Valid & Invalid Chargebacks: What’s The Difference?

- September 4, 2019

- 5 minutes

The payments industry categorizes chargebacks several different ways depending on the characteristics being analyzed.

For example, chargebacks are often labeled friendly fraud or malicious fraud. Another example is Visa® categorizing disputes as allocation or collaboration.

There is yet another, more general, way to classify chargebacks and it is probably the most helpful: valid chargebacks or invalid chargebacks.

What is a Valid Chargeback? What is an Invalid Chargeback?

Chargebacks can be valid or invalid.

VALID is defined as “legally binding,” “compliant,” and “officially acceptable.”

Therefore, a valid chargeback is a legitimate payment dispute. The reason for the dispute is credible, and the dispute adheres to card network rules.

Examples of valid chargebacks:

- The billing descriptor for the purchase was vague or hard to understand. The customer didn’t know what the charge was for or who to call to clarify.

- A criminal made an unauthorized purchase.

INVALID is defined as “without foundation,” “deficient in substance,” and “without legal force.”

So an invalid or false chargeback is an unnecessary or non-compliant payment dispute—a chargeback that shouldn’t have happened. The reason for the dispute is false or inaccurate, or the dispute doesn’t follow the card networks’ rules.

Examples of invalid chargebacks:

- The cardholder’s bank didn’t abide by time limitations and filed the chargeback 30 days after the deadline had passed.

- The cardholder’s claim via the dispute process was that the merchandise wasn’t delivered, but it actually was.

- The cardholder doesn’t want to bother with the refund process and files a chargeback instead by falsely claiming fraud.

- A husband uses a shared credit card without telling his wife. Thinking the purchase was unauthorized, the wife calls the bank to dispute the charge.

Which Dispute Type is Most Common — Valid or Invalid?

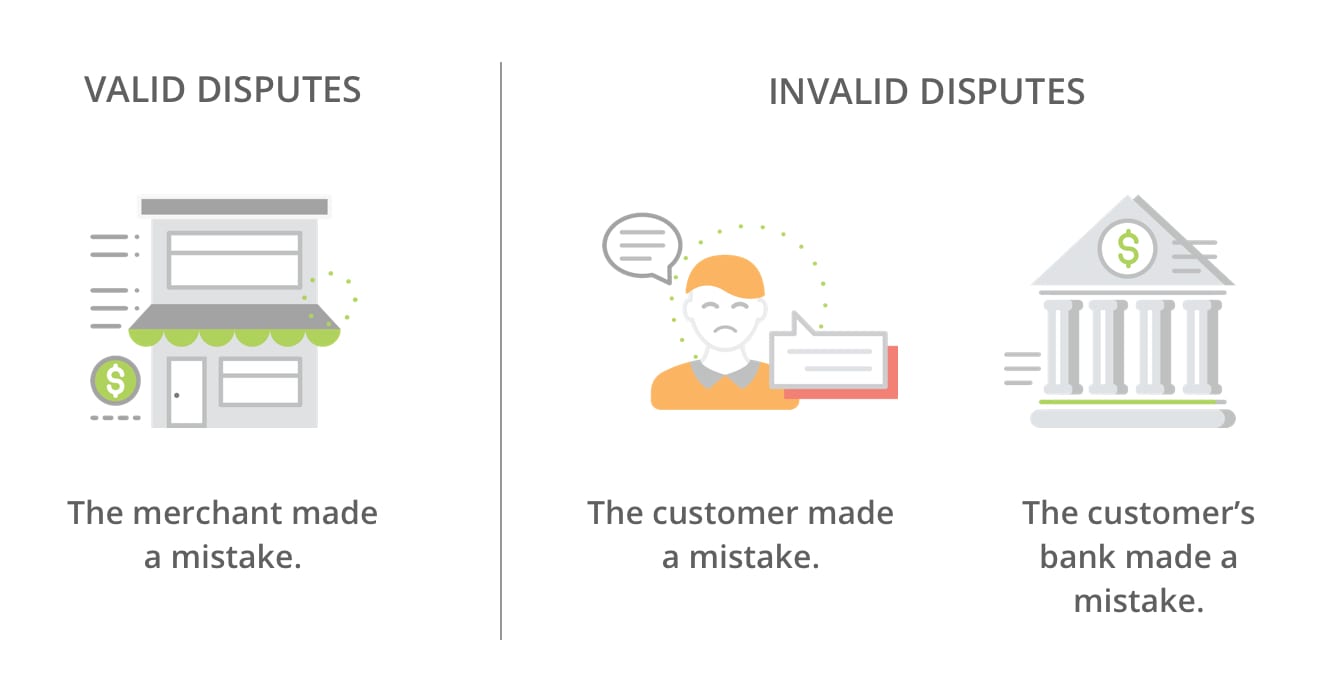

Another way to think about chargeback validity is this: who made a mistake?

Hopefully, you don’t have many valid chargebacks. If you are repeatedly making mistakes, that’s not good! You’ll likely have some pretty big problems to deal with.

Analyzing your chargeback data can help you determine which type of disputes are most common for your business. Take a deep dive into the available information and discover the underlying causes. If the majority of your disputes are valid, there’s good news—these types of chargebacks are usually preventable.

Simple updates to your business’s policies, procedures, and fraud rules can have a big impact. If you’d like to learn more about which changes could help your business the most, check out our most popular chargeback prevention articles:

So if you’re doing all you can to minimize errors and solve problems at their source, the majority of your disputes will be invalid.

Invalid chargebacks are commonly called friendly fraud or first-party fraud. And unfortunately, friendly fraud occurs quite often.

According to Midigator’s The Year in Chargebacks report, 77.2% of disputes classified as fraudulent chargebacks were actually cases of friendly fraud (customer or bank mistakes).

Other data found that merchants were only at fault for 21.4% of processing error disputes. The majority were either customer or bank errors.

Why Does it Matter if a Chargeback is Valid or Invalid?

Who cares if a dispute is valid or invalid? You should!

There are two reasons why it is important to monitor your chargeback types:

1Valid disputes can be prevented.

2Invalid disputes can be fought.

If you haven’t been concerned about the validity of your chargebacks, now is the time to readjust your management strategies.

Take the necessary steps to minimize valid chargebacks as much as possible. Then, fight your invalid chargebacks and recover lost revenue.

Something to Note:

Remember when we said determining validity is kind of like deciding who made a mistake? Invalid disputes are mistakes made by either the customer or the customer’s bank.

A lot of times, merchants will only respond to bank mistakes (disputes filed after the deadline, disputes that have already been refunded, etc.) because they are easy to fight and win.

If that is your philosophy — or your chargeback service provider’s — you are jeopardizing both your bottom line and the future of your business.

Bank mistakes make up a very small portion of invalid disputes. The vast majority are caused by customer mistakes or friendly fraud.

You should be fighting all invalid chargebacks, not just the easy-to-win cases.

There are several very valuable benefits of fighting invalid chargebacks. If you aren’t sure how to fight customer mistakes, check out the tools and services that can help.

Tips to Prevent Valid & Invalid Chargebacks

Chargeback prevention is an important task. It helps you retain revenue, avoid costs like the chargeback fee, and protect your reputation.

A complete strategy should address both valid and invalid chargebacks.

Preventing Valid Chargebacks

Valid chargebacks are the result of criminal activity or merchant error. Here are some tips to address both.

- Make sure your policies and contact information are easy to locate and understand. You want to make it easier for customers to contact you than the bank.

- Abide by all valid refund requests. If the request isn’t valid, don’t accept the delivery. Instruct the carrier to return the merchandise to the sender.

- Don’t charge the customer’s card before the merchandise has shipped.

- Make sure your fulfillment team understands your inventory and knows what merchandise to ship.

- Use clear, honest product and service descriptions so customers know exactly what they can expect.

- Use fraud detection software, like our partner Kount, to block fraudulent activity. Stop unauthorized transactions to reduce the risk of future chargebacks.

Preventing Invalid Chargebacks

Invalid chargebacks are harder to prevent — but not impossible.

- Use a clear billing descriptor so cardholders recognize and remember their purchase.

- Proactively reach out to customers after a purchase to gauge satisfaction.

- Consider extending your return policy and offer free return shipping. The more user-friendly your policies, the better the chance of a refund instead of a chargeback.

- Sign up for order validation solutions. You can send transaction data to the cardholder’s bank in real time. Increasing clarity about the interaction will hopefully resolve the issue without the need for a chargeback.

- Use prevention alerts to proactively refund disputed transactions.

Tips to Fight Invalid Chargebacks

The chargeback process is a consumer protection mechanism. However, it does provide merchants with the right to fight invalid chargebacks and recover revenue that’s been unfairly sacrificed.

Here are some tips to increase the effectiveness of your chargeback disputes.

- Check with your payment processor. See if there are any special requests or preferences for submitting a chargeback response. For example, should responses be mailed? Emailed? Faxed? What file types will be accepted?

- Make sure you understand the assigned reason code. Each card brand has its own classification system. So there are dozens of American Express, Discover, Mastercard and Visa chargeback reason codes to familiarize yourself with. If you understand the requirements of each, you can manage chargebacks on a case by case basis.

- Check compelling evidence options. Your chargeback response should be supported with documents or evidence that helps prove your case. Check the requirements for the assigned reason code, and then see what you have available.

These blog articles have insider tips and tricks to help you fight invalid chargebacks:

Want Help Managing Valid & Invalid Chargebacks?

It’s important to recognize the difference between a valid and invalid chargeback. But you don’t need to be the one to make that distinction.

At Midigator®, we believe the challenge of running a business should be delivering great products or services, not managing payment risk. Concerns about chargeback validity shouldn’t occupy another second of your time.

Your focus should be growing your business — Midigator’s technology can help prevent chargeback fraud and stop revenue-stealing disputes. Sign up for a demo today to learn more.