The chargeback process is a detailed workflow for handling payment disputes. It’s intended to provide standardization so case management is consistent.

If you understand the chargeback process, you can manage disputes with optimum ROI. But mistakes or misunderstandings could destroy your bottom line.

The Chargeback Process: A Real-Life Explanation

Chargebacks are an important part of the payments ecosystem, but they are very complex and can be difficult to understand. People often get confused by the terminology and technicalities of how the chargeback process works.

At Midigator®, we aim to remove the complexity of payment disputes. So we’ve come up with a simplified way to explain the chargeback process. We are sharing a real-world example of how a dispute unfolds.

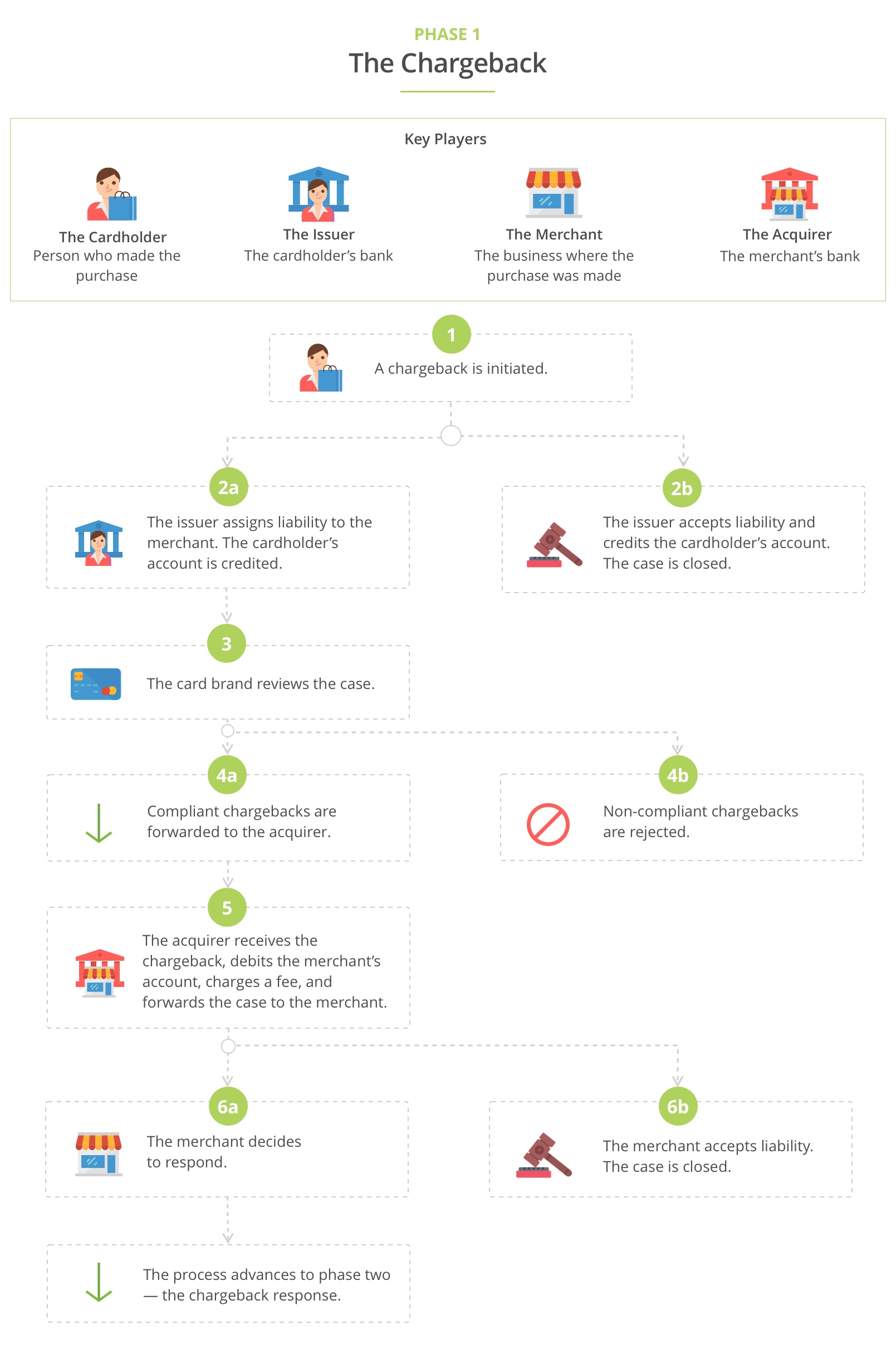

As you read through the story, there are opportunities to dive deeper into the specifics. Take a look at our detailed flow charts or simply continue through the narrative.

Meet the Main Characters

The various characters have different roles to play at each stage of the chargeback process. The complete workflow is made up of five phases:

- Chargeback

- Chargeback Response

- Pre-Arbitration

- Pre-Arbitration Response

- Arbitration

NOTE: Usually, the chargeback process is finished after one or two phases. Occasionally, a case will advance through all five stages (this is extremely rare for American Express® and Discover® disputes). In this example, the case progresses through the very last phase to give you a complete overview of the process.

Also, the chargeback process differs significantly for Visa® allocation disputes. Learn more here.

Without further ado, on to the story!

Chargeback

Carli’s employer was hosting a formal dinner party, and Carli needed something fabulous to wear. She found a great online store that offered custom, hand-made dresses. Mike’s Formal Wear could design exactly what she was looking for.

Three weeks later, Carli’s dress arrived on her doorstep. Excited, Carli rushed to try it on, but she was immediately disappointed — the dress was too small! Apparently, Carli had sent the wrong measurements!

Panicked, Carli emailed the customer service team at Mike’s Formal Wear and explained the situation. Mike was sympathetic but unable to do what Carli asked — he couldn’t make the dress larger nor could he offer a replacement since he wouldn’t be able to resell Carli’s custom dress.

Carli was upset. She was out a ton of money and still had to buy another dress. So Carli decided to file a chargeback.

She called Ian at her bank to dispute the charge and fibbed a little. She told Ian that she had ordered a dress from Mike’s Formal Wear, but Mike sent the wrong size and then refused to refund her money. Based on the information Carli provided, Ian decided the situation warranted a chargeback.

In the Mastercard® online portal, Ian entered the necessary information to initiate the dispute. Once the chargeback was filed, Carli’s bank account was credited for the transaction amount. Carli was ecstatic; she immediately went out to find a new dress — the party was only a week away!

Meanwhile, Mastercard forwarded the chargeback to Mike’s bank. His merchant account was debited for the amount that was returned to Carli plus a chargeback fee. A notice was sent to Mike, informing him of the chargeback.

Mike received the chargeback notice and was shocked. He had done nothing wrong! He had fulfilled his obligations yet Carli was punishing him!

What should Mike do? He had two options. Mike could just accept the chargeback —and the loss of revenue. Or he could fight back and try to recover his money as part of the dispute processes.

Mike decided to fight.

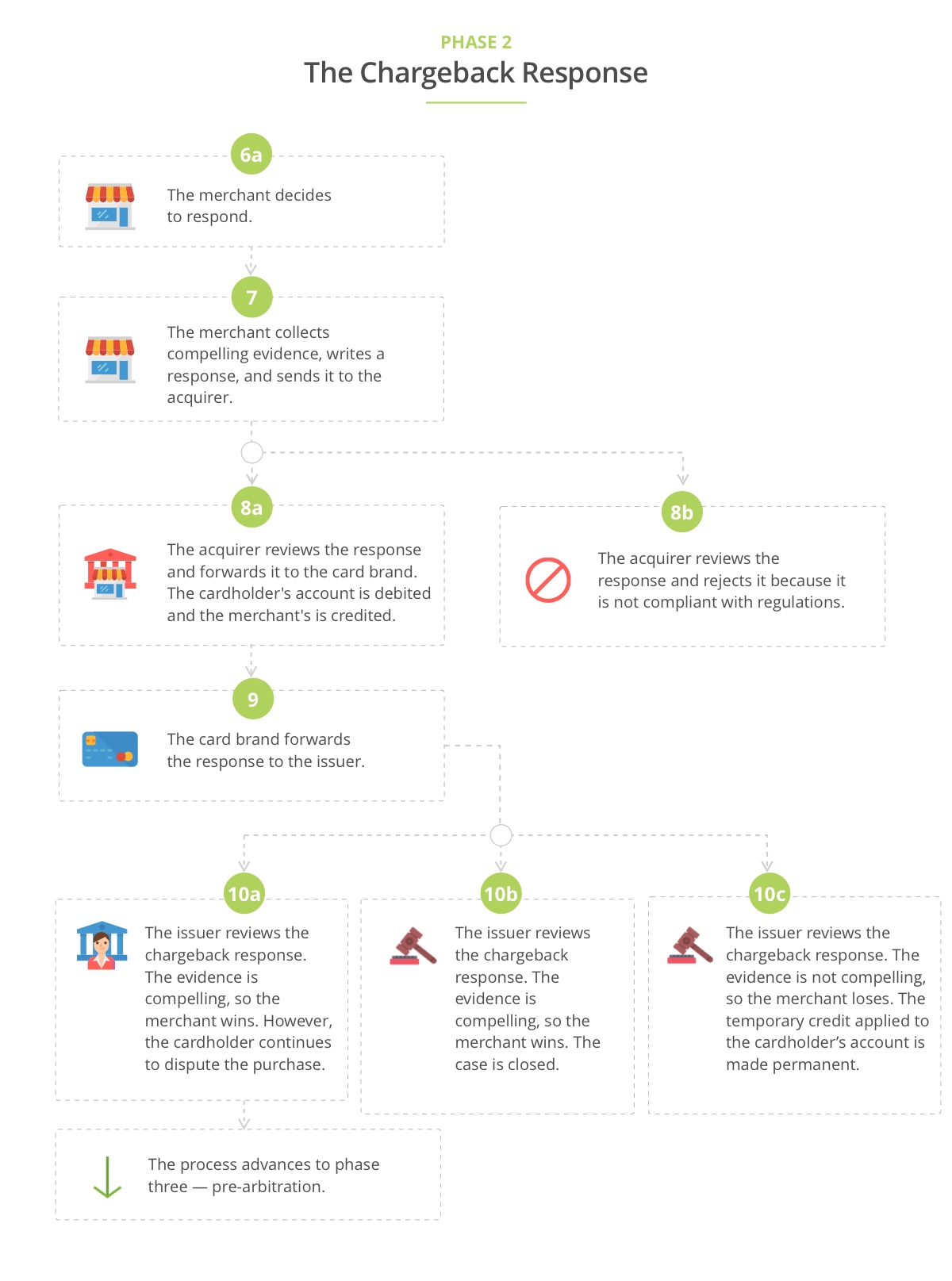

Chargeback Response

Mike collected all the information he had on file that related to Carli’s purchase — a description of the item she bought, the measurements she sent, the company’s refund policy, emails they had exchanged, and more. Mike could use this information as compelling evidence to support his case.

Mike wrote a cover letter to explain the situation and rebut Carli’s disputed transaction. He packaged everything up — the letter and his evidence — and sent the chargeback response to his bank.

At the bank, Adam received Mike’s chargeback response. He checked everything Mike had sent. It seemed like a compelling argument, and Mike had included all the necessary information. Plus, Mike had adhered to the bank’s submission deadline. Since everything seemed to be in order, Adam uploaded the response to the Mastercard online portal. Once again, the transaction amount was removed from Carli’s bank account and returned to Mike.

Carli’s bank was notified that Mike had responded to the chargeback. Ian received the case and looked it over. Mike’s evidence was strong and contradicted what Carli had said. Ian decided a chargeback reversal was valid.

Ian called Carli to explain the situation. Since Mike had successfully challenged the dispute, Carli’s account had been debited a second time.

Carli panicked. She had already spent that money! There was no way she could afford two dresses — especially since she couldn’t even wear one of them! Carli decided to try a different tactic.

She admitted that she had initially made a mistake. But since her original dispute, the situation had gotten even worse. Carli told Ian that she discovered that Mike’s sewing was faulty — some of the dress’s seams were wide open. The dress size was now irrelevant. The product was defective.

Carli demanded that Ian start disputing the charge a second time.

Pre-Arbitration

Ian went back to the Mastercard online portal. He disputed the transaction again, noting Carli’s new reasoning.

The new dispute notification was sent to Mike’s bank and Adam received it. He forwarded the news to Mike, along with advice on what to do next.

Adam told Mike he basically had two options. He could accept responsibility and his merchant account would be debited one last time. Or, he could respond and keep challenging Carli’s claims.

A lot of money was at stake — that dress wasn’t cheap! But, if Mike continued to fight, he had the potential to lose even more. The longer the battle raged, the more costs and fees there would be.

Despite the risks, Mike decided to keep fighting. He wasn’t ready to give up yet!

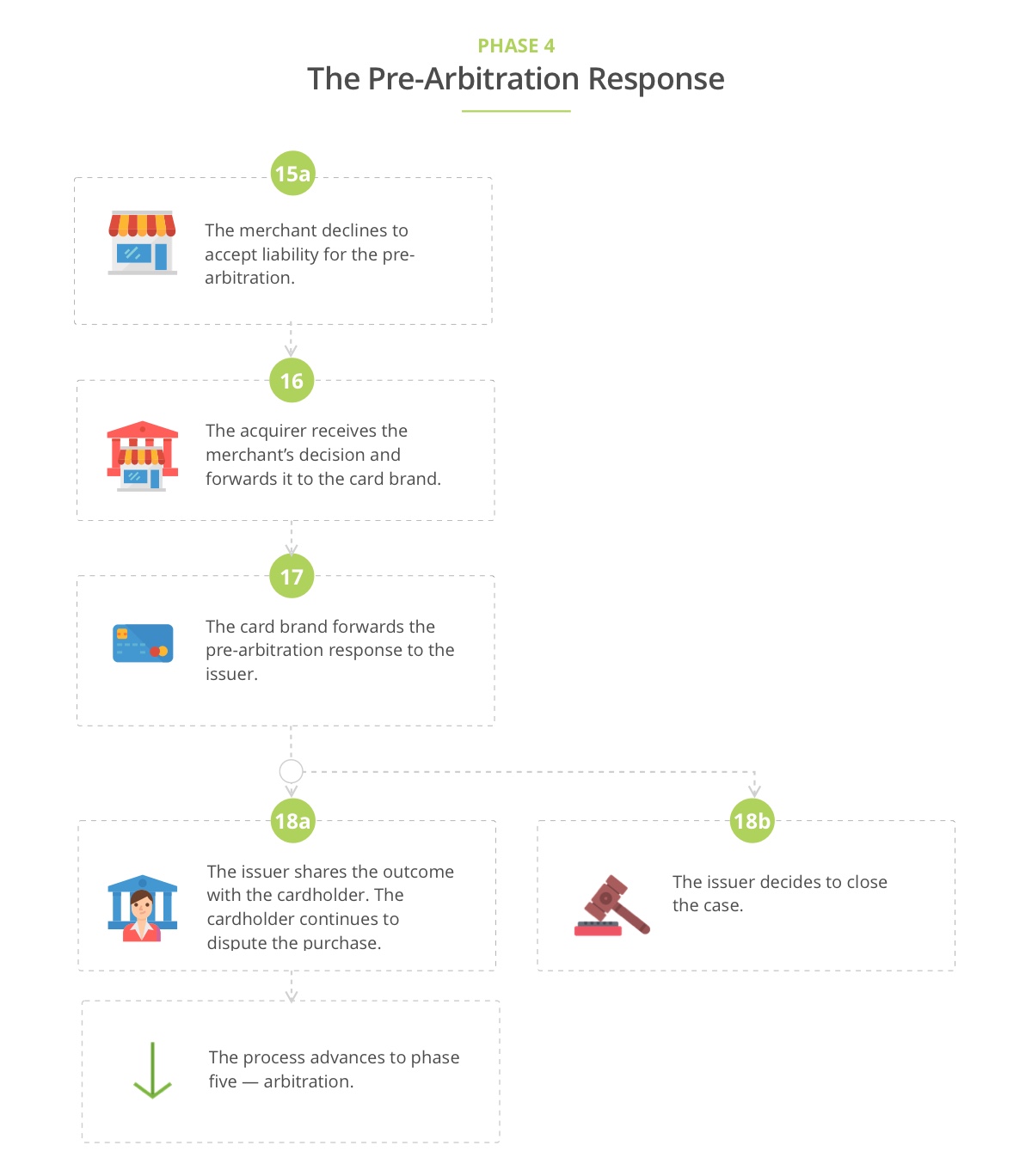

Pre-Arbitration Response

Mike sent his response to the bank. He even added more evidence — some photos he took of the dress before shipping that clearly showed the craftsmanship was not faulty.

Adam received Mike’s documents and forwarded them to Carli’s bank through the Mastercard portal.

When the response reached Ian, he reviewed the new information that Mike had sent. Once again, Mike had compelling evidence against Carli.

Ian called Carli to update her on the situation. Carli was shocked — and nervous. She fully expected Mike to just give up. She really wanted that money back in her account!

Anxious about the current condition of her finances, Carli asked Ian what her options were. Ian said there was one last chance to recover the money. Carli could appeal to Mastercard for arbitration. However, Ian warned Carli that she’d be taking a huge risk. Arbitration was an expensive process, and the losing party had to pay all the arbitration fees.

Carli decided to take the gamble. She was already out thousands of dollars — a couple hundred more wouldn’t make that much of a difference.

Arbitration

Ian initiated the arbitration process.

A representative at Mastercard reviewed all the information related to the case. And a decision was made: Carli, not Mike, had made a mistake. She’d filed a friendly fraud chargeback.

Mike had fulfilled his obligations and should be compensated. Carli needed to pay Mike for what she owed. Therefore, the temporary credit that was made to Mike’s account and the temporary debit to Carli’s account would become permanent.

The case was closed.

Key Things to Remember About the Chargeback Process

We hope this approach to explaining the chargeback process was helpful. Our aim was to make the workflow easy to understand.

However, the lighthearted nature of the telling might have led you to overlook a few points. Let’s review some important topics.

- This overview is a general explanation. It’s not a guarantee for all cases. The card brands (Discover, Visa, Mastercard, American Express, etc.) and payment processors have detailed rules that govern chargebacks. What we’ve explained here is the general process that applies to most disputes. However, there are some situations that might vary from the norm — for example, Visa’s allocation disputes.

- The process isn’t quick — each stage can last weeks or months. Reaching a decision takes time. And sharing the result of that decision takes even longer. From transaction to arbitration ruling, the complete process can take well over a year.

- The process is more difficult to manage when there are multiple disputes. In this story, the merchant was dealing with just one chargeback. But in real life, a merchant can receive several disputes in a single day from a host of issuing banks. Which means that at any given moment, you could be juggling multiple cases at different stages of the chargeback process. Managing all that can turn into a costly, confusing, time-consuming disaster!

- Arbitration is a costly risk. In this example, the merchant came out victorious. However, that isn’t always the case in real life. Our team of experts generally advise merchants to accept liability if a chargeback advances to pre-arbitration. You should only risk arbitration if the transaction amount is very high and the available evidence is very compelling — and even then, you should give the situation serious thought.

- Understanding the chargeback process is just one small piece of the puzzle. What we’ve explained here is the official process regulated by the card brands. But complete chargeback management involves much more. You also have to understand the process for detecting fraud, the process for proactively preventing disputes, the process for analyzing chargeback data, and the process for calculating win rates and ROI.

- MOST IMPORTANTLY, professionals can help. No one expects you to become a chargeback master — you don’t have to navigate the process alone. Everyone recognizes that you are an expert at running your business — and that’s a plenty big responsibility! You don’t have to handle chargebacks too.

Midigator is a technology company that helps merchants of all sizes in all industries prevent, fight, and analyze chargebacks. We can seamlessly handle all the challenges outlined here — and more!

- We create dynamic strategies so we are always one step ahead of evolving industry trends, regulations, and expectations.

- Our technology makes it easy to manage an unlimited number of disputes from an unlimited number of accounts.

- We can advise you on what should and shouldn’t be fought so you have the maximum return on investment.

- Our comprehensive services empower you to efficiently handle and fight chargebacks, all from a single platform.

Sign up for a demo today and see just how easy it is to manage the chargeback process with Midigator’s help.