Your business deserves to profit from every hard-earned sale you make. Don’t let friendly fraud chargebacks cheat you out of revenue that’s rightfully yours!

Get an inside look at the tools and strategies the professionals use to manage friendly fraud. Gain a comprehensive understanding or click to a specific topic:

What is Friendly Fraud?

Friendly fraud is a specific type of chargeback.

Chances are, you know exactly what a friendly fraud chargeback is — you just don’t know that it’s called friendly fraud!

Friendly fraud happens when a cardholder uses the chargeback process incorrectly, either as an intentional attempt to get something for free or an innocent misunderstanding.

friend●ly fraud

/ˈfrɛ́ndli frɔ́d / noun

- A chargeback request or payment dispute made with false claims, an illegitimate demand for a refund — “the customer committed friendly fraud because the shirt was the wrong size”

- A chargeback request or payment dispute made out of confusion, a misunderstanding — “the customer forgot about the purchase, so committed friendly fraud”

Friendly Fraud vs Malicious Fraud

All chargeback-related fraud falls into just two categories. Friendly fraud is one; malicious fraud is the other.

Friendly Fraud Defined

Friendly fraud happens when a cardholder uses the chargeback process incorrectly, either as an intentional attempt to get something for free or an innocent misunderstanding.

After buying an expensive pair of shoes, Melissa suffered from buyer’s remorse. Rather than return the shoes to the merchant for a refund, she opted for a chargeback because it was more convenient.

Jordan forgot to cancel services before his free trial ended. When his account was charged, he called the bank to complain.

Brenda didn’t recognize the business name listed on her statement and couldn’t remember buying anything. When she suggested it might be fraud, the bank issued a chargeback.

Ben was desperate to get his hands on the latest version of his favorite video game–but he really couldn’t afford it. So when the bill came, Ben told the bank he didn’t authorize the purchase.

Malicious Fraud Defined

Malicious fraud happens when a criminal steals a cardholder’s payment card or account information and uses it to purchase merchandise or services without the cardholder’s permission.

A criminal purchased a list of payment card information from a data breach and used Ron’s card to buy high-end designer purses that could be resold on the black market.

A criminal found Alicia’s credit card lying on the floor in a restaurant and used it to shop at several different online stores.

A criminal hacked into Lindsey’s account with her favorite coffee shop and used her stored payment information to purchase a bunch of gift cards.

However, industry conversations commonly include other “types” of fraud: family fraud, chargeback fraud, first-party fraud, third-party fraud, friendly fraud, and more.

Why? Why do people use all these different terms if there are just two forms of fraud?

The reason is because the payment industry as a whole lacks standardization. There aren’t regulations regarding definitions nor a universal vocabulary. Therefore, it’s common for new phrases to emerge that are actually just alternate terms for either friendly or malicious fraud.

Friendly Fraud Synonyms

- Chargeback fraud

- First-party fraud

- Family fraud

Malicious Fraud Synonyms

- Criminal fraud

- Third-party fraud

It doesn’t matter if you use the phrase chargeback fraud instead of friendly fraud. Nor is it a big deal if you use criminal fraud instead of malicious fraud. But it is essential to differentiate between friendly fraud and malicious fraud.

Some merchants have questioned why we feel so strongly about this. The following are their opinions and Midigator’s responses.

You might think differentiating between friendly fraud and malicious fraud is just a useless technicality. After all, both friendly fraud and malicious fraud result in chargebacks. Revenue loss happens either way!

Here’s the difference:

If you process an unauthorized transaction that is the result of malicious fraud, there is nothing you can do. You must accept the chargeback as a loss. The cardholder shouldn’t be held responsible because a fraudster slipped through your defenses.

But if the chargeback is the result of friendly fraud, you can fight back and recover revenue that is rightfully yours.

Because “fraud” is such a hot topic of conversation, you’ve probably already gone looking for tools to help reduce your risk exposure.

What you found were tools and services specifically designed to help prevent chargebacks resulting from malicious fraud. Some service providers might have even offered to reimburse you for chargebacks if malicious fraud slips through the cracks.

But what about friendly fraud?

Friendly fraud cannot be managed with tools designed to prevent malicious fraud.

That’s because friendly fraud results from legitimate and authorized transactions, so there aren’t red flags to be detected. And nothing can account for unscrupulous consumer behavior or misunderstandings.

If you only use tools designed for malicious fraud, friendly fraud will still be an issue.

Want proof? Answer these questions:

- Does your fraud tool ensure you are 100% protected against chargebacks? Is your monthly chargeback count zero?

- Are you free from all financial liability for chargebacks? Does your fraud tool’s reimbursement plan ensure you don’t lose any revenue to chargebacks?

If your answers are no, you don’t have comprehensive protection for your bottom line.

Once you understand what friendly fraud is — and isn’t — you can start managing it. Create a comprehensive plan that will both prevent and fight friendly fraud chargebacks.

How to Prevent Friendly Fraud Chargebacks

There are dozens of different reasons why a cardholder might commit friendly fraud: confusion, greed, laziness, buyer’s remorse, inattentive parenting, and much more.

That’s why it is so hard to get ahead of the revenue loss. But with the right tools and tactics, you can prevent friendly fraud with greater accuracy and higher ROI.

Resolve Disputes Before They Progress to Chargebacks

Sometimes, issuing banks are unwilling participants in friendly fraud plots simply because they lack the insight needed to confront and challenge requests for illegitimate chargebacks.

However, newly available tools are now able to share that essential information with banks when they need it. Order Insight, which was previously known as VMPI, is one example of a real-time collaboration tool that merchants can use to prevent friendly fraud chargebacks.

When a cardholder attempts to dispute a purchase, the bank can request information to help clarify the transaction. In a matter of seconds, the information is shared with the bank.

With the information that’s provided through these new collaboration tools, issuers can either clarify confusion that would otherwise lead to accidental friendly fraud or expose attempts to engage in cyber shoplifting.

If you are interested in using a collaboration tool to prevent friendly fraud, Midigator can help. Sign up for a demo, and we’ll show you which options are available.

Analyze Your Data

It’s impossible to force customers to come to you with their complaints instead of the bank. But you can reduce the risk that customers would have complaints in the first place, eliminating the need to reach out to anyone at all.

All you have to do is identify and solve the underlying issues that would incentivize friendly fraud.

You can do this by breaking down your chargeback data into different variables and then analyzing the outcomes.

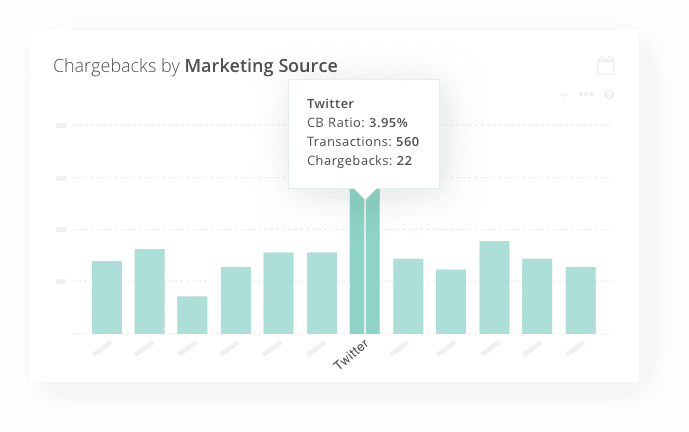

For example, one merchant traced disputes back to their original marketing source and discovered Twitter was attracting more friendly fraudsters than any other platform for that particular product. Retargeting to an older, more mature age demographic helped reduce chargebacks.

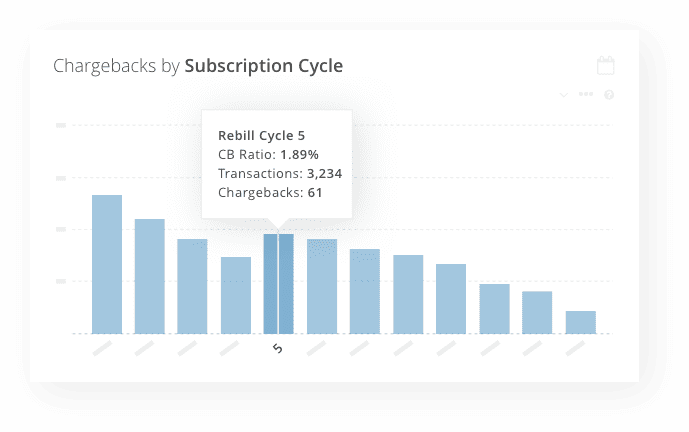

Another merchant analyzed chargebacks by billing cycle and discovered that perceived value dropped after the fifth billing cycle — and friendly fraud spiked. Sending a small gift and reminding customers of the cancellation policy helped prevent subscription billing chargebacks.

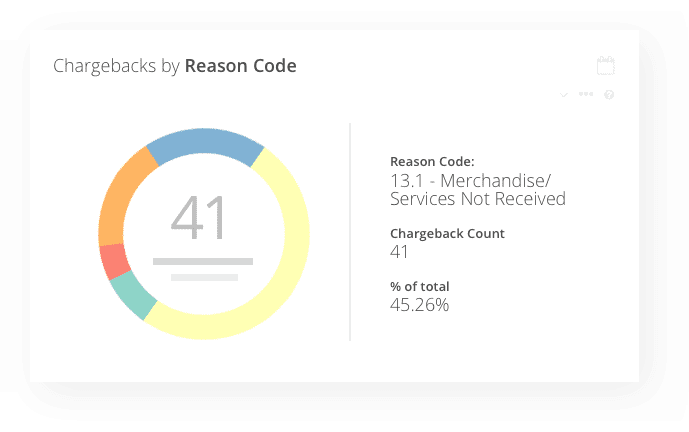

A merchant reviewed chargebacks by reason codes and found a significant portion were classified “merchandise not received”. The merchant improved communication to ensure accurate order information was conveyed to the fulfillment department and introduced a faster shipping option so deliveries coincided with customer expectations.

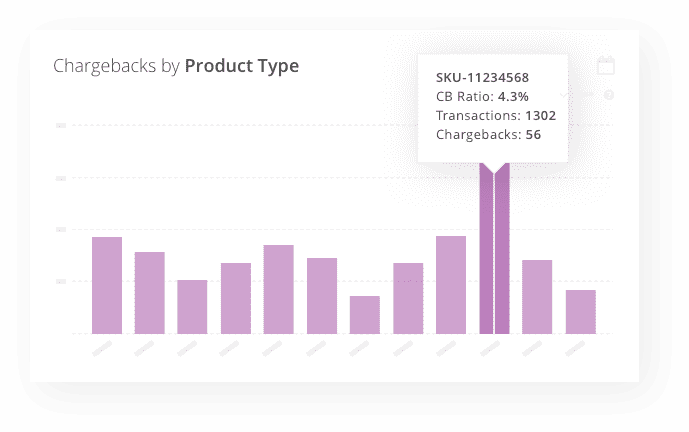

Another merchant checked chargebacks by product type. One product in particular had a chargeback rate that was nearly double all the other products. Upon review, the merchant discovered the product wasn’t the quality shoppers had come to expect from the business. Removing this product from the store helped prevent friendly fraud.

As you can see, data analysis is an effective way to prevent friendly fraud. However, the added step of first collecting and organizing the information before analyzing it can be so time-consuming and costly that it negates all potential benefits.

On the other hand, if the data is consolidated for you and laid out in user-friendly reports, it’s easy to detect patterns and trends.

Collecting and displaying the data you need to identify friendly fraud at its source is one of Midigator’s specialities. If you’d like to see the interactive analytics and reports for yourself, sign up for a demo.

How to Fight Friendly Fraud Chargebacks

When it comes to fighting friendly fraud, merchants often focus exclusively on the chargeback response (sometimes referred to as representment).

It’s true that there is a lot of administrative work that needs to be done (we have a step-by-step guide that explains the process). And for many merchants, “fighting friendly fraud” is thought of as a bunch of paper-pushing tasks that are repeated over and over for each chargeback.

However there are two stages, woven into those repetitive workflows, that require strategizing and intelligent decisions.

If you skip these strategic phases and make the entire process a monotonous activity, you won’t be able to successfully fight friendly fraud. You’ll invest a lot of resources into a losing cause and kill your ROI.

Which activities require careful thought and consideration?

Figure out what you should and shouldn’t fight.

Some chargeback “experts” will tell you to fight everything. After all, if you don’t fight, you can’t win.

However, this strategy is dangerous for two reasons.

First, you could inadvertently challenge a legitimate chargeback. Second, you could invest time and resources into cases that have negative ROI.

Here’s how Midigator suggests merchants fight friendly fraud: create strategic fight rules to filter out cases that shouldn’t be fought so you’re only fighting winnable, ROI-optimized cases of confirmed friendly fraud.

This means you don’t fight:

- Cases that cost more than the amount you’re able to recover

- Cases that have already expired

- Cases that don’t have sufficient evidence to prove friendly fraud

Don’t skip this important step — your business’s reputation and ROI depend on it!

Customize your responses.

When you fight friendly fraud, you need an air-tight case.

Cardholders are the bank’s customers. When it comes to processing chargeback requests, the old adage, “the customer is always right” reigns. It will take a highly-compelling argument to overturn the chargeback and force the issuer to acknowledge the friendly fraud.

Generic, one-size-fits-all chargeback responses won’t be able to do that. They won’t win.

Here’s where you push pause on the repetitive workflows and insert strategic thinking and intelligent decisions. What will it take to win?

Midigator’s technology customizes each chargeback response by dozens of different variables. If you fight friendly fraud chargebacks in-house, you can use our insights about what works best.

- Customize by Reason Code: Each chargeback is assigned a reason code — a description that helps you understand why the cardholder disputed the transaction. Reason codes also regulate which forms of compelling evidence must accompany your chargeback response. All required evidence should be included, but non-compelling items should be omitted.

- Customize by Product Type: Compelling evidence requirements vary by product type. For example, a chargeback response for physical goods will include things like delivery tracking information, and a response for digital goods would contain information about usage and download history.

- Customize by Sales Method: Compelling evidence requirements vary by sales method. A chargeback response for a card-present transaction will be different than a response for a card-not-present transaction. Within those different sales environments, disputes should be categorized even more distinctly — PIN transaction, recurring transaction, MO/TO transactions, etc.

- Customize by Geographical Location: Regulations vary by geographical location. The issuer’s and acquirer’s location will impact how a chargeback response is handled. Your response will need to adapt for things like timelines and language requirements.

- Customize by Processor Preferences: There is a chance your processor could terminate the response and never even send your case to the issuer for review. To ensure the processor accepts your case and advances it to the next stage, you’ll need to customize your response to the processor’s preferences. Each processor has different expectations, so responses need to adapt. This can include everything from how documents are ordered to the method used for submission.

Unfortunately, you can’t create a cookie-cutter template and use it for every chargeback you receive. If you want to win, you have to customize your responses.

Want Help Managing Friendly Fraud?

The revenue loss caused by a friendly fraud chargeback has a direct impact on your bottom line. But with access to insightful data and intuitive technology, you can keep financial losses to a minimum.

If you’d like to learn more about how Midigator can help prevent and fight friendly fraud, sign up for a demo today. You can see the technology in action and discuss strategies that will work best for your business.