Stripe Chargebacks: The Complete Guide to Managing Disputes

- August 19, 2022

- 12 minutes

Stripe is a powerful payment facilitator that enables merchants to accept debit and credit card payments. However, some of these transactions may lead to chargebacks. Stripe chargebacks occur when a customer files a dispute with the issuing bank, prompting a transaction reversal.

Each Stripe chargeback you receive eats into your revenue and costs your business money. And if you receive too many chargebacks, you can lose payment processing privileges entirely.

This detailed guide will help you learn how to prevent, manage, and fight Stripe chargebacks to protect your business and improve customer satisfaction.

Stripe Dispute Process

Chargebacks are a threat for nearly all online businesses. However, despite the shared risk, not all businesses manage chargebacks with the same process. The workflow can vary by the payment processor and card network involved.

In general, the chargeback process, incorporating Stripe, works like this:

As a payment facilitator, a chargeback on Stripe has some unique features and management nuances. Familiarizing yourself with the Stripe dispute process can help protect your revenue and avoid costly chargeback errors.

The following is a high-level overview of what is involved and what you should be aware of.

Before Receiving a Stripe Chargeback

Stripe will sometimes alert merchants to potential chargebacks before they’re filed with card issuers. In many cases, this can allow you to resolve a customer complaint before it becomes a Stripe chargeback.

Early Fraud Warnings (EFW)

Stripe sources information from Visa® TC 40 and Mastercard® SAFE data to alert you to potentially fraudulent activity. These early fraud warnings, or EFWs, don’t require a response, but they do allow you to analyze transaction details and issue a refund to avoid a Stripe chargeback.

According to Stripe, almost 80% of EFWs turn into chargebacks if merchants choose not to respond.

NOTE: There is no guarantee that you receive an EFW before receiving a Stripe chargeback. The systems that process EFWs are separate from those that process chargebacks and may not always be in sync. Moreover, EFWs are only sent for fraud claims. There are dozens of other reasons why a dispute could be initiated, and those causes don’t have a warning system in place.

Inquiries

In some cases, a card brand may choose to request information before the bank will initiate a chargeback. Stripe refers to these requests as “inquiries,” though they may also be called retrievals or requests for information.

NOTE: Mastercard and Visa have retired retrieval requests. These brands now use the order validation process to exchange information (Order Insight for Visa and Consumer Clarity for Mastercard).

However, American Express® and Discover® do still send inquiries — which should not be ignored. If you receive an AmEx or Discovery inquiry but don’t respond — whether you use Stripe or another payment processor — the case will automatically turn into a chargeback and you will not have the right to respond.

Stripe recommends responding to each inquiry immediately and with the intent of resolving any issues with the customer who initiated the claim.

RELATED READING:

Inquiries often occur when a cardholder doesn’t recognize a transaction description. From there, the issuing bank submits an inquiry requesting details related to the purchase.

You can resolve an inquiry and avoid a Stripe chargeback by doing one or both of the following:

- Providing documentation that answers the dispute type for the specific inquiry

- Issuing a full refund of the transaction (partial refunds may still result in a Stripe chargeback)

If the Stripe dispute status of an inquiry remains open after 120 days without escalation to a chargeback, Stripe will close the inquiry. This also indicates that the card brand doesn’t intend to escalate the inquiry to a chargeback.

After Receiving a Stripe Chargeback

After a customer submits a dispute with the issuing bank, you’re first notified of a new Stripe chargeback via the Stripe dashboard, your email, and any integrations with relevant apps or services (like Midigator®).

Once the chargeback occurs, the total disputed amount will be debited from your Stripe balance. This amount will be held for the duration of the Stripe dispute process and until a final decision is reached.

You may also be charged a dispute fee. After receiving a chargeback, Stripe will also debit your balance for its dispute fee.

You can check in on the Stripe dispute process at any point via your dashboard, which displays the:

- Debited amount of the chargeback

- Dispute fee

- Stripe dispute reasons — or chargeback reason code

- Cardholder’s claim that was filed with the issuing bank

During the dispute process, Stripe will also restrict your ability to issue a refund for the disputed transaction. This eliminates the risk of crediting the cardholder twice — and suffering double the revenue loss.

If you choose to fight the chargeback, Stripe requires you to upload supporting evidence. Submitting evidence via the Stripe dashboard is pretty straightforward. You can also respond via a chargeback platform like Kount. Stripe submits this material to the issuing bank on your behalf. The issuer then informs Stripe of the decision and the outcome is shared with you.

If you win the dispute, you will be refunded the total of the disputed transaction and Stripe’s dispute fees. If you lose, your customer keeps the disputed amount.

Stripe considers this decision final, though you may be entitled to chargeback arbitration. Arbitration is a costly and time-consuming process that relies on a third party to issue a final and binding verdict. However, arbitration isn’t supported during the Stripe dispute process.

Stripe Chargeback Time Limit

The Stripe dispute timeline aligns with the card brand chargeback time frames.

Typically, card brands allow customers to submit a chargeback within 120 days after making a purchase (although there are some exceptions). In other words, you’re still at risk of receiving a chargeback even months after you’ve made a sale.

Once you receive a chargeback, the Stripe dispute timeline typically allows:

- 7 to 21 days for you to respond to the issuing bank

- 60 to 75 days for the issuer to evaluate your supporting documentation and decide the case

Stripe Chargeback Fee

The Stripe dispute fee is $15 for each chargeback you receive. This amount is debited from your Stripe balance upon receipt of a dispute, in addition to the total disputed amount of the transaction and any other fees or penalties you incur.

If you eventually win your Stripe chargeback case, the Stripe dispute fee is returned to you.

NOTE: According to Stripe documentation, the dispute fee will be refunded if you win the chargeback response. This is extremely unusual. Very few payment processors will reimburse merchants for the dispute fee. If you use another payment processor in conjunction with or instead of Stripe, keep this in mind!

Merchants in the Single Euro Payments Area (SEPA) who receive a chargeback in which a Cartes Bancaires payment card was used do not incur any Stripe dispute fee.

Stripe Chargeback Limit

Both Stripe and the card brands (Mastercard, Visa, etc.) take on a lot of risk when they allow merchants to process payments. Faulty business practice could end up costing them a lot of money.

Therefore, it’s important to monitor risk factors and take action if activity becomes worrisome.

One risk factor that is carefully monitored is chargeback activity. The primary metric that’s monitored is your chargeback-to-transaction ratio (CTR), the percent of your transactions that lead to chargebacks.

The card brands have clearly outlined how this metric should be calculated. And most acquirers and processors use the same calculations and thresholds that have been set by the brands. However, Stripe handles things a little differently.

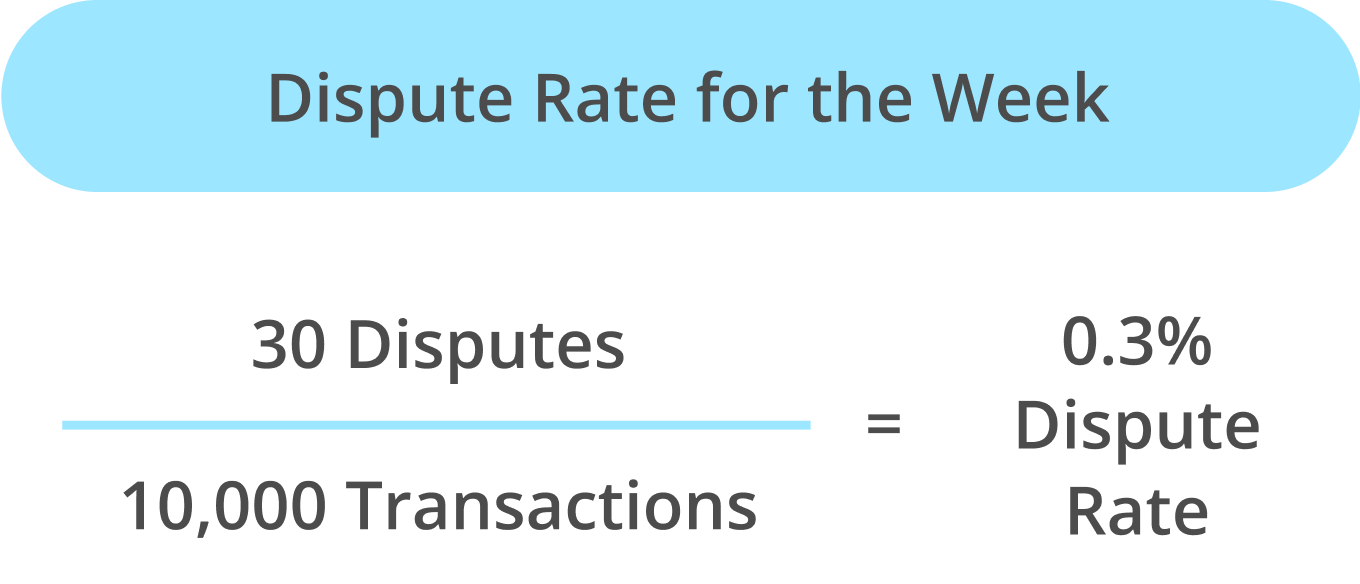

Stripe provides merchants with two metrics:

- Dispute activity: the percentage of disputes on successful payments by dispute date.

- Dispute rate: the percentage of disputes on successful payments by charge date.

The following is a hypothetical example of how the two metrics are calculated.

You processed 10,000 transactions this week. You also received 100 chargebacks. Thirty of the 100 chargebacks were from transactions processed this week. Seventy of the 100 chargebacks are associated with transactions processed last week. Your dispute activity and dispute rate are as follows:

Stripe claims that the card brands evaluate ‘dispute activity’ to determine if you exceed their acceptable chargeback thresholds.

Any Stripe chargebacks you receive — even those you win — add to your dispute activity. Typically, dispute activity above 0.9% is considered excessive, though other factors can play a role in your placement into a monitoring program.

If your dispute activity nears this threshold, Stripe may reach out to offer guidance for preventing disputes and chargebacks. Or, Stripe might simply revoke payment processing capabilities without any warning.

A WORD OF WARNING: Stripe is very strict about chargeback ratios. If your Stripe dispute rate or activity is excessive, your account may be closed. This can happen even if you’re not classified as a high-risk merchant or if you’ve never hit the limit previously. To avoid account closure, you need to prioritize preventing Stripe chargebacks from occurring.

Preventing Stripe Chargebacks

It’s impossible to fully avoid chargebacks, but you can take steps to prevent them. And the best defense is a strong offense.

To avoid breaching the Stripe dispute activity threshold — which Stripe is strict about enforcing — you need to prioritize chargeback prevention using effective tools and strategies.

Here’s what the chargeback experts at Midigator recommend.

✔ Use prevention alerts.

Chargeback prevention alerts are a popular and effective chargeback reduction technique.

If a cardholder disputes a transaction with a participating bank, the bank will notify you of the complaint before initiating a chargeback. This advanced warning gives you time to review the situation and see if there is a way to resolve the problem — such as issuing a refund.

If you refund the disputed transaction, the case shouldn’t advance to a chargeback.

NOTE: There are several tools and techniques for preventing chargebacks. For example, many merchants are exploring order validation (Order Insight for Visa and Consumer Clarity for Mastercard). RDR is another popular option.

However, for Stripe merchants, order validation and RDR probably aren’t a viable option.

To use these , you have to have a unique CAID (Card Acceptor ID) to identify your business. But since Stripe is a payment facilitator and manages all clients under a universal MID, merchants don’t have individual CAIDs.

Therefore, for Stripe merchants, alerts are the most effective chargeback prevention technique to use. And not just because they are the only tool compatible with the Stripe platform, but because they have been in use for more than a decade and have proven to be effective. Prevention alerts can reduce chargeback ratios by 30-40%.

Moreover, prevention alerts are quick and easy to implement. You can be up and running in as little as 24 hours.

If you are struggling to manage Stripe chargebacks and are interested in prevention alerts, sign up for a demo of Midigator. We’ll help you create an effective, efficiency strategy to prevent chargebacks.

✔ Follow your service agreement.

Stripe is a payment facilitator, which means it specifies the rules and regulations you’re expected to follow to maintain an account in good standing. These are outlined in its services agreement.

Familiarizing yourself with the terms of the Stripe services agreement can help you understand and implement best practices for preventing Stripe chargebacks. It also gives you guidance about expectations and policies to help you manage chargebacks within Stripe’s rules.

✔ Only sell high-quality products and services.

Customers often file chargebacks if the products or services they purchase are:

- Counterfeit

- Defective

- Not as described (misrepresented)

Avoid Stripe chargebacks by only selling high-quality products and services. Use accurate and informative product descriptions and high-resolution product photos so customers know exactly what they’re ordering.

✔ Optimize order fulfillment and shipping.

Delayed or missing shipments and orders can result in Stripe chargebacks. To avoid these types of disputes, you might want to optimize your fulfillment process by:

- Fulfilling orders quickly

- Shipping orders accurately

- Working with carriers who provide tracking data

- Informing customers of any delays during shipping

- Monitoring your inventory to ensure customers aren’t unknowingly purchasing out-of-stock items

- Requiring proof of delivery for high-value orders

✔ Write clear billing descriptors.

Billing descriptors help your customers identify transactions on their billing statements. If customers are unable to recognize their transactions, they may file chargebacks, impacting your Stripe dispute rate.

To avoid these types of Stripe chargebacks, check to make sure your billing descriptors are as clear as possible. Include information such as:

- A description of the product or service and time it was purchased

- Your website address and contact information

- The doing-business-as (DBA) name of your company

✔ Provide excellent customer support.

A compassionate, responsive, and understanding customer support team can help resolve customer disputes and prevent Stripe chargebacks. Ensure that customers have easy access to your support team and strive to resolve issues shortly after they come to your team’s attention.

Additionally, provide clear, accessible, and customer-friendly policies that outline your refund and return processes. Include links to these policies in every communication you send to your customers, and include easily accessible links on your website.

✔ Consider Stripe Chargeback Protection.

Stripe Chargeback Protection is a form of chargeback insurance, using a machine-learning tool to block fraudulent transactions and the resulting chargebacks.

When you agree to this , Stripe uses information gathered from across its network and partnerships with card brands and other financial partners to analyze each transaction and flag potentially risky behavior.

Depending on its analysis, Stripe Chargeback Protection will:

- Block fraudulent transactions.

- Apply dynamic 3D Secure to high-risk transactions, requiring additional information before processing the payment.

Like any chargeback insurance policy, Stripe Chargeback Protection will reimburse you if an approved transaction results in a chargeback. And that’s a great selling point. But recovering lost revenue doesn’t stop the chargeback from happening. Nor does it protect your chargeback-to-transaction ratio. So be sure to weigh the pros and cons before signing up.

RELATED READING:

Fighting Stripe Chargebacks

If a chargeback is invalid — meaning it shouldn’t have happened — you can respond and attempt to recover the revenue that’s been revoked.

There are two ways to fight Stripe chargebacks.

- You can respond directly from the Stripe dashboard.

- You can use Midigator’s intelligent chargeback technology.

There are several reasons why it’s better to use Midigator for .

- Chargeback management is not Stripe’s area of expertise. The platform has the functionality to create and submit a chargeback response. However, the technology is not backed by chargeback expertise. Midigator’s team members have decades of experience and a direct line of communication with the card brands. We know what it takes to win and will help you get the best results possible.

- Stripe doesn’t offer a complete solution. Stripe is an excellent payment processing platform. But again, chargeback management is not the company’s primary focus. While the technology can help you recover lost revenue, it doesn’t have sufficient to prevent chargebacks from happening. Midigator, on the other hand, can prevent, fight, analyze, and automate chargebacks — all from a single platform.

- You might outgrow the Stripe platform. Stripe is a great payment processing platform for new and limited businesses. However, it can’t always accommodate businesses as they grow and evolve. Eventually, you may choose to use other payment processors in addition to or in place of Stripe. In these situations, you’ll want a single point of truth for all your chargeback management tasks and data. You don’t want to have different strategies and different data for each of your payment processors. You want everything in one place — like Midigator.

If you’d like to fight Stripe chargebacks with the highest success rate, the best revenue recovery, and the least amount of effort, sign up for a demo of Midigator today.

Because we already have a direct integration to the Stripe platform, we can offer you multiple response strategies. Just pick the one that’s best for your business!

Regardless of whether you use Midigator or the Stripe dashboard, there are some best practices to consider as you respond to invalid chargebacks.

Review the reason code.

The assigned chargeback reason code outlines why a customer submitted the dispute. Once you know why a chargeback happened, you can start building a case to address the claims that were made.

Depending on the reason code, supporting documentation may include:

- Copies of the order confirmation, invoice, or receipt

- Proof of delivery or tracking information

- The customer’s IP address and geolocation at the time of purchase

- Communications between your support team and the customer

- Proof you issued a refund for the transaction in question

Decide if you should accept or fight the Stripe chargeback.

Fighting a chargeback takes time, effort, and money. To maximize your ROI, you need to decide whether it’s worth accepting or fighting a Stripe chargeback.

Start by doing these four things:

- Determine the validity of the chargeback. Valid chargebacks are legitimate payment disputes and can’t be fought, as is the case with criminal fraud. In contrast, invalid chargebacks are inaccurate, false, or non-compliant with card brand rules and can be fought, as is the case with friendly fraud.

- Evaluate your available supporting documentation. If the chargeback is invalid, do you have sufficient Stripe dispute evidence to challenge it?

- Check the response deadline. All chargebacks come with a response deadline. You need to submit your case within the allotted time period. Make sure the case hasn’t expired.

- Consider how much money you’ll recover. What is the dispute amount? Is it more or less than the cost of fighting? If you’ll spend more than you’ll recover, building a response probably is not a good use of time and resources.

If you decide to fight, you’ll need a strong, convincing argument.

Build your chargeback response.

If you choose to fight the Stripe chargeback, your next step is to create a chargeback response package with supporting documents that disprove the cardholder’s claim.

We have a detailed guide on how to write a winning chargeback response. It has step-by-step instructions you’ll want to check, including how to write a chargeback rebuttal letter.

Submit your case.

Once you’ve collected all your information and created a cover letter to explain your argument, you need to send it off for review.

If you use Midigator, we’ll submit the response for you through our . If you respond via the Stripe platform, you’ll need to follow the steps they outline to ‘counter dispute’.

Check your dispute status and wait for a decision.

After submitting your dispute response, it will be sent to the issuer for review. Outcomes will be displayed in your Stripe or Midigator dashboard, depending on the platform you use.

Winning the chargeback case means the issuer ruled in your favor and overturned the dispute. The original purchase amount of the transaction and Stripe’s dispute fee will be credited back to your account.

If you lose, the case will be closed. The temporary credit issued to the cardholder will become permanent.

Managing Stripe Chargebacks with Midigator

Managing Stripe chargebacks can be a challenging, expensive, and time-consuming process — even with all of the guidance Stripe provides. To protect your revenue with the greatest efficiency possible, you need a solution that prioritizes ROI — and that’s exactly what Midigator does.

Midigator is intelligent chargeback technology that helps businesses of all sizes in all industries prevent, fight, analyze, and with the best ROI possible. On average, clients who use Midigator achieve the very best chargeback management outcomes:

- Spend 85% less time managing chargebacks

- Cut costs by 45%

- Reduce chargebacks by 50%

- Improve win rates by 116%

- Generate 914% ROI

And because Midigator is a verified Stripe partner, you can get started quickly and easily.

Request a demo today to see how easy it is to integrate Midigator with your Stripe account to protect your business from Stripe chargebacks and disputes.