protection possible.

What is the workflow for prevention alerts?

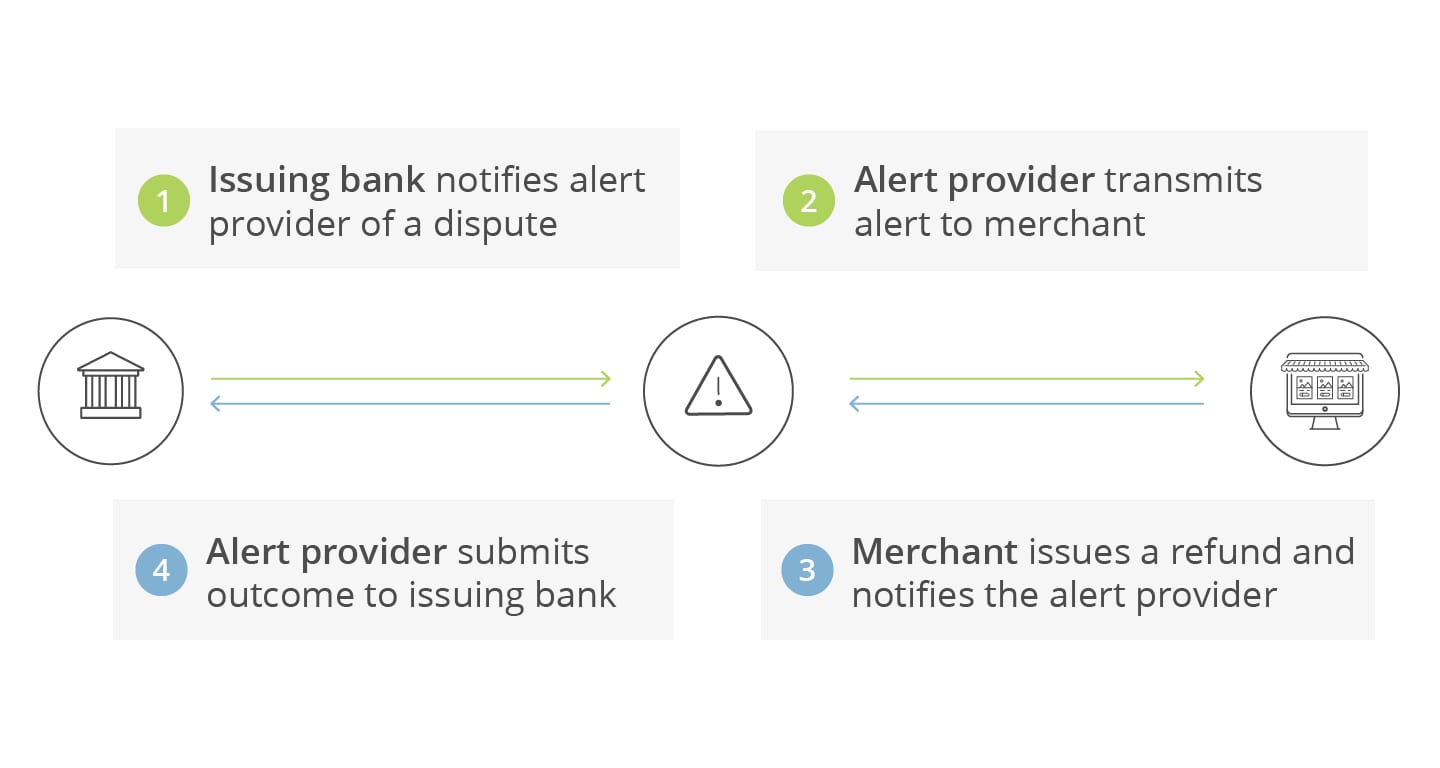

In general, the prevention alert workflow is pretty straightforward.

1 The issuer notifies the alert provider of the dispute.

2 The alert provider transmits an alert to the merchant.

3 The merchant refunds the original transaction and notifies the alert provider that action was taken.

4 The alert provider notifies the issuer that the dispute has been resolved.

(click image to zoom)

How can I optimize prevention alert management for maximum ROI?

If managed correctly, chargeback prevention alerts can yield significant ROI. Best practices and management tips depend on how you choose to integrate with the alert networks.

You can either integrate directly with Verifi and Ethoca, then manage all responsibilities in-house. Or, you can integrate through a preferred partner and outsource some or all responsibilities.

Options are listed below, ordered from highest ROI to lowest.

OPTION #1:

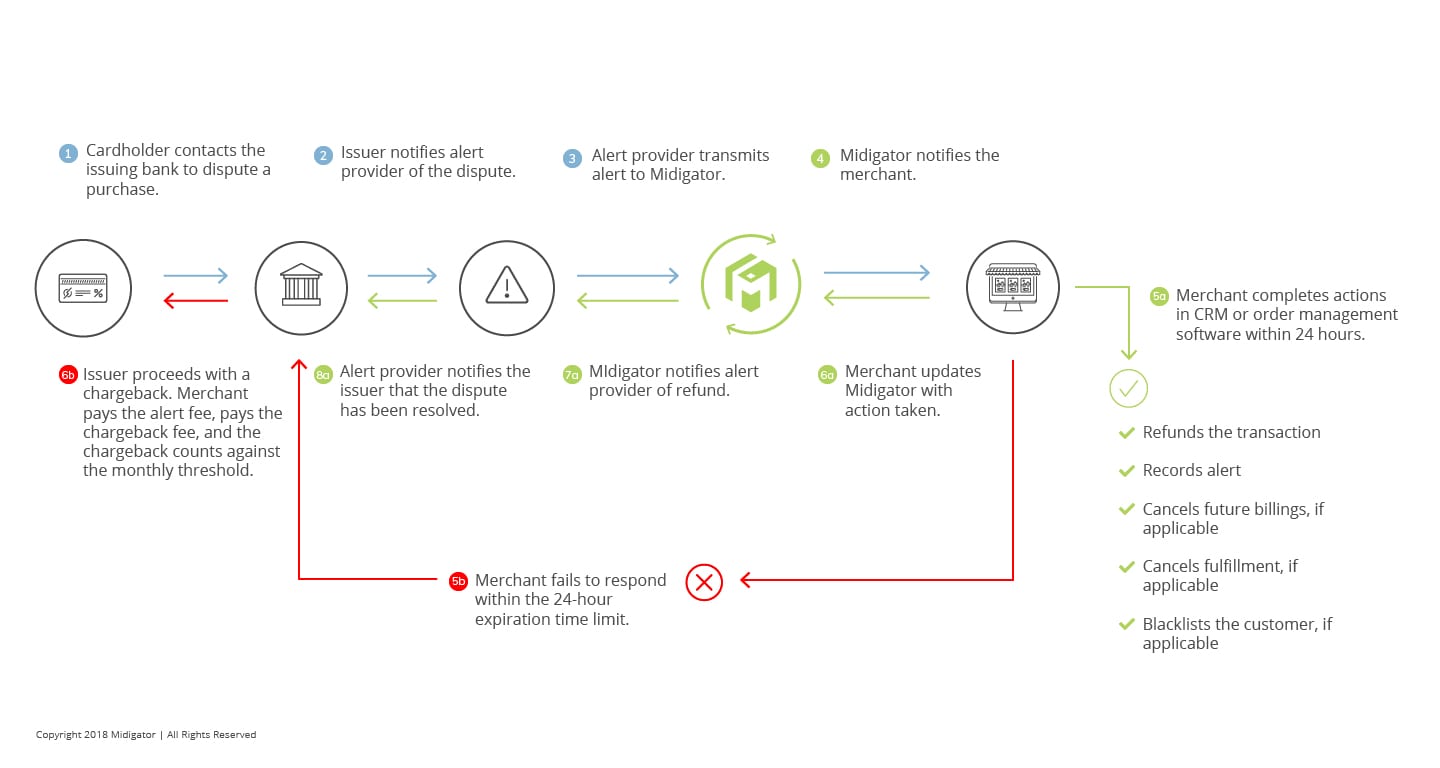

Integrate Through a Preferred Partner and Automate

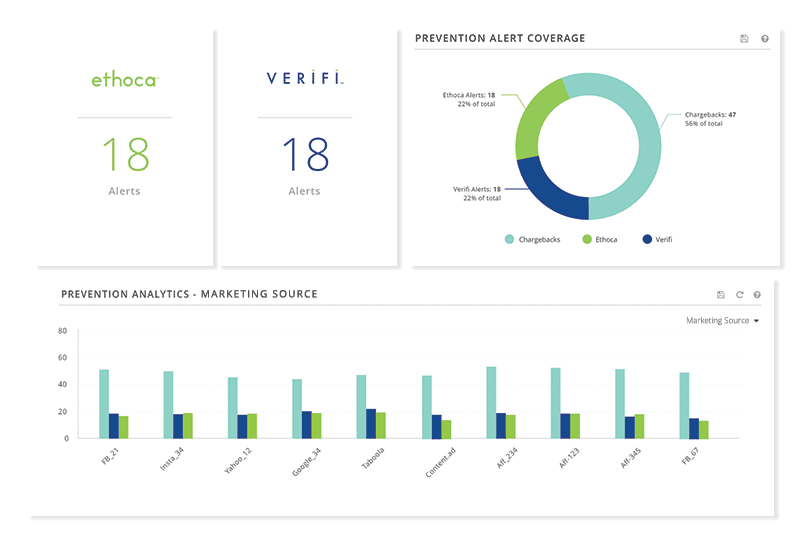

Midigator® is a certified preferred partner for both Ethoca and Verifi. The automated technology can fully manage prevention alerts on your behalf.

Here’s how it works: (click image to zoom).

This is the most popular management option because it offers the highest ROI. The reasons it yields such superior results are:

- All your data will be in one platform. If you do choose to use both the Ethoca and Verifi dispute resolution networks, you can monitor outcomes for both vendors from a single platform. You won’t have to log into multiple portals to see what is happening.

- The automated technology eliminates the need for additional labor. You won’t have to increase FTEs or add responsibilities to your existing dedicated team.

- You won’t have to worry about costly mistakes. With real-time automation, you won’t have to worry about cases expiring or refunding after the time limit has passed.

- You’ll have access to in-depth analytics. Through direct integrations with your CRM (or order management system) and alert providers, all your data will be funneled into the Midigator platform. The technology can use that data to generate in-depth analytics. These analytics can help you determine why the dispute happened in the first place. And prevention alerts are usually issued within 24 hours of the dispute, unlike chargebacks that reach the merchant 2-5 weeks later. So if you analyze your prevention alert data, you can predict future chargeback trends and take action to solve issues at their source much sooner.

The reason this management style produces the highest ROI is it prevents the most chargebacks possible with the fewest costs.

Chargeback prevention alert prices are the same whether you integrate directly with the provider or you integrate through Midigator. But with Midigator, you have all the additional benefits — at no additional cost. You get the automation and analytics completely free.

Another benefit of using prevention alerts through Midigator is the option to have a comprehensive chargeback management strategy. Everything you need is in one place. You can prevent, fight, and analyze chargebacks from a single platform.

OPTION #2:

Integrate Through a Preferred Partner and Manage In-House

Midigator also offers a partially-automated solution to help streamline workflows. This option is ideal for merchants who can’t or don’t want to integrate their CRM with Midigator.

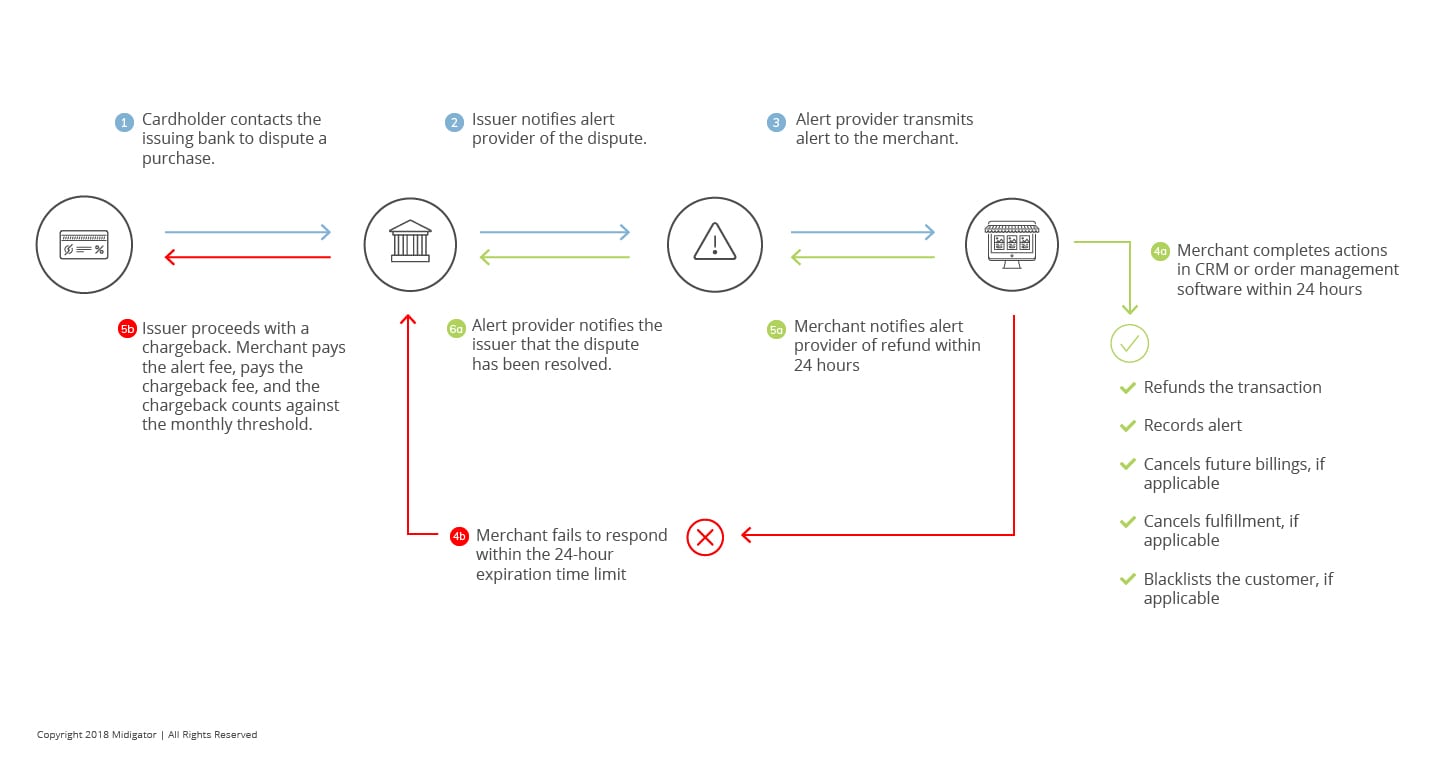

The workflow is as follows (click image to zoom).

If you choose this option, you’ll experience several benefits.

- All your chargeback prevention alerts can be accessed from a single platform. You won’t have to log into multiple portals. You can view all your chargeback alerts from both vendors in a detailed report, and all your management responsibilities will happen within a single dashboard.

- You’ll be able to automate about half of your responsibilities. This means you can reduce your in-house involvement.

- You’ll have access to reporting. Managing prevention alerts for both vendors in a single platform means you’ll be able to consolidate your data for easier analysis.

With this option, you’ll also have the ability to create a comprehensive chargeback management strategy. Again, everything you need is in one place. Midigator makes it easy to prevent, fight, and analyze chargebacks from a single platform.

OPTION #3:

Integrate Directly to Alert Provider(s) and Manage In-House

The last management option is to integrate directly with Ethoca and Verifi. If you choose this option, you’ll need to manage all responsibilities in-house.

You’ll be notified via email that a prevention alert has been issued. You’ll then log into the portal for the corresponding alert provider. After checking the prevention alert details, you’ll log into your CRM to match and resolve the alert. Finally, you’ll go back to the prevention alert portal and submit the resolution.

This process will be repeated for each prevention alert you receive, potentially sending you into both your Ethoca and Verifi portals multiple times per day.

The process looks like this (click image to zoom).

To achieve the best results possible, you’ll want to follow these best practices when managing in-house:

- Monitor prevention alerts 24 hours a day, 7 days a week, 365 days a year. You must respond to prevention alerts within 24 hours. If you don’t, the alert will progress to a chargeback and you’ll double your expenses. Issue refunds and respond to alert providers as promptly as possible.

- Watch for unsuccessful alerts. If you refund a prevention alert within the time limit and you still receive a chargeback, you are entitled to a refund for the prevention alert fee. If you manage in-house, you’ll need to keep an eye out for these situations and submit necessary paperwork to secure a refund. These situations are rare, but should be monitored to ensure optimum ROI.

- Don’t forget to update your CRM. Make sure future transactions are cancelled (if applicable). If the merchandise hasn’t been shipped, stop fulfillment. And if you maintain a blacklist, add the customer to prevent future chargebacks.

- Create reports and analyze your data. Prevention alerts contain a wealth of information. The more data you analyze, the better your insight. Try to trace disputes back to their original marketing source, issuer BIN (bank identification number), country, product type, and price point. Analyzing this data for all your prevention alerts can help you understand why customers disputed the original transaction.

It’s important to note that not all merchants can work directly with Verifi and Ethoca. The alert providers typically only accept enterprise-level clients that meet minimum volume requirements. A merchant account with lower volume must receive prevention alerts through a preferred partner.

Ready to Try Chargeback Prevention Alerts?

Midigator has hundreds of clients and approximately 90% use chargeback prevention alerts. Not only do these merchants find value in working with a chargeback management company and receiving prevention alerts, they also recognize the highest ROI is achieved by letting Midigator automate processes and analyzing the data that is generated.

If you think prevention alerts can help your business too, contact Midigator today. We’ll take you through a demo of the software so you can see the automation in action.