Pre-Arbitration Explained for Mastercard & Visa

- May 5, 2020

- 6 minutes

Pre-arbitration is a commonly misunderstood topic in the payment industry. One of the primary reasons for the confusion is a lack of consistency — processes and regulations differ significantly between Mastercard® and Visa®.

It is very important to understand the different pre-arbitration processes. In some situations, it’s best to simply accept liability for pre-arbitration disputes. But in other situations, it is incredibly valuable to respond.

So which is which?

What is Pre-Arbitration?

In an effort to simplify things, let’s use an analogy to loosely explain the dispute resolution workflow — including pre-arbitration. Let’s think of it like a tennis match.

A tennis ball — or in our case, a payment card transaction — is volleyed back and forth between opponents.

Sometimes the match is short. One solid hit and the game is over. Other times, a lot of back and forth is needed before a winner is declared.

Think of pre-arbitration as the second-to-last hit in a long, drawn-out match.

The transaction has gone back and forth, over the net, several times. If the game-winning point isn’t served up with pre-arbitration, the case is turned over to the card brand for arbitration.

The chargeback process consists of several different stages that allow for back-and-forth communication between the cardholder’s bank (issuer) and the merchant’s bank (acquirer). Pre-arbitration is one such stage. It is an additional attempt to resolve a dispute after previous stages have fallen short.

Why Would a Case Advance to Pre-Arbitration?

Many disputes are resolved with relatively little back and forth. A Mastercard or Visa collaboration dispute would only advance to pre-arbitration if:

- A merchant responds to the dispute but the response isn’t compelling.

- A merchant responds with a compelling argument, but the cardholder introduces new information.

- A merchant responds with a compelling argument, but the cardholder changes the reason for the dispute.

How Does Pre-Arbitration Impact the Chargeback-to-Transaction Ratio?

It’s common for merchants to think of pre-arbitration cases as a second chargeback — the cardholder challenges the same transaction a second time.

Fortunately, that isn’t a completely accurate interpretation of the situation. A second chargeback would negatively impact the chargeback-to-transaction ratio a second time. In reality, pre-arbitration does not affect the chargeback-to-transaction ratio.

How Does Mastercard Use Pre-Arbitration?

While the concept of pre-arbitration is universal, Mastercard and Visa have different execution strategies.

Mastercard recently restructured the brand’s pre-arbitration process. As of July 2020, Mastercard’s pre-arbitration phase fits into the overall chargeback process like this:

1. First Presentment – The merchant’s transaction data is submitted to the cardholder’s bank. The bank charges the cardholder’s account.

Other commonly used terms: transaction settlement, transaction clearing

2. Chargeback – The cardholder’s bank disputes the transaction. Funds are withdrawn from the merchant’s bank account.

Other commonly used terms: payment dispute, transaction dispute, dispute

3. Second Presentment – The merchant challenges the chargeback by providing evidence that validates the original purchase or disproves the chargeback.

Other commonly used terms: representment, chargeback dispute, chargeback response, dispute response

4. Pre-Arbitration Case Filing – The chargeback process has ended, yet the cardholder’s bank wishes to address information provided in the second presentment.

Other commonly used terms: second chargeback

5. Pre-Arbitration Response – The merchant’s bank reviews the pre-arbitration case and does one of two things:

-

- Accepts liability. The merchant’s bank accepts liability, and the case is closed.

- Denies liability and rebuts the case. The merchant’s bank uploads supporting documents and adds a short memo to explain why the case is being rebutted. This gives the cardholder’s bank a choice: accept liability or advance the case to arbitration.

6. Arbitration Case Filing – The cardholder’s bank does not want to accept liability and seeks to challenge the merchant’s pre-arbitration response. The bank requests that Mastercard review the case, issue a verdict, and assign responsibility. The losing party must pay all fees.

How Should Merchants Respond to Mastercard Pre-Arbitration?

Technically, merchants have two pre-arbitration response options.

- Accept liability.

- Deny liability and rebut the case.

If the merchant accepts liability, the case is closed. The downside is that revenue cannot be recovered. The advantage to accepting liability is that the merchant won’t incur more costs.

In the majority of situations, it is best for the merchant to accept liability and not submit a pre-arbitration response.

There are some situations where it may be appropriate to respond to the pre-arbitration case filing. For example, the cardholder’s bank is only allowed to file pre-arbitration if the first chargeback was valid. So if the bank didn’t act within the time limit, for example, the merchant can respond and challenge the validity of both the chargeback and the pre-arbitration case filing.

However, these situations are usually few and far between.

It’s important to note that if a merchant submits a pre-arbitration response, the case will likely advance to arbitration. Once an arbitration verdict is issued, the losing party will forfeit the original transaction amount and pay hundreds of dollars in arbitration fees. Therefore, it is only advisable for merchants to respond to Mastercard pre-arbitration if there is sufficient and relevant evidence.

How Does Visa Use Pre-Arbitration?

Visa’s pre-arbitration process is quite different from Mastercard’s.

The most significant difference relates to where pre-arbitration fits in the dispute process and who is responsible for initiating it.

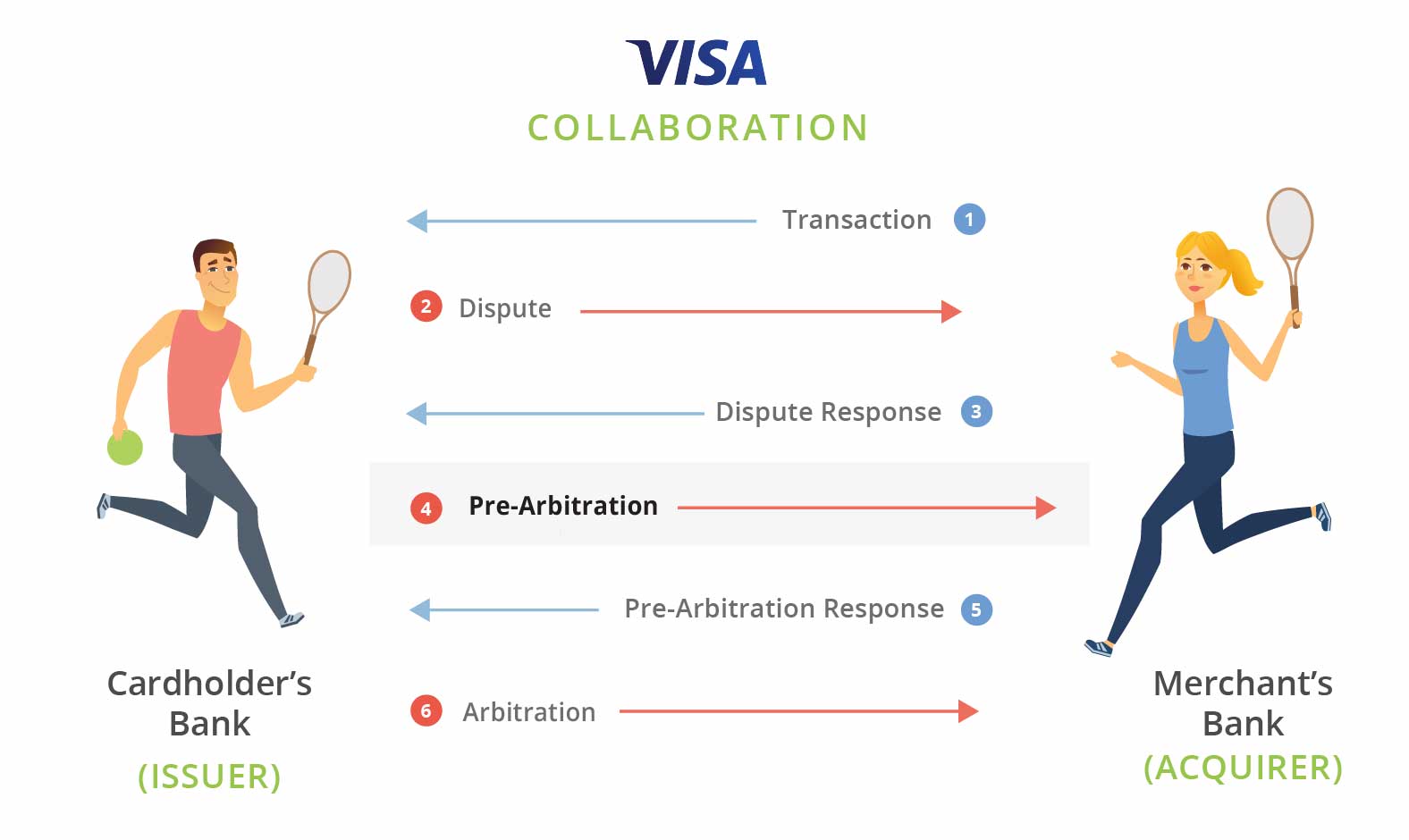

Visa has two different dispute workflows: allocation and collaboration. The volley for Visa’s collaboration disputes is the same as Mastercard’s process — the cardholder’s bank serves pre-arbitration to the merchant’s bank.

The entire dispute resolution workflow for collaboration looks like this:

However, for Visa’s allocation workflow, the process switches. The merchant’s bank serves pre-arbitration (and arbitration) to the cardholder’s bank.

The entire dispute resolution workflow for allocation looks like this:

Basically, the Visa pre-arbitration processes break down like this:

Cardholder’s bank serves pre-arbitration to merchant

Cardholder’s bank decides whether or not to escalate the case to arbitration

Merchant’s bank serves pre-arbitration to cardholder

Merchant’s bank decides whether or not to escalate the case to arbitration

Why is Allocation Pre-Arbitration Different?

Visa uses two different workflows to manage two different types of disputes.

The collaboration workflow does just what its name implies. It enables the cardholder’s bank and merchant to work together — or collaborate — to clarify what happened with a transaction. Information is shared back and forth until a decision is made.

The allocation workflow also does what its name implies. It assigns — or allocates — dispute responsibility to either the cardholder’s bank or the merchant. Visa’s technology platform uses available data to make a decision.

Unlike the collaboration process, allocation assigns liability to the merchant before the merchant has had a chance to present evidence.

It’s important for merchants to note these seemingly small differences because they have a big impact on how pre-arbitration responses should be handled.

How Should Merchants Respond to Visa Pre-Arbitration?

Merchants have the same pre-arbitration response options for Visa as Mastercard.

- Accept liability.

- Deny liability and rebut the case.

And for Visa’s collaboration disputes — which use the same basic workflow as Mastercard — the suggested response is the same. Merchants should accept liability and eliminate additional costs unless there is a very compelling reason to challenge the decision.

However, for Visa’s allocation disputes, the advice is much different.

For collaboration disputes, merchants have already tried and failed to prove the validity of the transaction. However, for allocation disputes, merchants aren’t given that chance — until pre-arbitration. Pre-arbitration is the one and only opportunity a merchant has to address a cardholder’s claims.

Merchants can and should advance allocation cases to pre-arbitration when appropriate. For example, Visa outlines 25 different compelling evidence options for reason code 10.4.

If merchants have the correct compelling evidence, they can fight and win allocation disputes with pre-arbitration.

Still Have Questions About Pre-Arbitration?

Pre-arbitration can be a confusing topic. However, it is important to understand the brand-specific details. If you don’t, your bottom line could suffer.

If you’d like to learn more, contact our team of experts today. At Midigator, we aim to remove the complexity of payment disputes. We’ll help you understand how to manage disputes with the maximum amount of ROI — and the least amount of effort.

Contact Midigator today.