Tips to Manage Card-Not-Present Transactions & Fraud

- March 11, 2021

- 7 minutes

Card-not-present transactions offer several benefits, but the rewards come with unique risks. Striking a profitable balance means you need a strategic and scalable management strategy.

Are you interested in adding card-not-present transactions to your business’s sales model? Here’s what you need to know.

Card-Present vs. Card-Not-Present Transactions

Card-present transactions and card-not-present transactions are two payment methods you can use to help grow your business. Both payment methods come with a unique set of benefits and challenges, which means it is essential you know the difference between the two.

Examples of Card-Present Transactions

Card-present (CP) transactions occur when the customer’s card is present at the time of the purchase. A point-of-sales (POS) terminal is used to read the physical card as part of an in-person interaction, typically within a brick-and-mortar store. CP transactions are processed in the following ways:

- Swiping a card with a magnetic strip

- Inserting an EMV chip card into a card reading device

- Utilizing a contactless or near-field communication (NFC) card reader

Examples of Card-Not-Present Transactions

With a card-not-present (CNP) transaction, you do not have access to the physical card at the time of the purchase. Instead, the customer communicates the card details to you. Cardholders can complete CNP transactions in several ways, including:

- Entering information into an online or ecommerce store

- Reading card information over the phone

- Subscribing to recurring payments

NOTE: Mobile wallets, such as Apple Pay, Google Pay and Samsung Pay, enable both card-present and card-not-present transactions. Payments made in stores via contactless card terminals are considered card-present transactions. Payments made within apps or on the web are card-not-present transactions.

Because the card is not present at the time of purchase, there tends to be more risk associated with CNP than CP. To balance the risk with reward, you need to know what to expect from card-not-present transactions.

Benefits of Card-Not-Present Transactions

If you want to grow your business, you’ll need to scale your profits — and the CNP environment can help. Card-not-present transactions, specifically ecommerce, are increasing in popularity each year.

Source: Digital Commerce 360 analysis of U.S. Department of Commerce data

Embracing this trend can benefit your business in several ways, including enhancing the customer experience, reaching new markets, and creating more effective marketing campaigns.

Enhance the Customer Experience

Card-not-present transactions are useful for cardholders, especially in ecommerce. Customers enjoy being able to shop at their own pace — whenever and wherever it’s convenient for them.

In fact, the number one reason people shop online is because they can shop 24 hours a day, seven days a week. Accepting card-not-present transactions gives customers more freedom than you can provide with only card-present transactions.

Moreover, card-not-present transactions allow you to meet generational demands as some demographics are moving to a CNP-only mindset. The majority of Millennials (born between 1981 and 1996) and Gen Xers (born between 1965 and 1980) have become ecommerce-oriented — 67% of Millennials and 56% of Gen Xers would rather shop online instead of at brick-and-mortar stores.

Overall, CNP transactions will help improve the customer experiences, which will enhance relationships, enable more sales, increase revenue, and boost your bottom line.

Reach New Markets

Adding card-not-present transactions to your payment methods allows you to open up your business to new customers. You’ll be able to sell to people on the other side of the country or even on the other side of the world.

Internet sales are increasing worldwide. As the popularity of ecommerce grows globally, your target audience will expand and be easier to reach.

Source: Statista

Card-not-present transactions allow you to connect with new customers who never would have walked into your store, allowing you to expand sales outside of brick-and-mortar’s normal constraints. Reaching more customers in new markets is key to growing your business.

Create Targeted Marketing Campaigns

Generally speaking, card-not-present transactions provide more information and insights than card-present transactions. With CNP, you might have access to the customer’s email address, browsing history, IP address, and more. And depending on privacy guidelines (like GDPR, CCPA, etc.), this information can help you to create in-depth customer profiles, which can be used to drive up customer lifetime value (CLV).

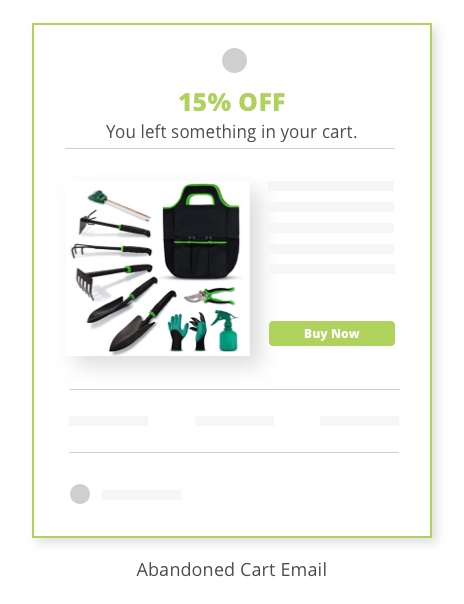

For example, you can send follow-up emails to remind customers of the products they looked at but didn’t buy. If customers browse in traditional brick-and-mortar stores and leave without purchasing the items they were considering, there isn’t anything you can do about it. But if customers add items to their online cart but don’t actually check out, you can send emails encouraging them to finish the purchase.

These abandoned cart emails produce an average revenue of $5.64 per message (to put that in perspective, a welcome email yields an average of $0.18).

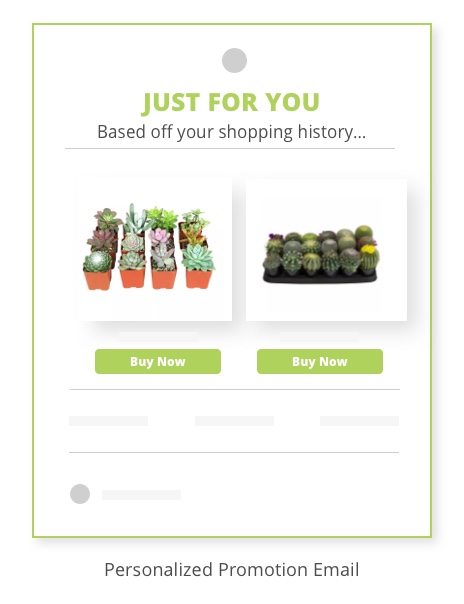

Or, you can reference the customer’s order history to create personalized deals and promotions. If a customer has a history of buying a certain type of product — gardening tools, for example — a promotional email for a similar item — potted plants — would probably be pretty enticing.

You could also use IP addresses to create retargeting campaigns. Create appealing, personalized ads and display them on social media or other websites your customer visits.

Risks of Card-Not-Present Transactions

While card-not-present transactions have many benefits, there are also some risks. The most significant danger is losing money instead of making money.

You will need to know what risks come with CNP transactions so you can better protect your company against potential losses.

Increase the Likelihood of Fraud

Card-present transactions have built-in protections that help shield your business from fraud. Some examples include:

- Shoppers must be present at the time of purchase, making it easy to notice any nervousness or suspicious behavior. It is also possible to verify the cardholder’s identity if the situation does seem unusual.

- Point-of-sale terminals that read EMV chips can detect counterfeit cards and prevent unauthorized transactions.

- Merchandise is handed over at the time of purchase, leaving no chance it can get lost in the mail or stolen from a front porch.

Unfortunately, these same safe-guards don’t exist with card-not-present transactions. And without these protections, you could be more vulnerable to fraud.

Increase the Risk of Chargebacks

With more fraud and less contact with the cardholder, you can expect to see a higher rate of chargebacks. These chargebacks may happen for several reasons.

- When cardholders sign up for subscriptions, they are actively engaged in the purchasing process. But they aren’t directly involved in subsequent charges. This makes it easy to forget about their commitment down the road. Chargebacks are often an issue if cardholders don’t remember to cancel their subscriptions in time.

- When ordering items online, through the mail, or over the phone, customers cannot examine the products before buying them. Without experiencing the merchandise firsthand, there is a greater chance of cardholder confusion or dissatisfaction.

- CNP, especially ecommerce, has created a cultural shift. Consumers are accustomed to instant gratification. This means they are more likely to incorrectly use the chargeback process and dispute transactions instead of requesting refunds because it is often perceived as the quicker and more convenient option.

- It’s easier for fraudsters to steal account information than actual cards. This means card-not-present transactions are the perfect opportunity to make unauthorized purchases that eventually turn into chargebacks.

Pay More in Fees

With a higher likelihood of fraud and an increase in chargebacks, card-not-present transactions are considered risky endeavors. And this risk doesn’t just impact you. It could affect the other parties involved too — cardholder, issuer, card brand, and acquirer.

To compensate for any potential financial loss, these stakeholders typically charge higher fees for card-not-present transactions than they do for card-present.

Best Practices for Card-Not-Present Transactions

Unfortunately, accepting card-not-present transactions does come with its own set of risks. But that doesn’t mean you should avoid CNP altogether. If you do, you will miss out on all the profit-boosting benefits this sales method has to offer.

To get the good without the bad, focus on minimizing potential dangers. The following suggestions can help you leverage card-not-present transactions to increase profits with as few risks as possible.

- Understand and maintain PCI compliance. PCI regulates how you obtain, use, and store payment card information.

- Follow all card brand rules for payment processing, especially if you use highly regulated techniques such as free trials or introductory offers.

- Ensure you understand what chargebacks are and the potential risk they could pose for your business — especially friendly fraud. Chargebacks can be a complicated subject; take a proactive approach to education so you aren’t caught off guard.

- Be aware of the common red flags for card-not-present transactions.

- Sign up with a fraud detection service to identify and block unauthorized transactions.

- Use tools such as the card security code, address verification service, and 3D Secure 2.0 to verify the shopper’s identity and reduce the risk of fraud.

- Sign up for prevention alerts to intercept and resolve disputes before they become chargebacks.

- Consider using services such as Consumer Clarity and Order Insight to verify orders in real-time and avoid chargebacks.

- Recognize the differences between customer service expectations for in-person and online shopping.

- Optimize your processes and policies for the CNP experience.

- Run several test purchases with different types of cards from different brands to check how your billing descriptor displays. Make sure it is easy for customers to recognize your business and remember their purchase.

- Fight invalid chargebacks. No matter how good your prevention efforts are, you’ll still receive chargebacks. They are an inevitable part of card-not-present transactions. But that doesn’t mean that revenue loss should just be accepted as a cost of doing business. Fight back and recover what has been unfairly sacrificed.

- Get professional help. Your focus should be growing your business, not managing payment disputes. If your chargeback situation is difficult to manage, let Midigator help. Sign up for a demo today to learn more.

Manage Card-Not-Present Risk With Midigator

Whether you are new to the CNP environment or have been around for years, you’ll want to maintain a proactive, evolving strategy for risk management. The biggest component of that strategy needs to be chargeback management.

Chargebacks can quickly and easily become an uncontrollable liability for a card-not-present business. If you are struggling to keep risk in check, Midigator can help.

Midigator provides comprehensive chargeback management services that can help you retain revenue with minimal effort and maximum ROI. Sign up for a demo today to learn more.