Rapid Dispute Resolution (RDR) Explained & Simplified

- April 6, 2020

- 7 minutes

What is Rapid Dispute Resolution (RDR)? Can it help your business prevent chargebacks? How does it integrate with other dispute management tools you are currently using?

The following is a simplified explanation of RDR and the impact it could have on your business.

What is RDR?

RDR is an upgrade to a previously-established platform called Chargeback Dispute Resolution Network (CDRN). Over the last few months, Visa has rebranded several well-known and commonly-used tools. Another example is Order Insight.

- WHAT: RDR is a chargeback prevention tool created by Verifi and made available to merchants through various technology resellers (like Midigator®).

- HOW: When an issuing bank is ready to process a chargeback, the RDR platform allows your acquirer to automatically issue a credit to your customer instead.

- WHY: RDR helps keep your Visa dispute counts low. And participation shows your acquirer that you are committed to resolving disputes quickly and proactively should they arise.

Why Should I Use RDR?

RDR can benefit your business in several different ways.

Reduce Chargeback Rates

Since Rapid Dispute Resolution settles customer complaints at a pre-dispute stage, before they progress to chargebacks, this tool can help keep your chargeback-to-transaction ratio low. Resolved cases do not count against your chargeback ratio. This reduces the risk of breaching chargeback thresholds.

Take Quick Action

With Rapid Dispute Resolution, you’ll know about disputes within a matter of hours or days instead of weeks or months. Identifying issues early means you can solve problems quicker, avoid chargebacks, and prevent more disputes from happening.

Improve the Customer Experience

By being more responsive and supportive, you’ll improve the customer experience and increase perceived value.

How Does Rapid Dispute Resolution Differ From Order Insight and CDRN?

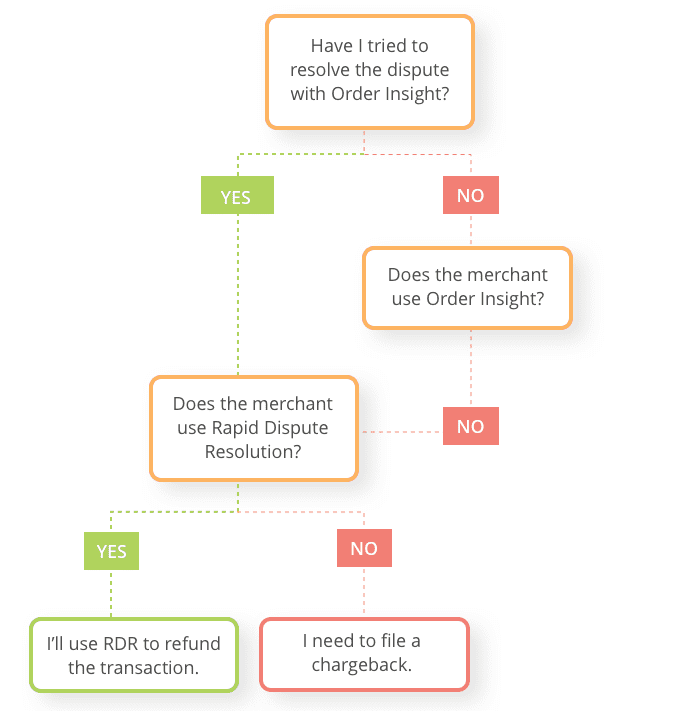

The most effective chargeback management strategies are multi-layer strategies — multiple tools are used at different stages throughout the lifecycle of chargeback disputes.

Rapid Dispute Resolution, Order Insight, and CDRN (Verifi’s chargeback prevention alerts) are all dispute resolution tools that complement each other. They are used either consecutively or interchangeably throughout the dispute lifecycle.

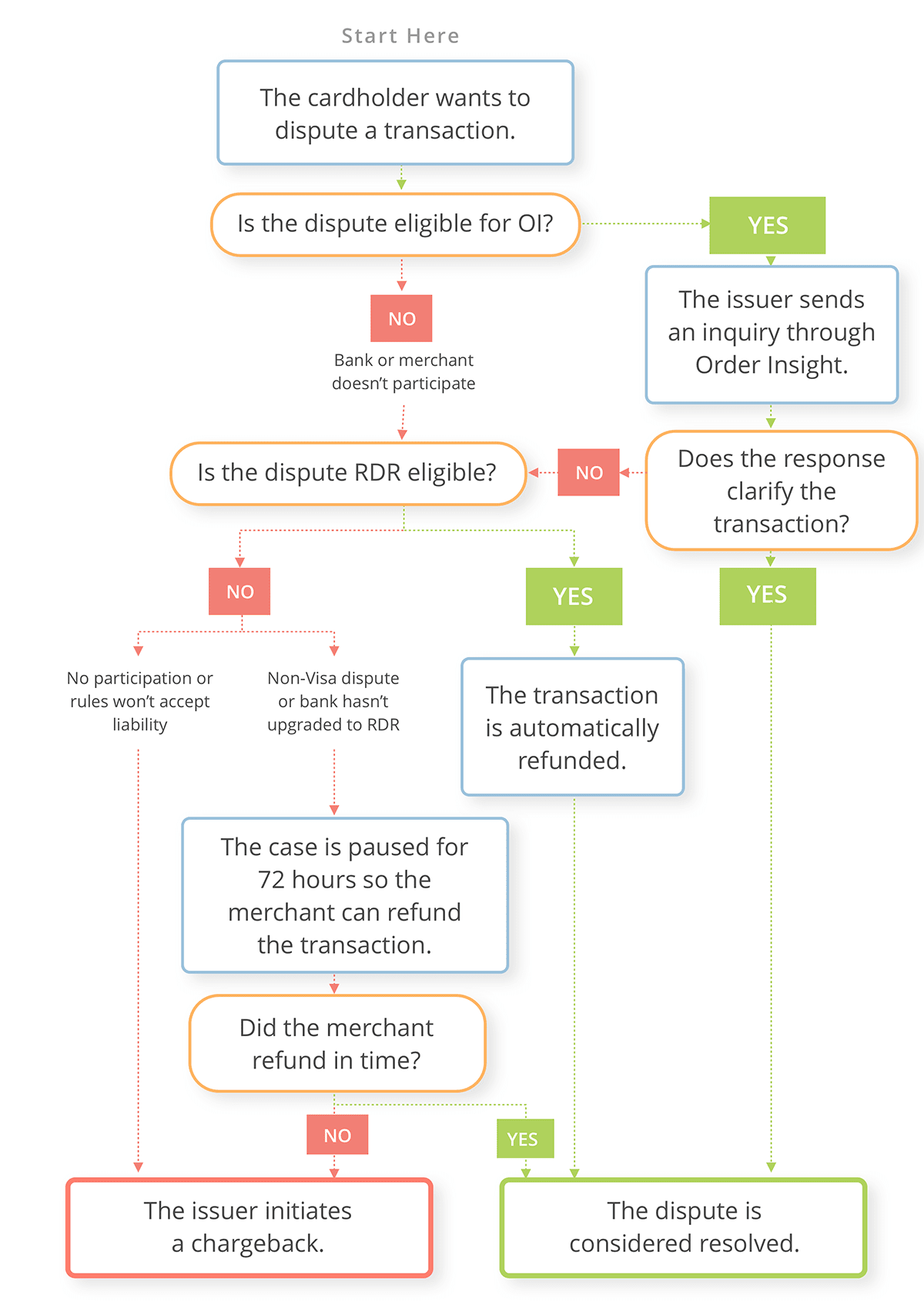

Order Insight is the first option issuers have to resolve a dispute. The bank can request order details that hopefully help “talk off” the dispute. No credits or refunds are made to the customer yet.

If OI isn’t successful or you don’t use OI, the case may advance to Rapid Dispute Resolution. This platform automatically debits your account and refunds the customer.

If the issuer hasn’t upgraded to the RDR platform or the dispute is for a non-Visa transaction, the CDRN network allows you (or your facilitator) to refund the transaction.

If you want the most complete chargeback protection possible, you will use several different management tools. Not only should you use these Visa-specific platforms, you should also add other tools like:

- Identify verification tools (AVS, CVV, and 3D Secure 2.0)

- Fraud detection tools (third-party vendors)

- Consumer Clarity (Mastercard)

- Prevention alerts (Ethoca)

- Analytics (Midigator)

- Chargeback responses (Midigator)

Together, Order Insight, RDR, and chargeback prevention alerts are used in this workflow.

How Does RDR Work?

Five things need to happen if you want to use Rapid Dispute Resolution to its fullest potential.

Enroll

If you are interested in using RDR, you can enroll in RDR services through a facilitator. Midigator is a preferred facilitator for RDR and offers this tool along with Order Insight, prevention alerts, analytics, reporting, and chargeback responses.

To enroll with RDR, your facilitator will need:

- Your merchant account ID (MID)

- A list of billing descriptors you use for that MID

If you are ready to get started with RDR, contact Midigator today.

Set Response Rules

If you use RDR, you are essentially empowering the platform to accept dispute liability on your behalf. When this happens, the platform allows your acquirer to debit your account for the dispute amount so it can be refunded to the customer.

However, there might be situations where you don’t want an auto decision, especially if it automatically accepts liability. Rather, it might be better to let a case progress to a chargeback. Then, you can respond and potentially recover the revenue rather than sacrifice the funds without a fight.

The action that RDR takes is based on a defined set of rules that you create. The characteristics of each dispute will be compared to your chosen response criteria. Then, the dispute will either be refunded or the case will advance to a chargeback.

You can base your response rules on the following elements:

- Issuer BIN

- Transaction date

- Authorization date and time

- Transaction amount

- Transaction currency code

- Purchase identifier

- Dispute category

- Dispute condition code

For example, you might tell RDR if the transaction amount is below $50, accept liability. Or, if the category is fraud disputes, accept liability. Or, if the transaction currency code is not USD, accept liability.

If you don’t set response rules, Rapid Dispute Resolution will automatically accept liability for every disputed transaction that is submitted to the platform. If you’d like to funnel disputes into different response types, you’ll want to submit rules during the enrollment process.

Want help determining which response rules would be best for your business? Contact one of our experts to learn more.

Resolve Disputes

When a customer contacts a participating bank to dispute a purchase, the bank will first consult Visa Resolve Online (VROL) — the platform that issuing and acquiring banks use to manage payments and disputes.

The issuer will check to see what has already been done and what should happen next.

If the case has already gone through Order Insight or if you don’t use Order Insight, the issuer will proceed to Rapid Dispute Resolution. Once the dispute has been submitted to RDR, the platform will act according to your pre-set rules.

NOTE: If you accept liability for the dispute through RDR, Visa guarantees the case will not advance to a chargeback. You don’t need to worry about double losses or a chargeback fee.

Reconcile

After your merchant account is debited, you’ll need to note the activity in your order management system (OMS or CRM).

Visa’s process for reporting RDR activity is similar to the chargeback process. Notices will be sent to your acquirer and your acquirer will share the information with you via your solution provider.

Once you receive the debit notice, you’ll want to update your OMS or CRM:

- Note that the transaction amount was debited from your account.

- Indicate the debit was initiated through RDR for data analysis purposes.

- Cancel future charges if the transaction was part of a subscription.

- Cancel any ongoing services.

- Block access to digital goods or platforms.

- Stop fulfillment if the merchandise hasn’t already gone out.

- Update your blacklist if you use one.

Analyze Outcomes

The final step is perhaps the most important: analyze your RDR data.

Data analysis is one of the most helpful dispute management tools available, but it is also the most commonly overlooked.

Every transaction dispute — whether it is refunded through RDR or advanced to a chargeback — contains a wealth of valuable information. You can use your RDR data to do two things:

1. Understand why disputes are happening. As you analyze your data over time, you’ll detect patterns and norms for your business. Then, anything that differs from the norm indicates a hidden problem that needs to be fixed. Armed with a solution that resolves the issue, you can prevent future disputes.

For example, an unusually high volume of low-dollar customer disputes could indicate fraudsters are buying your merchandise to test stolen card information. Or you might find one marketing source is more susceptible to friendly fraud than others.

2. Calculate and optimize your ROI. If you’ve set response rules, you’ll want to monitor outcomes over time and adjust your rules to optimize return on investment.

Also, if you use RDR in conjunction with other tools, such as Order Insight, you’ll want to determine how one tool impacts the other and influences overall ROI.

Here are some things you might want to monitor:

- How many cases progressed to RDR after Order Insight? How much time passed before the case escalated? Were there additional touch points with the customer after Order Insight but before RDR?

- How often did you accept liability? How many cases advanced to a chargeback? Should you accept liability more often? Less?

- What were the most commonly used dispute conditions?

- If you let cases advance to chargebacks, how many did you fight? How many did you win?

- How quickly did you receive RDR notifications? How often were you able to stop fulfillment? Did you have enough time after the disputed transaction to cancel the next subscription charge?

Data is a powerful tool, but analysis can be a very time-consuming process if you have to first collect and compile the data. That’s why your RDR facilitator should provide the information for you. Then, all you need to do is put it to good use.

Midigator provides real-time reporting and in-depth analytics for all our services, including RDR. Sign up for a demo today, and learn more about the data analysis opportunities that are available.

Ready to Get Started?

If you’re ready to add Rapid Dispute Resolution to your chargeback management strategy, Midigator can help.

At Midigator, we aim to remove the complexity of payment disputes. Not only do we simplify the enrollment process and data analysis for RDR, we also make it easy to create a comprehensive management strategy from a single platform. Whether you want to reduce chargebacks or respond and recover revenue, Midigator has the tools you need to succeed.

Sign up for a demo today, and get started.