A retrieval request is a request made to you, the merchant, for additional information. A request is usually made when a cardholder or the cardholder’s bank needs greater insights about a purchase. The cardholder’s bank asks you to provide documents with clarifying information.

This communication process is regulated by the card brands (Mastercard, Visa, American Express, Discover, etc.) and may be referred to by different names — ticket retrieval request, inquiry, copy request, first request, request for information, soft chargeback, etc.

Retrieval requests can be a valuable part of the payment dispute process, but they are often misunderstood. This detailed guide for merchants will help you understand the purpose of retrieval requests and how to use them to prevent chargebacks.

Retrieval Request Reasons

Retrieval request regulations vary significantly from one card brand to another. For example, American Express has more than a dozen retrieval request reason codes while Discover only has four.

In general, most retrieval requests are issued to merchants for one of the following reasons:

- The cardholder wants information for his or her records. For example, a cardholder needs to submit an expense report but has lost the transaction receipt. Or the ink has faded and the receipt is no longer legible.

- The cardholder questions how something was handled and wants clarification. For example, merchandise hasn’t been received and the cardholder wants to confirm the delivery date. Or a cardholder thought a purchase qualified for a refund and wants to review the merchant’s policies.

- Either the cardholder or bank suspects fraud. For example, the customer doesn’t recognize a purchase and assumes it was unauthorized. Or the bank notices unusual account activity and suspects a processing error.

- Law enforcement or legal professionals are conducting an investigation. For example, an employee used a corporate card for personal purchases. Or a shopper is in possession of a counterfeit credit card and high-dollar merchandise.

The Retrieval Request Process

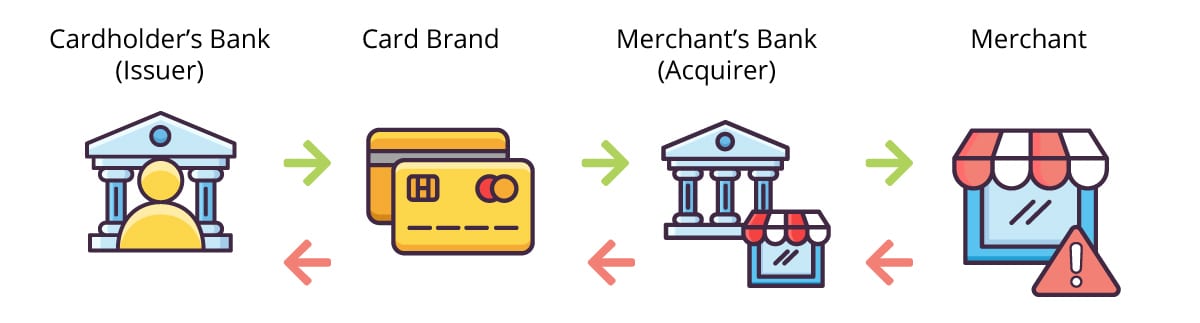

A retrieval request is initiated by the issuer (cardholder’s issuing bank). It is sent through the card brand to the acquirer (merchant’s acquiring bank). If the acquirer has access to the requested information, the acquirer will respond. If not, the request will be forwarded to the merchant.

The merchant collects the appropriate documents and responds to the request via the acquirer who forwards the information to the issuer through the card brand.

Retrieval Request FAQs

There is often confusion about retrieval requests and how they relate to the chargeback process. The following information answers some of merchants’ most commonly asked questions.

If you have questions about retrieval requests that aren’t addressed here, feel free to reach out to our team of experts.

How much are retrieval request fees?

Most retrieval requests are accompanied by a fee. There may also be retrieval request fees if you don’t respond or don’t respond with the correct information.

The amount you are charged varies based on things such as the processor you use and the card brand associated with the transaction.

If you’d like specific information about retrieval request fees, you can contact your payment processor.

Are there time restrictions for retrieval requests?

Timelines are regulated by the card brands.

| Brand | Maximum Number of Days Between Transaction and Retrieval Request | Maximum Number of Days to Respond |

|---|---|---|

| Not Regulated | 20 days |

| 365 days | 30 days |

| 120 days | 30 days |

| 120 days | 30 days |

It’s important to note that the response timeline is for the acquirer. You, the merchant, won’t actually have 20-30 days to respond to a retrieval request; you may have less than a week. Be sure to check the response deadline your processor provides and act quickly.

What information do retrieval requests contain?

Again, the information included in the retrieval request will depend on the card brand. However, you can usually expect some of the following pieces of information to be provided:

- Card number

- Cardholder’s name

- Transaction amount

- Authorization code

- Transaction date

- Acquirer reference number

- Applicable reason code

You can use this information to locate the transaction in your CRM and determine how to respond.

Do retrieval requests always lead to chargebacks?

In some situations, a retrieval request may be followed by a chargeback and incur chargeback fees. But other issues can be resolved easily, and the case won’t need to advance.

The outcome usually depends on how you handle the retrieval request.

If you provide enough clarifying information, you submit it on time, and the documents are legible, you may be able to avoid a chargeback. However, if you don’t do these things, a chargeback might be unavoidable.

In fact, if you don’t reply to the retrieval request, you don’t reply on time, or you don’t supply all of the requested information, Discover and American Express will automatically file a chargeback. And in these situations, chargeback response rights are revoked — you will not be allowed to challenge the dispute.

How should I respond to retrieval requests to prevent chargebacks?

If you want to reduce the risk of a retrieval request turning into a chargeback, do these three things:

- Respond quickly and before the deadline.

- Provide all the requested information.

- Make sure the documents are legible.

Sometimes, it’s helpful to go above and beyond card brand expectations by sharing even more information than is requested. There are two different types of information you could share. The documents you provide depend on the goals you are trying to achieve.

If your primary chargeback prevention goal is to keep counts low and avoid threshold breaches, you may want to refund the transaction. In responding to retrieval requests, you would state that the transaction has been refunded and the cardholder’s account has been credited.

This should eliminate the need for a chargeback which would help reduce your chargeback-to-transaction ratio. However, you will sacrifice revenue.

If your primary chargeback prevention goal is to reduce revenue loss, you may want to treat retrieval request responses the same as chargeback responses and share all the information you have available. This is especially important for Discover and American Express as detailed information is expected during the retrieval/inquiry phase.

The more compelling evidence you provide, the more clarity the cardholder and bank will have. This could stop the chargeback and allow you to retain the revenue. However, the success rate is generally lower than issuing a refund.

Are retrieval requests being phased out?

Retrieval requests are certainly used less now than they were a few decades ago. And there are three reasons why:

- Most card brands no longer require the use of retrieval requests. In years past, an issuer had to complete the retrieval request process before filing a chargeback. Now, only Discover requires issuers to use this process.

- Cardholders have better access to information. Things like order confirmation emails and online accounts make it easy for cardholders to review information that was previously only printed on a receipt. Recognizing a charge prevents the need for requests.

- Newer processes provide information quicker and more efficiently. Tools like Consumer Clarity and Order Insight serve the same basic purpose as a retrieval request but they provide the information in real time.

Even though they are less popular than they once were, retrieval request usage has remained fairly consistent — even increasing slightly — for two years. The following charts show retrieval request activity for a small subset of Midigator® merchants from August 2018 to July 2020.

However, this trend is largely driven by a single brand: Discover. Discover is the only card brand that still requires issuers to send retrieval requests before initiating certain chargebacks.

Despite having the lowest percent of transaction volume, Discover had the highest percent of retrieval request activity.

What does this mean?

It means that chargeback management trends, strategies, and available tools are constantly evolving. A management tool that works for one merchant may not work for you. A strategy that was successful last year may not yield positive results today. And a tactic used for one card brand might not be effective with another.

No matter what tool or strategy you use, it’s important to carefully analyze your data over time. Data-driven decisions have a better impact on your bottom line than hunches and guesses.

Need Help with Retrieval Requests or Chargebacks?

Retrieval requests are a valuable part of chargeback management, but they are just one piece of a comprehensive strategy to combat friendly fraud and ensure a smooth payment process.

If you’d like the most complete solution possible with maximum ROI, contact Midigator today. We’ll help you manage retrieval requests, alerts, and chargebacks with a single platform. Sign up for a demo and get started today!