Chargeback Reason Codes: 5 Things For Merchants to Know

Reason codes might seem like a pretty straightforward part of the chargeback process. But in reality, they aren’t as simple as you think!

Find out the hidden impact of chargeback reason codes.

1. Chargeback reason codes don’t always tell the full story.

In theory, reason codes help merchants understand why customers dispute purchases. But in reality, chargeback reason codes aren’t always as insightful as they appear to be.

That’s because customers often use the chargeback process incorrectly, either as an intentional attempt to get something for free or an innocent misunderstanding. This is called friendly fraud.

If the customer is being honest, the reason code would be relevant. But if the chargeback is friendly fraud, any reason code could be used as a disguise for the cardholder’s real motive.

13.1 Merchandise Not Received

Did the package get lost in the mail? Or is the customer cyber shoplifting?

4837 No Cardholder Authorization

Did a criminal slip past your fraud defense? Or did the cardholder forget about the purchase?

13.7 Cancelled Merchandise/Services

Is your cancellation policy too restrictive or hard to find? Or did the customer know how to cancel but just forgot to call?

It’s so hard to tell what is really happening when a customer disputes a transaction! One way to eliminate this complexity and have greater insight about why customers are charging back is to use detailed analytics. Learn more here.

2. All chargeback reason codes qualify for representment.

This might seem strange, but it’s true: chargeback representment rights apply to every single reason code. There are no reason codes that you are not allowed to fight.

You’re probably thinking, “But fraud! I can’t fight a chargeback if it is fraud!”

In certain situations, yes, you can. Take a look at the following example.

| THE SITUATION | CAN YOU RESPOND? |

|---|---|

| The cardholder really was a victim of criminal activity, and the chargeback is recovering lost funds. | NO |

| You uncovered the fraud and already refunded the transaction. A chargeback would credit the cardholder a second time. | YES |

| Initially, the cardholder requested a chargeback because she didn’t recognize the transaction. A week later, she remembered what the charge was. Rather than contact the bank to cancel the chargeback, the cardholder called you to apologize. | YES |

| You have proof the cardholder is cyber shoplifting and falsely claimed fraud to get free merchandise. | YES |

The bottom line is…don’t set your fight rules by reason code. Don’t assume representment is off limits just because the chargeback has a certain reason code.

Each chargeback needs to be managed on a case-by-case basis. If you have general, cookie-cutter standards, you’ll needlessly forfeit a lot of revenue.

Since it is challenging to determine what should and shouldn’t be fought with manual processes, you should consider using intelligent chargeback management technology. You’ll be able to fight more with less worry and stress. Learn more here.

3. If you want to fight a chargeback, your response needs to be customized for the reason code.

Each reason code has specific requirements for compelling evidence (documents that challenge the claims made with the chargeback). Before you fight, you’ll want to carefully review what will and won’t be accepted with a response.

If you skip this step—if you use a one-size-fits-all response—you’ll have a very low success rate. Customized packages have the highest win rates.

Again, customizing responses can be challenging. Contact Midigator if you’d like help simplifying this process.

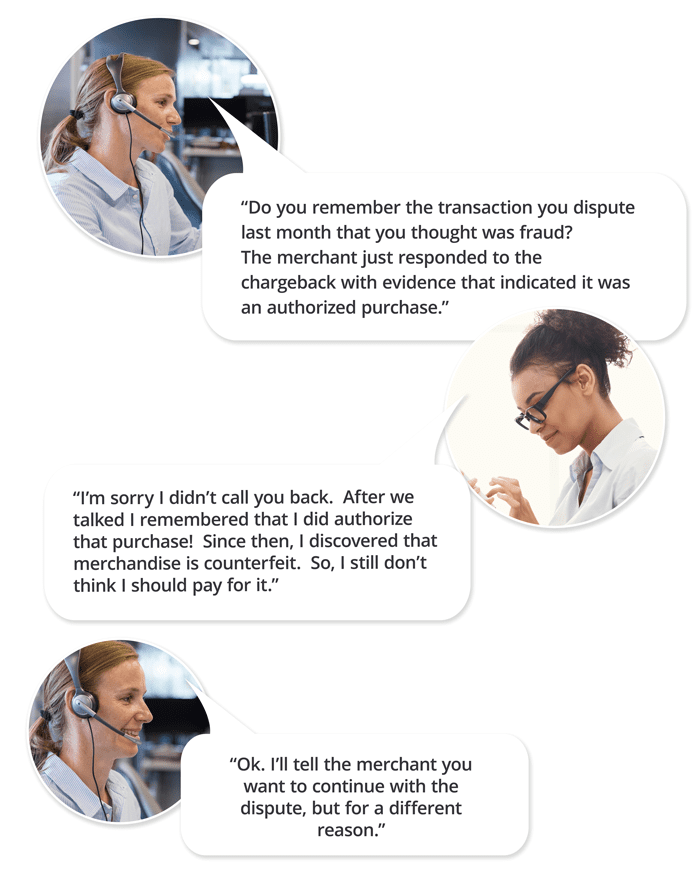

4. Chargeback reason codes can change.

Sometimes, a chargeback is re-classified with a different reason code.

This most commonly happens after you’ve fought a chargeback and won. If the cardholder has new information or the argument changes, the issuer will dispute the purchase again with a new reason code. This second dispute is called pre-arbitration (sometimes referred to as a second chargeback).

For example:

5. Some reason codes are automatically fought by your acquirer.

All chargeback responses need compelling evidence. If your acquirer has access to these documents, a response might automatically be submitted on your behalf.

Examples of disputes your payment processor might be able to fight include:

- Chargebacks that allege you didn’t request authorization

- Claims you processed the transaction late

- Chargebacks that are invalid because they don’t comply with the card network’s regulations

It’s important to know which chargebacks your acquirer will and won’t fight. You don’t want to devote time and resources to a case that has already been taken care of.

Simplifying the Complexities of Chargeback Reason Codes

Does all this information make chargeback management seem even more confusing than you thought it was?

The chargeback process is complex—if you try to manage it on your own. But at Midigator®, we believe the challenge of running a business should be delivering great products or services, not managing payment risk.

If you’d like Midigator to remove the complexity of payment disputes so you can focus on growing your business, we’d be happy to help. Sign up for a demo to learn more.