Do you want to prevent chargebacks and stop unnecessary revenue loss? Great! Chargebacks have negatively impacted your bottom line for long enough!

The strategy is relatively straightforward. To avoid chargebacks, you need to identify the reasons for disputes and solve the underlying issues.

There are dozens of reasons for chargebacks. We’ve analyzed the various reasons and determined what needs to be done to stop disputes at their source. Check out these ten tips to avoid chargebacks and the associated revenue loss.

- Follow the rules.

- Sell high-quality goods or services.

- Prevent criminal fraud.

- Fulfill orders promptly and accurately.

- Use clear billing descriptors.

- Write customer-friendly policies.

- Provide exemplary customer service.

- Analyze your chargeback data.

- Use order validation and prevention alerts.

- Respond to invalid disputes.

1. Follow the Rules

Everyone from processors and card brands to local and federal governments has rules about how payments should be handled. If you break a rule — even if it’s an innocent mistake — you may receive a chargeback.

For example, these reason codes are used when card brand rules are broken.

- No Reply – You were asked to provide transaction information but didn’t acknowledge the request.

- Late Presentation – You were supposed to process the transaction within a set time limit but didn’t meet the deadline.

- Required Authorization was not Obtained – You were required to seek authorization from the issuing bank but didn’t submit the request.

- Incorrect Currency – You were expected to adhere to the cardholder’s currency conversion preferences but didn’t comply with what was asked.

To avoid these chargebacks, make sure you understand and abide by applicable rules.

Start by familiarizing yourself with chargeback reason codes. Check out this database. Dig into each entry to learn why chargebacks happen and what you can do to prevent them.

2. Sell High-Quality Goods or Services

For your customers, purchases — especially those made online — require trust and faith despite the unknown. Until they put your merchandise to use or your services are rendered, customers have no idea what the quality will actually be. If you break that trust or don’t meet expectations, the result is usually a chargeback.

There are several quality-related reasons why customers might dispute transactions:

- Counterfeit Goods – The cardholder claims you promised genuine merchandise, but the merchandise received was counterfeit.

- Goods or Services are not as Described – The cardholder claims to have received goods or services that were different from what was described.

- Goods or Services are Defective – The cardholder claims the quality wasn’t what was expected or the item was defective.

To avoid these chargebacks, focus on providing the customer with a high-quality experience.

- Don’t sell counterfeit products. Make sure your merchandise is genuine.

- Survey your customers. Ask about perceived value and quality. Then, remove any subpar items from your inventory.

- Write detailed, easy-to-understand product and service descriptions. Include several images taken from different angles. Use a zoom feature or highlight noteworthy characteristics. Mention features like material, color, size, weight, duration, file type, etc.

- Share customer reviews. Peer feedback can inspire confidence and set the right tone.

3. Prevent Criminal Fraud

Criminal (or malicious) fraud happens when a cardholder’s payment card or account information is used without permission. Since transactions are unauthorized, they usually result in chargebacks.

These unauthorized purchases can be made with both card-present and card-not-present transactions. Examples of fraud-related reason codes include the following:

- Card Not Present Fraud – The cardholder claims a mail order, telephone order, or internet order that you processed was not authorized.

- Card Present Fraud (Counterfeit Card) – The cardholder has a chip card, and someone made a counterfeit copy of it. You processed a transaction with the counterfeit card on a terminal that wasn’t EMV-compliant rather than using a chip-reading device that would have detected the fraud. Now, the cardholder claims the purchase was unauthorized.

- Card Present Fraud (No PIN) – The cardholder has a PIN-preferring chip card, but your point-of-sales (POS) terminal doesn’t require a PIN to finalize the transaction. Now, the cardholder claims the purchase was unauthorized.

To avoid these chargebacks, you need a team of well-educated employees, fraud detection tools, and modern payment processing technology.

- Become familiar with the most common characteristics of high-risk orders. There are 30 fraud red flags to watch out for during internet, telephone, and in-person transactions.

- Consider a fraud detection service. There are several vendors that aim to detect and stop potentially fraudulent orders.

- Add identity verification tools to the checkout process. Address verification service (AVS), card verification values (CVV), and 3D Secure 2.0 can help ensure the shopper is the actual cardholder.

- Only use EMV-compliant terminals. If applicable, upgrade to a PIN-preferring POS for the highest level of protection.

- Use fallback options — like manually entering transaction data — as a last resort. If you do perform a key-entered transaction, make an imprint of the card.

4. Fulfill Orders Promptly & Accurately

Order fulfillment is an important part of a comprehensive chargeback prevention strategy.

If customers order one thing, but you ship something completely different, they’ll understandably be frustrated. And since today’s consumers are accustomed to instant gratification, you have to move quickly.

There are a few chargeback reason codes that relate to order fulfillment:

- Goods or Services Were Not Received – The customer claims you didn’t provide the goods or services as promised.

- Goods or Services Were Damaged – The cardholder claims to have received goods or services that were damaged.

To avoid these chargebacks, you need a well-trained fulfillment team that adheres to policies designed to reduce potential problems.

- Educate your fulfillment team. Make sure team members are familiar with your merchandise and know what to ship.

- Use adequate supplies. Package merchandise in the correctly sized box and use sufficient packing materials so items won’t break in transit.

- Adhere to timelines. Give accurate estimates for delivery so customers know when to expect purchased items.

- Monitor inventory. Ensure your fulfillment department has a way to report low inventory. You don’t want to find out after an order has been placed that you can’t fulfill it.

- Check digital products. Confirm that the correct items are being delivered. Make sure the actual file type and size match what you’ve promised. Look for downloading errors or other technical glitches.

- Follow through with services. If you’ve promised to perform a service, do it! And do it the way you’ve said you would — don’t cut corners, show up late, or cheapen the experience.

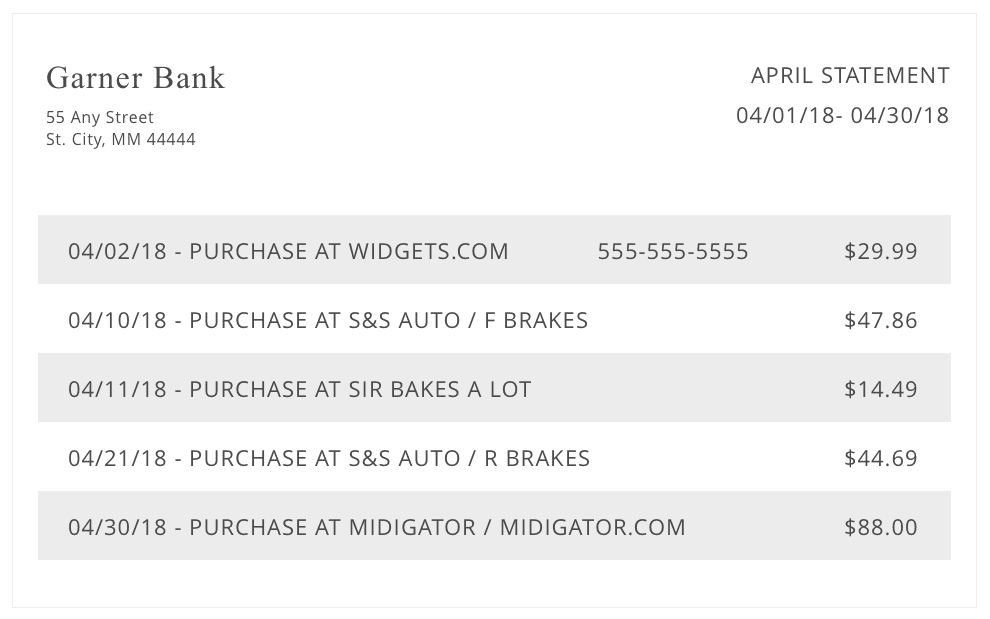

5. Use Clear Billing Descriptors

Some chargebacks are the result of confusion. It’s not uncommon for cardholders to forget about their purchases or have trouble understanding why their accounts were charged.

Previously, the card brands had specific reason codes that were used to classify disputes caused by uncertainty. For example:

- Cardholder Does Not Recognize – The cardholder claims not to recognize a card-not-present transaction.

However, most of those reason codes have been retired. Now, when customers are uncertain about a transaction, the dispute is simply classified as fraud.

To avoid chargebacks caused by confusion, write easy-to-recognize billing descriptors that help the customer understand exactly what was purchased.

- Use the “doing business as” name that customers are familiar with in the descriptor. Make sure your processor hasn’t used your legal business name by default.

- Try abbreviations. Descriptors are usually between 20 and 25 characters. If your descriptor is too long, use abbreviations so more of your message is conveyed.

- Add your phone number. If customers have questions, they can call you instead of the bank.

- Check for variations. Your billing descriptor might vary by card type (credit, debit) and brand (Visa, Mastercard). Run a few test purchases to see how it displays. Make sure it is easy to understand in all circumstances.

6. Write Customer-Friendly Policies

If your business is focused on providing an exemplary customer experience, chargebacks probably won’t be a significant concern. But if customers feel like their desires aren’t important, their rights aren’t respected, or their needs won’t be met, disputes could be abundant.

For example, failure to write and share clear policies will commonly cause the following chargebacks:

- Misrepresentation – The cardholder claims you misrepresented the terms of the sale.

- “No Show” Hotel Charge – You didn’t tell the cardholder about the “no-show” fee before finalizing the hotel reservation.

To avoid these chargebacks, create policies and practices that are focused on enhancing the customer experience.

- Write clear policies that are easy to find. Outline what is expected of the customer and what you’ll offer in return. Share your policy several times throughout the buying journey: on the sales page, the checkout page, and the order confirmation email.

- Extend the time limit for refunds and returns. It might take awhile for customers to form opinions about their purchases. If your refund deadline has passed but the chargeback time limit hasn’t expired, a dispute will seem like an appealing option.

- Consider offering free return shipping. If you make the shopper pay for shipping but there are no costs associated with a chargeback — and the customer gets to keep the merchandise — a chargeback looks like a pretty sweet deal.

- Add customer reviews to your policy page. Ask satisfied customers to explain how easy your return process is and how helpful your customer service team is. Other shoppers may be enticed to give it a try instead of a chargeback.

7. Provide Exemplary Customer Service

When shoppers aren’t satisfied with their purchases, they usually have one goal in mind: to get their money back. If you can’t easily make that happen, the bank will.

There are several reason codes that relate to refunds and cancellations. For example:

- Cancelled Recurring Transaction – The cardholder claims you processed a recurring transaction after a cancellation requested was made.

- Cancelled Merchandise or Services – The cardholder claims to have returned merchandise or cancelled a service, but credit hasn’t been applied to the cardholder’s statement yet.

- Credit Posted Incorrectly – You processed a transaction, but the cardholder claims it should have been a refund.

- Cardholder Dispute for Timeshares – The cardholder claims the timeshare was cancelled, but you charged the cardholder anyway.

To avoid these chargebacks, quickly and accurately resolve customer complaints with top-notch customer service.

- Fulfill valid refund and cancellation requests. If a refund or cancellation request adheres to your policy, make sure your team follows through on what’s been promised.

- Send an email after the refund or cancellation has been issued. Let your customers know you’ve acted upon their requests and estimate when they can expect to see the money returned to their account.

- Notify customers before you process recurring transactions. Remind customers of upcoming charges, especially if a significant amount of time passes between each recurring billing cycle.

- Answer the phone within a few rings and limit wait times. Generally, an increase in customer frustration is proportional to the length of time spent waiting for attention.

- Respond to emails with personalized solutions. An autoresponder can be used to acknowledge a customer complaint, but it usually needs to be followed by a personalized message that addresses the customer’s unique situation.

- Be active on social media. You might use social media for marketing, but your customers use it for communication. Be prepared to field conversations on your various social platforms, just like you would with any other communication channel.

8. Analyze Your Chargeback Data

Sometimes, it might not be immediately obvious why a customer disputes a transaction. Unfortunately, ‘friendly’ fraud can make it difficult to understand the real reason for disputes.

Data analysis can help provide needed clarity. If you analyze your chargeback data, you can uncover the hidden reasons for disputes and solve problems at their source.

Here are some examples of how merchants have used Midigator’s analytics to avoid chargebacks:

- How Analytics Help Merchants Sell in More Countries with Less Risk

- How Analytics Help Stop Criminal Fraudsters

- How Analytics Help Determine the Perfect Price Point

- How Analytics Help Uncover Merchant Errors

- How Analytics Help Expose High-Risk Marketing Sources

- How Analytics Help Expose High-Risk Issuing Banks

- How Analytics Help Prevent Subscription Billing Chargebacks

9. Use Order Validation & Prevention Alerts

Midigator offers two services that can help you avoid chargebacks: order validation and prevention alerts.

Order validation enables you to communicate with issuing banks in real time to resolve customer disputes. When a customer disputes a purchase, the issuing bank can reach out for more information. The details you provide will hopefully help the bank clarify and “talk off” the dispute so it won’t advance to a chargeback.

Prevention alerts intercept disputes and pause the chargeback process for about 24 hours. During that time, you can refund the disputed transaction. The goal is to resolve the dispute so you can avoid a chargeback and reduce the risk of threshold breaches.

If you are interested in either order validation or prevention alerts, let us know. You can sign up for a demo and we’ll explain these services in greater detail.

10. Respond to Invalid Disputes

Chargeback prevention might be a top priority, but unfortunately, it’s impossible to completely eliminate all risk. So, you also need a plan for when chargebacks do happen.

Your chargeback management philosophy should be something like this:

Prevent as many disputes as possible, and then fight what you can’t prevent.

This tip is important, but it might not be for the reason you think. Responding to invalid disputes won’t help you avoid chargebacks, but it will help you avoid revenue loss — and that’s crucial.

Focusing exclusively on chargeback prevention leaves a lot of money on the table. But you can recover that lost money with the second half of your strategy: fighting.

This blog article has tips on how to fight chargebacks. If you’d like help implementing those suggestions, let us know. Midigator makes it easy to recover the maximum amount of revenue possible with the least amount of effort. Sign up for a demo today to learn more.

Avoid Chargebacks with Midigator

Are you tired of chargebacks stealing your hard-earned money? Do you want to put a stop to the revenue loss? Let Midigator help!

We have tools and techniques that can help you avoid chargebacks. And better yet, we can incorporate your prevention goals into a strategy that also fights chargebacks so you have maximum revenue protection — without increasing labor costs or manual processes.

Sign up for a demo today to learn more and get started.