What would you think if someone told you it was possible to recover revenue that you’ve unfairly lost to illegitimate chargebacks without lifting a finger or exerting any effort?

What if you were also told that the revenue you’d recover would far exceed the costs you’d put into earning it?

If you think that sounds like a far-fetched claim or an impossible reality, then you don’t want to miss the story Oscar’s Outdoor Odyssey* has to share.

The Story of How a Merchant Recovered More Revenue with Fewer Costs and No Manual Labor

This is the story of how a merchant used Midigator® automation to fight chargebacks more successfully and efficiently.

THE SITUATION

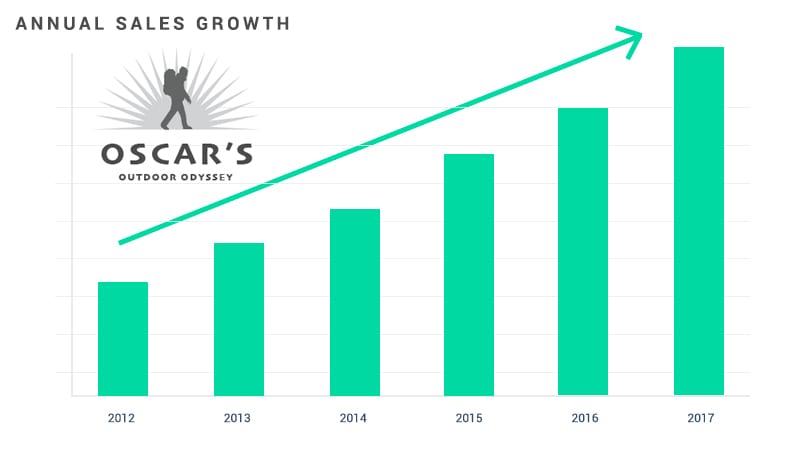

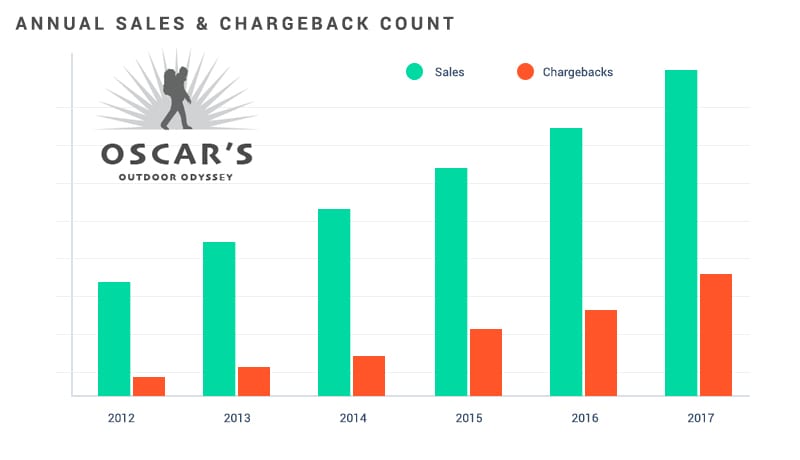

Oscar’s Outdoor Odyssey, an online retailer that sells wilderness survival supplies, was experiencing notable year-over-year sales growth.

Oscar was excited about the influx in revenue but was also overwhelmed by all the day-to-day responsibilities of running a successful business. One area, in particular, where Oscar struggled was chargeback management. This shortcoming was especially worrisome because chargebacks were becoming more and more of an issue as sales increased.

It pained Oscar to lose money to chargebacks. He knew in his gut that a good portion of those transaction disputes were friendly fraud. He really wanted to fight back and recover the lost revenue, but there were so many challenges to overcome:

- Chargeback rules are complicated. He didn’t know what he was supposed to do or when he had to have it done by.

- He didn’t have time to fight chargebacks. Oscar was wearing nearly all the hats in his business, and fighting chargebacks wasn’t a priority when he had to do things like get orders out the door.

- His chargeback responses didn’t win. When he did make time to fight back, he usually lost!

- He had a negative ROI. The effort Oscar put into fighting chargebacks cost more than what he was able to recover.

Chargeback Response Win Rate

24%

Quarterly Revenue Recovery

$5,500

Return on

Investment

-26.5%

Client: Mid-Size eCommerce | Q3 2017 Revenue: $1,427,762 | Q3 2017 Chargeback Count: 648

THE TAKEAWAY

Oscar was losing almost $8,000 to chargebacks each month. He realized he didn’t have a sustainable business model. As sales increased, chargebacks would increase too.

So, Oscar reached out to Midigator. He was able to easily hand off his chargeback management responsibilities and let Midigator fight on his behalf.

Midigator connected to Oscar’s CRM (customer relationship management software) and his payment processor.

Midigator created chargeback response templates that could be customized for each dispute based on reason code, available compelling evidence, product type, processor specifications, and more.

Midigator received chargebacks on Oscar’s behalf from his payment processor.

The technology retrieved necessary compelling evidence from Oscar’s CRM to complete the chargeback response packages.

The technology automatically submitted chargeback responses to Oscar’s payment processor in near real time to eliminate the risk of expired cases.

Midigator updated customer information in Oscar’s CRM to note the action taken and cancel future purchases if applicable.

Midigator clearly displayed all outcomes in its user-friendly, interactive dashboard so Oscar could monitor results in real time.

THE OUTCOME

Oscar’s Outdoor Odyssey saw an immediate improvement in their ROI.

ROI Before Midigator

Q3 2017

-26.5%

ROI After Midigator

Q4 2017

281%

Total Increase in ROI

Q3 to Q4 2017

1,163%

ROI improved because of two key factors: revenue recovery increased and costs decreased.

↑ Revenue Recovery Increased

Midigator was able to fight more chargebacks than Oscar could, so there were more opportunities to recover revenue.

Because Midigator knew what to submit and how to submit the chargeback response packages, the cases were more compelling and had a higher win rate.

And because responses were submitted almost instantaneously, Oscar’s Outdoor Odyssey capitalized on every opportunity to recover revenue; there was no risk of cases expiring or revenue being forfeited.

BEFORE Midigator

Q3 2017

Win Rate

24%

Recovered Revenue

$5,500

AFTER Midigator

Q4 2017

Win Rate

81.9%

Recovered Revenue

$18,976

↓ Cost Decreased

Midigator’s technology-enabled pricing was less expensive than the value of Oscar’s time. Also, the technology knew what should and shouldn’t be fought, ensuring resources weren’t wasted on cases that had no chance of winning.

Combined, these elements resulted in a 34.1% decrease in management costs.

Overall Results

Decrease in

Management Costs

↓ 34.1%

Increase in Revenue

Recovery

↑ 241.3%

Total Increase in

Management ROI

↑ 1,163%

Oscar learned a very important lesson. Chargebacks are not just a cost of doing business. There are cost-effective ways to fight back against friendly fraud and recover lost revenue.

*Our client requested their actual name remain anonymous.

Do You Want to Recover More Revenue and Achieve a Higher ROI?

If you would like to fight chargebacks and recover revenue with greater success and efficiency, Midigator can help. Sign up for a demo today.

At Midigator, we believe the challenge of running a business should be delivering great products or services, not managing payment risk.

Our technology removes the complexity of payment disputes so businesses can get back to business.

Customize My Demo

Customize My Demo